The modern age, you see, is a perpetual siege. Every connected device, a potential breach in the fortifications. A single compromised system can cost a company the equivalent of a minor principality—roughly $4.4 million, if my calculations are correct. A tidy sum, wouldn’t you agree? The guardians of the digital realm, naturally, demand their due. By 2030, the cybersecurity market is projected to swell to over $350 billion. Investors, predictably, have thrown money at these protectors, inflating valuations to the point of absurdity. All, that is, except in one peculiar case.

There exists a company, SentinelOne, which attempts to shield its clients from the digital demons with the aid of artificial intelligence. Its shares, however, have fallen into a rather precipitous decline – over 80% from their peak in late 2021. A most unfortunate circumstance, though perhaps… an opportunity. One might even suggest it is the most undervalued artificial intelligence play currently haunting Wall Street.

A Crowded Stage for Digital Knights

SentinelOne specializes in endpoint security – protecting the individual devices that form the network. Their technology, powered by autonomous AI, proactively seeks out threats, like a diligent, if somewhat paranoid, watchman. They have earned accolades and serve a clientele of impressive scale. Yet, the cybersecurity arena resembles a particularly chaotic marketplace. Every corner is contested, every niche overflowing with competitors. New entrants arrive daily, while established players engage in constant, exhausting skirmishes for dominance.

SentinelOne has achieved growth, certainly, but not without a few bruises along the way. In the past year, they experienced a defection of key personnel to the rival firm, CrowdStrike Holdings – a rather unsettling development. And, alas, the company remains unprofitable. In this crowded field, establishing pricing power proves…difficult. One feels a distinct lack of leverage, as if attempting to negotiate with a particularly stubborn bureaucrat.

The Price of Shadows

Here’s a glimmer of hope, if one is inclined to seek it. SentinelOne is currently generating positive free cash flow and possesses a rather substantial war chest—$650 million—with minimal debt. A comforting sight, even for a cynic. And, despite the headwinds, the company continues to expand. Analysts predict revenue of approximately $1 billion for the current fiscal year, with projected growth of around 20% next year.

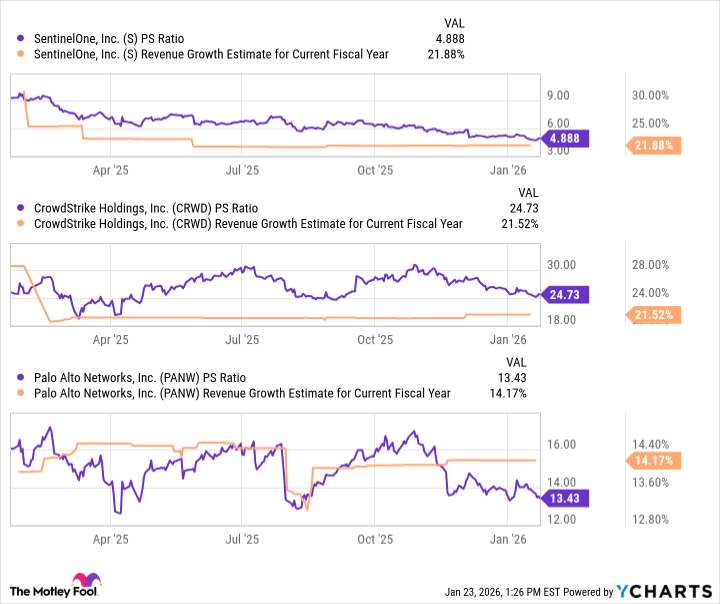

True, SentinelOne remains dwarfed by the scale of CrowdStrike or Palo Alto Networks. But its valuation has become…remarkable. Consider the following comparison:

Compared to its peers, SentinelOne is trading at a fraction of the price. Now, let us be clear: this is not a guaranteed triumph. SentinelOne must continue to innovate, to grow, and to convince the market that it can survive in this brutal landscape. But if it succeeds, its discounted valuation offers a compelling opportunity for substantial returns.

I wouldn’t suggest this is a stock to hold for eternity. Rather, it’s a contrarian idea, a bargain with a compelling upside. A shadow worth examining, wouldn’t you agree? One must always be wary of bargains, of course. They often conceal hidden flaws, or worse, a devilish trick. But occasionally… occasionally, one finds a genuine treasure.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- All weapons in Wuchang Fallen Feathers

- Where to Change Hair Color in Where Winds Meet

- Top 15 Celebrities in Music Videos

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Best Video Games Based On Tabletop Games

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

2026-01-27 22:22