As a seasoned researcher with years of experience navigating the turbulent waters of the cryptocurrency market, I find myself both intrigued and cautious about Shiba Inu’s (SHIB) recent price surge. The meme coin mania has indeed pushed SHIB to an eight-month high, making a significant portion of its supply profitable. However, it’s crucial to remember that the crypto market is as unpredictable as a rollercoaster ride on a stormy day.

Over the last several weeks, the frenzy surrounding meme coins drove Shiba Inu‘s (SHIB) price to reach an eight-month peak of $0.000030 on November 12. Consequently, a large chunk of Shiba Inu’s total supply is now generating profits.

Consequently, with changing market feelings, numerous Shiba Inu investors are choosing to safeguard their profits by offloading their SHIB tokens.

Shiba Inu Holders Sell For Profit

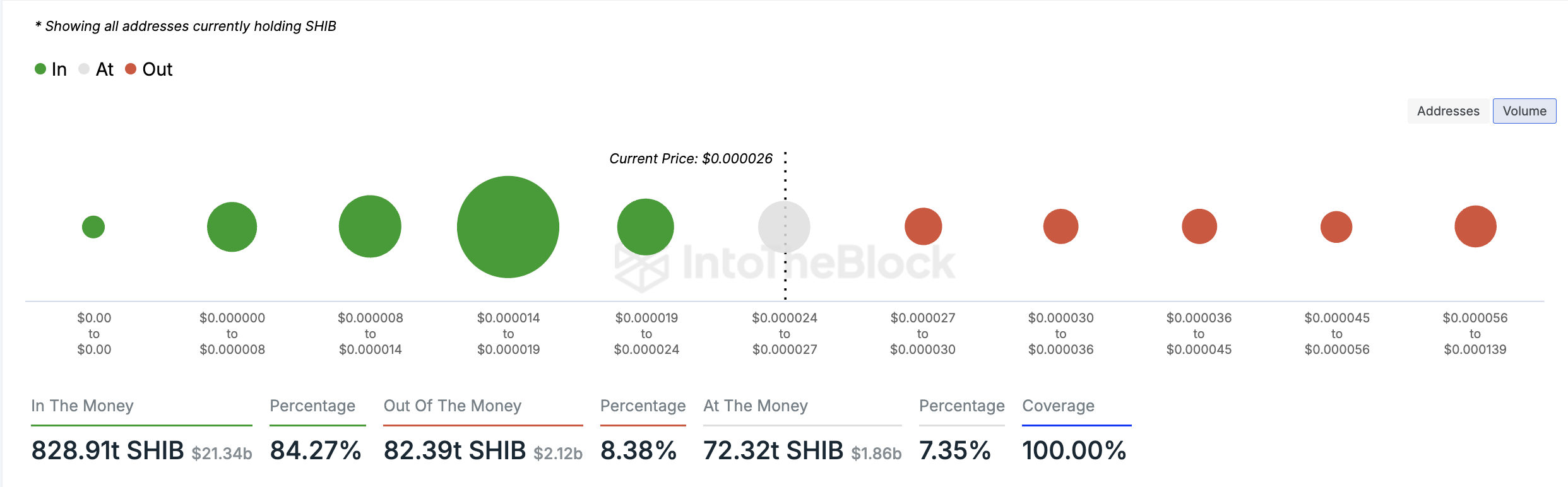

829 trillion Shiba Inu coins owned by 851,000 investors (representing approximately 62% of total Shiba Inu coin holders) are currently considered “profitable,” based on IntoTheBlock’s Global In/Out of the Money metric.

An address is deemed “profitable” when the worth of the assets stored within it exceeds the total amount initially paid for those assets (on average). This suggests that the owner could make a profit if they were to sell their possessions at the current market value.

Conversely, approximately 82.39 trillion Shiba Inu (SHIB) coins are being held by around 398,000 wallets that are “underwater,” meaning these owners are currently in a position where the value of their coins is lower than what they originally paid for them.

