In the rugged expanse of Wyoming, where the wind howls like a coyote in the dead of night, Senator Cynthia Lummis has been bestowed the honor of chairing the newly minted Senate Subcommittee on Digital Assets. This appointment comes courtesy of Senator Rick Scott, the head honcho of the Senate Banking Committee, and it’s about as surprising as finding a tumbleweed in a dust storm. 🌪️

A Bold Agenda for Digital Assets

Lummis has laid out two ambitious goals for her subcommittee:

- To pass legislation that would lay down the law for digital asset markets – because who doesn’t love a good rulebook?

- To keep a watchful eye on federal agencies, ensuring they don’t go all cowboy and overreach their authority.

“Digital assets are the future,” Lummis declared with the fervor of a preacher at a revival meeting. “If the United States wants to remain the big cheese in financial innovation, Congress needs to get its act together and pass bipartisan legislation that not only establishes a legal framework but also strengthens the U.S. dollar with a strategic bitcoin reserve. I’m just tickled pink that my colleagues trust me to lead this historic charge, and I can’t wait to send some bipartisan legislation to President Trump’s desk this year that will secure our financial future,” she added, likely while sipping on a cup of coffee as strong as her resolve.

Senator Scott, ever the cheerleader, chimed in, “Blockchain technology and cryptocurrency could democratize the financial world – and there’s no better champion for this wild frontier than my pal Cynthia Lummis. Since day one, she’s been riding the digital assets wave, and I’m proud to have her lead our new subcommittee. Together, we’ll craft a commonsense regulatory framework that keeps innovation right here in the good ol’ U.S. of A., instead of letting it gallivant overseas.”

With whispers of a formal Bitcoin reserve swirling like dust devils, former Binance CEO Changpeng Zhao cheekily remarked that such a development is “pretty much confirmed.” Well, hold onto your hats, folks! 🎩

Momentum Builds for a Bitcoin Strategic Reserve

Several states, including Pennsylvania, Texas, Ohio, New Hampshire, and Wyoming, have jumped on the Bitcoin bandwagon, introducing strategic reserve legislation. Coinbase CEO Brian Armstrong has also been waving the Bitcoin flag, calling it “foundational to the global economy, akin to gold” in a recent blog post. Can you hear the cash registers ringing? Cha-ching! 💸

During a digital asset panel at the World Economic Forum in Davos, Armstrong reiterated that despite the current fixation on meme coins and social tokens, Bitcoin remains a viable player in the game.

On X today, Armstrong pointed out that Bitcoin’s market cap of ~$2T is about 11% of gold’s market cap of ~$18T. It’s like comparing apples to oranges, but hey, they’re both fruits, right?

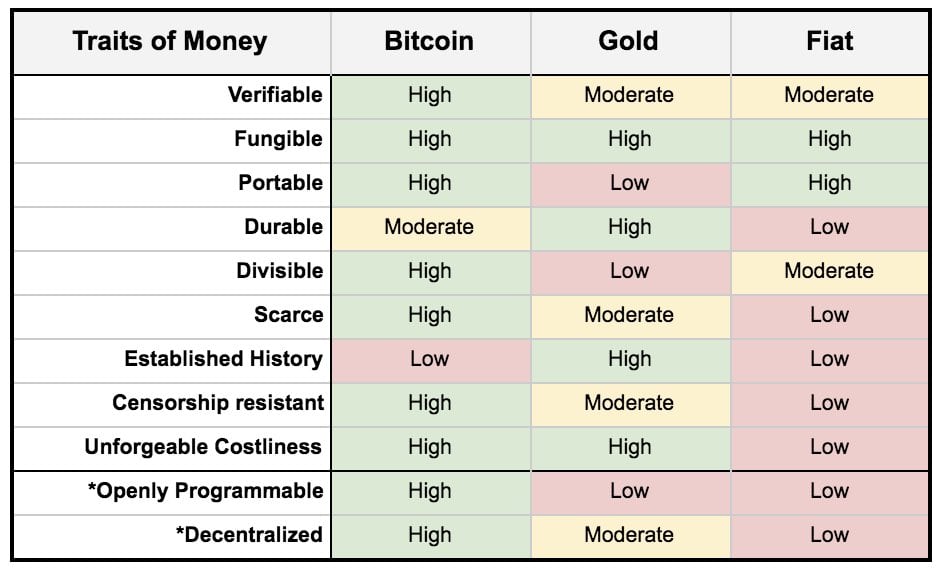

“Bitcoin is a better form of money. It has the decentralization and scarcity of gold, but better divisibility, portability, and (I think) even fungibility. It’s relatively harder to tell if gold is pure, or contains some lead in the middle of the bar,” he mused. Well, if that doesn’t sound like a riddle wrapped in a mystery, I don’t know what does!

“Any country with gold reserves should hold at least 11% of that amount in Bitcoin reserves. And I believe in the next 5-10 years Bitcoin’s market cap will likely surpass Gold. So these reserves should grow to exceed Gold,” Armstrong confidently declared. Talk about a bold prediction!

Odds that a Strategic Bitcoin Reserve will go ahead shot up to 70% on Polymarket before settling back down at 68%. It’s like watching a rollercoaster ride – hold on tight! 🎢

While Lummis is known to be a staunch Bitcoin advocate, she’ll be a champion for the entire digital asset industry. She’s set to be a powerful ally for altcoins like Ripple’s XRP and Solana, which is good news for all the digital cowboys out there!

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Elder Scrolls Oblivion: Best Battlemage Build

- ALEO PREDICTION. ALEO cryptocurrency

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- 30 Best Couple/Wife Swap Movies You Need to See

- Revisiting The Final Moments Of Princess Diana’s Life On Her Death Anniversary: From Tragic Paparazzi Chase To Fatal Car Crash

- Who Is Emily Armstrong? Learn as Linkin Park Announces New Co-Vocalist Along With One Ok Rock’s Colin Brittain as New Drummer

2025-01-23 22:22