Cybersecurity specialist SentinelOne (S) has been the stock market equivalent of showing up to a black-tie event wearing socks with sandals. Underwhelming quarters? Please. It’s like watching someone step on a rake in slow motion. But hold your horses – their latest earnings report feels like finding a $20 bill in an old pair of jeans. The stock jumped 7% faster than my neighbor’s kid fleeing the scene after egging my car. At $20, it’s the investing version of getting a second coffee refill before work.

Let’s dissect this like a passive-aggressive thank-you note. Why might SentinelOne be the growth stock equivalent of a perfectly ripe avocado? Buckle up, because here’s where things get interesting.

The AI boost that feels like a passive-aggressive compliment

SentinelOne’s fiscal Q2 revenue hit $242 million – a 22% jump that feels like your ex saying “You look great, seriously” at a wedding. Their AI platform Singularity isn’t just a product, it’s a full-blown soap opera of digital drama. CEO Tomer Weingarten claims AI adoption is driving growth, which sounds like my dentist bragging about how much I “improved” my flossing habits.

Purple AI, their security assistant? Triple-digit growth that makes me question my life choices. It’s attached to 30% of licenses sold, which apparently delivers “55% faster threat remediation” – though I’d settle for 55% less existential dread when checking my portfolio. The 338% ROI over three years? That’s the investing equivalent of finding out your college roommate became a billionaire while you were busy arguing about the proper way to load a dishwasher.

The Prompt Security acquisition? It’s like when you begrudgingly admit your neighbor’s advice about landscaping was actually useful. Now SentinelOne can monitor generative AI applications in real-time, which sounds less like cybersecurity and more like trying to prevent my cousin from sending another poorly-considered email to the entire family chain.

Growth acceleration that’s making me suspiciously optimistic

Half their contracts are for AI/cloud products – a $50 billion market they’re trying to conquer. It’s like watching someone try to organize the world’s most chaotic potluck dinner. But here’s the kicker: their margins tripled to 5.4%, which feels like getting a compliment on a tie I specifically wore to annoy my brother-in-law.

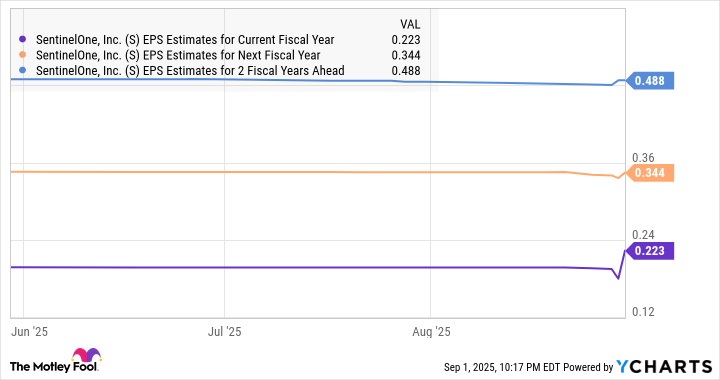

Trading at 7x sales versus tech’s 8.6x? That’s the investing version of finding a $100 bill in a jacket pocket you haven’t worn since the Obama administration. Analysts expect earnings to quadruple? Sure, just like they expect me to understand TikTok trends.

So here we are. A stock growing faster than my mother-in-law’s unsolicited advice, margins improving like my posture after a $200 massage, and a valuation that makes me question why I ever bought Bitcoin. Maybe it’s time to stop overthinking and just press the buy button before I invent another reason to be annoyed. 🚨

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Why Nio Stock Skyrocketed Today

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

2025-09-05 14:46