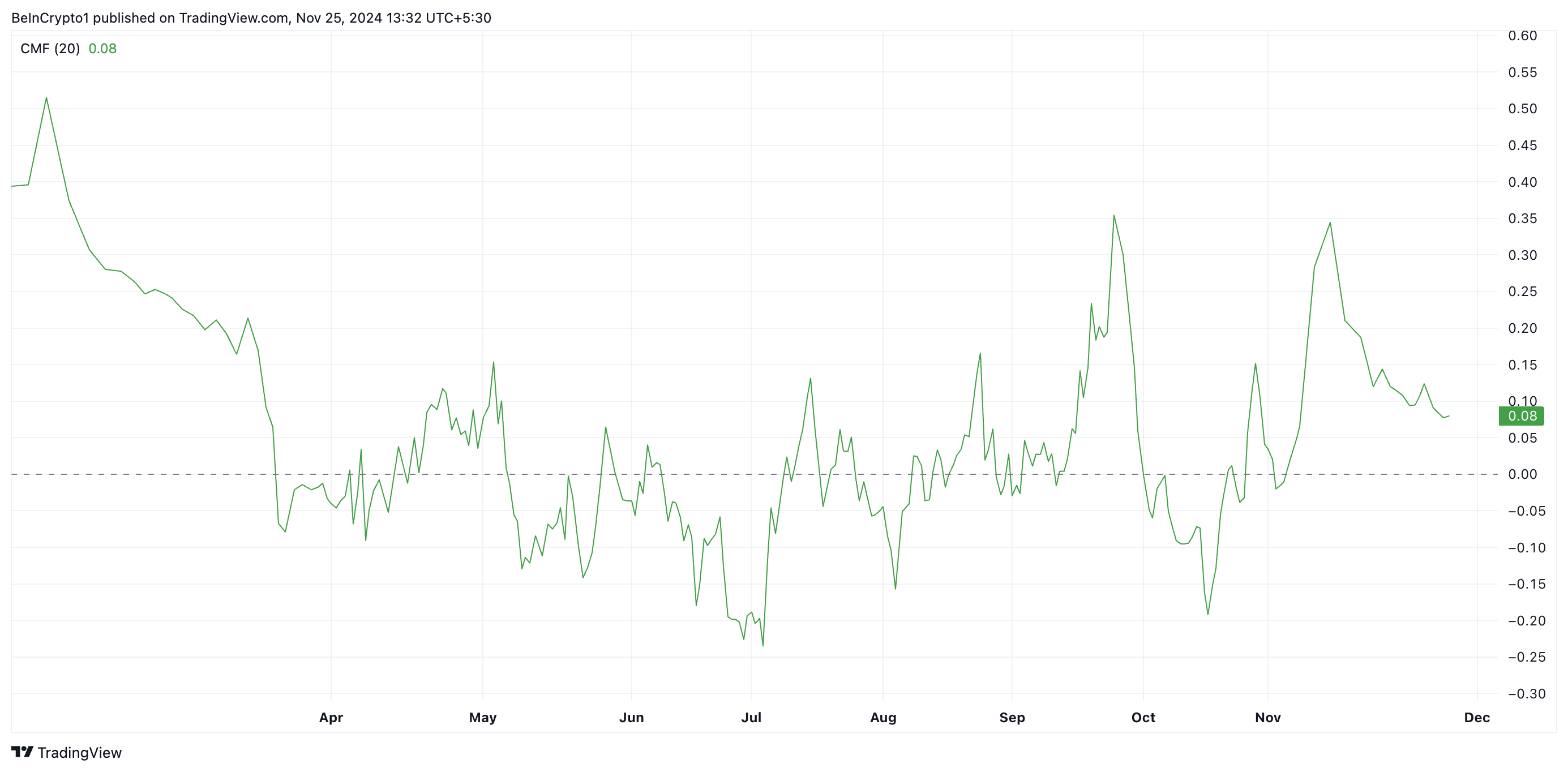

62% of its owners are currently experiencing gains, leading to an increase in selling actions. This trend can be seen in SHIB’s decreasing Chaikin Money Flow (CMF), which currently stands at 0.08 and is moving towards the middle or zero line.

The CMF measures the market’s buying and selling pressure. When it falls toward the zero line, it signals weakening buying momentum, indicating that market participants are losing conviction in the uptrend.

Furthermore, the configuration of Shiba Inu’s Moving Average Convergence Divergence (MACD) graph supports a bearish perspective. Presently, the MACD line (represented by blue) is positioned beneath the signal line (depicted in orange).

This tool monitors changes in an asset’s price patterns and momentum, providing buy or sell recommendations. When the Moving Average Convergence Divergence (MACD) line drops below the signal line, it signals a downward trend and verifies the end of an upward trend. It implies that there is growing selling pressure, which may lead to the asset’s price falling even more.

SHIB Price Prediction: A Decline To $0.000020?

Right now, Shiba Inu (SHIB) is being traded at approximately 0.000025 USD, representing a 4% decrease in the past 24 hours. Despite this dip, it’s still holding above a crucial support level at 0.000022 USD. If SHIB drops beneath this support, there’s potential for its price to fall even lower, possibly down to around 0.000020 USD.

If profits decrease and there’s an increase in interest for the meme coin, it could surge past the resistance level at $0.000026, aiming to regain its highest point of eight months, which was $0.000030.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2024-11-25 13:32