![]()

Behold, the market’s fickle heart turned toward Intel (INTC), its stock leaping like a startled hare as Nvidia (NVDA) cast a $5 billion net over the ailing chipmaker. The crowd clapped its hands at the spectacle, yet few paused to ask whether this was a marriage of minds or a desperate grasping at the hem of a passing tide. Nvidia, that titan of the data-center age, saw its shares rise by 3.5%, a modest reward for a bargain that left Intel’s shareholders clutching shares priced below their Thursday zenith. One might wonder: is this the dawn of a new era, or merely the echo of a gilded cage?

The pact, they say, is to forge a custom solution for artificial intelligence in data centers, as if the gods of silicon and code had conspired to etch their names into the annals of human folly. Intel’s x86 chips, now entwined with Nvidia’s GPU chiplets, promise to push the “bounds of personal computing”-a phrase that rings hollow to those who recall how often such promises have dissolved into the ether of obsolescence. Yet the market, ever a creature of habit, cheers as though it were the first time such alchemy had been attempted.

And so the ripples spread. ASML (ASML), Applied Materials (AMAT), and Lam Research (LRCX)-those unseen laborers in the cathedral of progress-found their shares buoyed by the crowd’s blind faith. The irony is thick as molasses: while the world gazes at the gilded statues of Nvidia and Intel, it is the toilers in the shadows who lay the bricks. Yet this truth, like a whisper in a tempest, is drowned out by the clamor for instant glory.

The Machinery of Vanity

Modern chipmaking is a symphony of contradictions. Nvidia, that maestro of design, entrusts its creations to foundries like Taiwan Semiconductor, where Applied Materials and Lam Research grind their wafers into works of art. The process is a liturgy of precision: epitaxy, photoresist, etching, polishing-each step a testament to human hubris in its quest to tame the infinitesimal. Yet here lies the rub: for all their sophistication, these machines are but tools in the hands of those who wield them. What does it say of our civilization that we measure progress in nanometers and quarterly earnings?

Applied Materials, with its deposition systems, is the patient sower of silicon seeds. Lam Research, though less dominant, plies its trade in plasma etching, carving circuits as if sculpting the soul of the machine. But it is ASML, that Dutch titan, who holds the key to the kingdom. Its EUV lithography machines-mirrors that bend light like a poet bends language-are the pinnacle of this mechanical sublime. Yet one cannot help but ponder: is this the height of human ingenuity, or merely the latest in a long line of Sisyphean labors?

The Tyranny of Monopoly

ASML’s grip on EUV technology is a double-edged sword. The market, in its infinite wisdom, has crowned it king, yet the company’s future remains tethered to the whims of a world that may one day tire of smaller transistors. The high-NA machines, those nascent titans of precision, are lauded as the future, yet their sales are still a mere flicker against the DUV behemoths. Is this not the fate of all innovators? To build bridges to a future that may never arrive, while the present clings to the familiar with the desperation of a drowning man?

And what of the investors, those modern-day alchemists who seek to turn market movements into gold? They are drawn to ASML not for its moral virtue, but for its moat-a fortress built on physics and patents. Yet even moats dry, and the walls of empires crumble. The contrarian investor, ever the skeptic, must ask: is this a moat or a mirage? A fortress or a folly?

The Illusion of Value

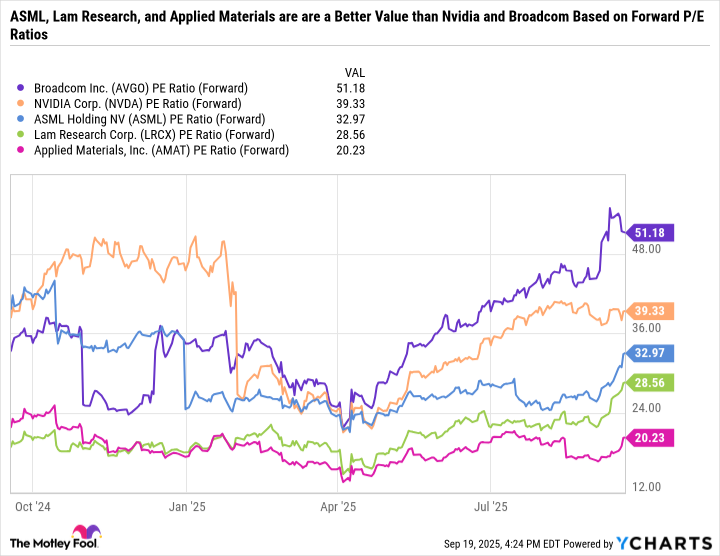

The market’s obsession with valuation is a comedy of errors. ASML, Lam Research, and Applied Materials trade at forward P/E multiples that seem almost charitable compared to the “Ten Titans.” Yet the dividend yields-0.8%, 1%-are the crumbs of a feast the market refuses to acknowledge. Is this not the paradox of our age? That the stars are overpaid while the unseen laborers are undervalued? Perhaps the true tragedy lies not in the mispricing of stocks, but in the blindness of those who fail to see the forest for the trees.

Let the crowd chase the glitz of Nvidia and Broadcom. Let them build their portfolios on the shifting sands of hype. The contrarian, with Tolstoyan patience, will seek the quiet strength of the unseen. For in the end, it is not the gilded names that endure, but the hands that toil in the shadows. 🌀

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Gay Actors Who Are Notoriously Private About Their Lives

- Games That Faced Bans in Countries Over Political Themes

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- 9 Video Games That Reshaped Our Moral Lens

- ETH PREDICTION. ETH cryptocurrency

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

2025-09-24 12:35