As a seasoned researcher with over two decades of experience studying economic trends and policies, I’ve seen my fair share of ambitious proposals that promised to revolutionize the financial landscape. However, the proposal for a Bitcoin reserve by Senator Cynthia Lummis presents unique challenges that are hard to ignore.

However, the proposal faces significant challenges, both legislative and economic.

Historically, the United States has relied extensively on its gold reserves to bolster the dollar and offer protection during economic ups and downs. By September 2024, the U.S. possesses around 8,133 metric tons of gold, far surpassing the holdings of other countries such as Japan (845 tons) and China (2,113 tons). In contrast, the eurozone collectively has about 10,784 tons. The significant amount of gold held by the U.S. is highly valued for its liquidity and stability, serving as a key foundation for national economic strategies.

Lummis’ idea of holding $200 billion worth of Bitcoin may seem significant, but it only amounts to less than 2.5% of the world’s total gold reserves, raising questions about its potential influence and strategic importance. Could a volatile digital asset like Bitcoin offer the same level of security as traditional gold reserves?

To carry out this ambitious plan, the incoming Trump-Vance administration might consider using an executive order to direct the Treasury to set aside funds for purchasing Bitcoin. By adopting this approach, they could circumvent some of the typical regulatory obstacles related to cryptocurrency and classify Bitcoin as a strategic asset similar to the Strategic Petroleum Reserve, which President Biden utilized in 2022 to mitigate escalating fuel prices.

As a crypto investor, I recognize the appeal of building a long-term Bitcoin reserve, but it’s important to understand that this would necessitate congressional approval. The intricacies of multi-year budgeting make it a complex process. Although the Trump administration may lean towards a more accommodating stance on cryptocurrencies, there will undoubtedly be strong opposition from traditionalists in Congress. Many legislators view Bitcoin as overly speculative and risky, especially when considering its potential integration into national reserves. This hesitance could potentially halt Senator Lummis’ proposal at a crucial moment.

In terms of practical implementation, overseeing a Bitcoin reserve could potentially be assigned to the U.S. Department of the Treasury, much like its current role in managing gold reserves. The acquisition of Bitcoins might be made easier through various funds within the Federal Reserve System. However, as talks continue, the potential risks involved in incorporating a volatile asset such as Bitcoin into the national balance sheet are likely to face close examination from both the Senate and the House of Representatives.

With inflation concerns continuing to dominate economic discussions, any initiative involving Bitcoin may encounter significant resistance from both the public and policymakers. Importantly, even a $200 billion Bitcoin fund would constitute a mere fraction of the staggering $35.9 trillion U.S. debt, further complicating the argument for its adoption as a national reserve asset.

For now, it looks like Lummis’ Bitcoin reserve plan may face challenges in the short term. Although executive orders might initiate some government action, a complete reserve would demand broad cooperation from Congress due to the extensive asset purchases involved. Given the present political environment, it’s doubtful that enough legislative backing can be gathered within the next two years.

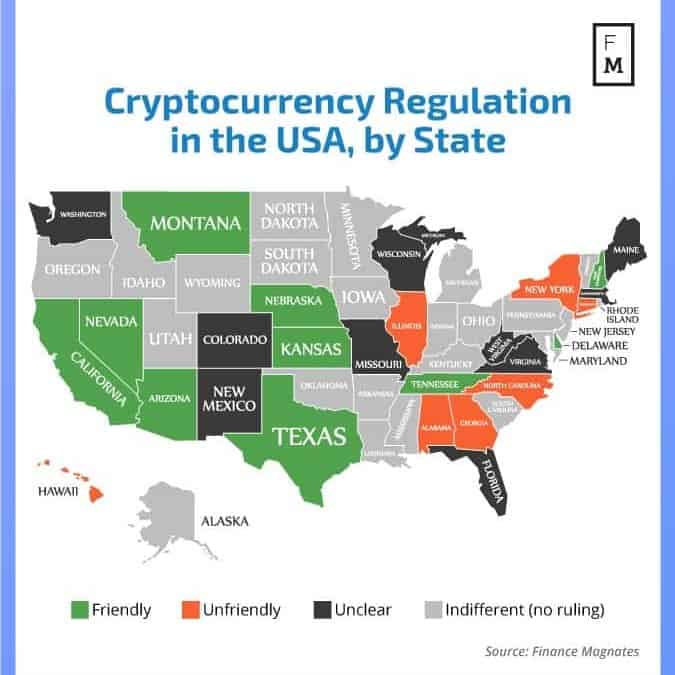

State By State

An alternative approach could involve individual states establishing their own Bitcoin Reserves. As Dennis Porter, CEO of Satoshi Action Fund expressed on platform X, “It is indeed confirmed that by the year 2025, several states are expected to propose Strategic Bitcoin Reserve legislation.

Several states are demonstrating a growing enthusiasm for incorporating Bitcoin into their financial systems. For instance, Texas and Wyoming have created legal frameworks that treat digital assets as commercial entities, while Arizona has attempted to pass multiple bills recognizing Bitcoin as valid currency. If these legislative efforts progress, it might signal a significant stride towards the adoption of Bitcoin within state-level monetary policies.

A Hero Steps In

Senator Cynthia Lummis is determined to continue her pursuit of establishing a strategic Bitcoin reserve, aiming to strengthen the financial position of the United States. She sees this digital asset as a tool that can boost America’s financial dominance and security in the 21st-century global economy.

The proposed mechanism involves the U.S. Treasury Department acquiring 1 million Bitcoin over five years, amounting to approximately $65 million at current prices. This acquisition would be managed transparently, with the Treasury overseeing the reserve’s operations.

Senator Lummis compares Bitcoin to traditional assets such as gold, implying that, similar to how gold reserves have been crucial for a country’s financial stability throughout history, Bitcoin can function as a modern digital asset that strengthens and secures the U.S.’s financial dominance in the 21st-century global marketplace.

Addressing Decrypt, Lummis stated that the process for its formation is already in motion with the proposed Boosting Innovation, Technology, and Competitiveness Through Optimized Investment Nationwide Act, often called the “Bitcoin Act,” yet to be passed.

According to Lummis, the proposed bill sets up a network of secure Bitcoin storage systems, managed by the U.S. Department of Treasury. This network aims to buy one million Bitcoins over time, which amounts to about 5% of the total supply. Moreover, it reinforces the right for individual Bitcoin owners to store their own cryptocurrency.

Senator Lummis explained that the Strategic Bitcoin Reserve would mimic the Treasury Department’s current duty of managing the country’s gold reserves. This reserve would function independently from the Federal Reserve System. The goal was to create it as a contemporary counterpart to our gold reserves, acting as a digital insurance policy during economic instability, while preserving the Treasury’s traditional role in protecting important national assets.

The bill put forth by Lummis in July didn’t progress past the Senate. However, it remains essential for the Senate and the House to examine and approve this legislation, with the final step being presidential approval.

The upcoming Congress offers an excellent opportunity to pass this digital asset bill, along with other sensible digital asset legislation,” Lummis stated.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- USD ILS PREDICTION

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- 9 Kings Early Access review: Blood for the Blood King

- Every Minecraft update ranked from worst to best

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- 10 Shows Like ‘MobLand’ You Have to Binge

2024-11-09 14:20