As a seasoned analyst with over two decades of experience in financial markets, I have seen my fair share of regulatory battles and shifts in policy priorities. In the case of Caroline Crenshaw’s re-nomination as a US SEC commissioner, I find myself cautiously optimistic about the potential impact on crypto regulation in the US.

The potential renewal of Caroline Crenshaw’s position as a commissioner at the U.S. Securities and Exchange Commission is currently undecided. This matter will be put to a vote by the Senate Banking Committee on Wednesday, and if approved, it could significantly influence the direction of cryptocurrency regulation within the United States in the future.

Should Crenshaw be appointed, she is set to sit on the Securities and Exchange Commission (SEC) until the year 2029. Yet, her past actions and what appears to be a cold attitude towards cryptocurrencies have sparked significant backlash.

Crenshaw’s Controversial Crypto Stance

While serving at the SEC, Crenshaw has developed a strong partnership with Chair Gary Gensler, who is recognized for his tough regulations on cryptocurrencies. Some of Crenshaw’s detractors contend that her views are actually stricter than Gensler’s.

As a researcher, I’d rephrase that statement as follows: “I find myself expressing stronger opposition towards cryptocurrencies compared to Gensler, given my stance on the approval of Bitcoin spot Exchange-Traded Funds (ETFs).” This way, it’s more personal and easier to understand.

Seyffart noted that she wasn’t merely supportive of Gensler regarding cryptocurrencies; instead, she was noticeably more critical towards crypto than Gensler himself. As evidence, he pointed to her dissenting letter about the Bitcoin ETF approvals in January, which was unusual since fellow democrat commissioner Lizárraga didn’t sign onto that particular statement.

The ETF analyst referred to a disagreement letter she wrote on January 10th, where Crenshaw expressed opposition to the approval of Bitcoin ETFs trading in real-time markets. In this letter, the SEC commissioner highlighted issues related to investor protection and potential market manipulation as her reasons for dissent. It’s worth noting that Democratic Commissioner Jaime Lizárraga did not share Crenshaw’s viewpoint on this matter, adding weight to the strength of Crenshaw’s stance.

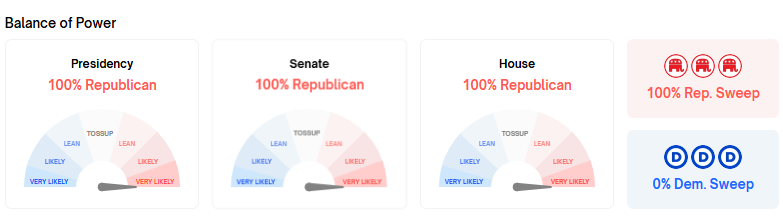

Crenshaw’s decision to seek re-nomination arrives as the Republican-led Senate and House indicate changes in their regulatory focus. As per the forecasting platform Polymarket, the GOP enjoys a significant advantage in both houses, increasing the significance of this week’s vote.

Eleanor Terrett of Fox Business reported that if the Senate approves her appointment, she can work on the commission till 2029. If she’s not endorsed, President Trump can choose another person instead.

Broader Implications for Crypto Regulation

Furthermore, Terrett emphasized the similarity between Crenshaw’s views and Gensler on significant matters, indicating that her proposed policies could potentially encounter obstacles in a legislature predominantly controlled by Republicans. Besides her standpoint on cryptocurrency, Crenshaw has been vocal about promoting stricter climate reporting requirements and other progressive agendas.

Although these priorities strike a chord with her Democratic supporters, they’ve sparked criticism from Republican legislators, who claim that implementing these measures could be too burdensome for businesses and may discourage investment.

Currently, Trump, who often voices criticism towards the SEC’s existing cryptocurrency regulations, has pledged significant changes if given the opportunity. He has sworn to revamp U.S. cryptocurrency laws beyond Gensler’s strict proposals, which could lead to a more innovative and dynamic regulatory landscape.

Essentially, Byron Donalds stated that President Trump is prepared for a thorough overhaul, not just a simple tidying up. He explained that this process involves selecting individuals with relevant experience from our industries within the U.S., based on their long-term contributions. These insights were reportedly shared during their private conversations.

Amid the campaign hype, Trump also repeatedly emphasized the need for regulatory clarity. He committed to challenging statutes that stifle innovation and reduce unnecessary red tape, potentially positioning America as the leader in crypto’s future.

The cryptocurrency sector will keep a close eye on the upcoming vote, as they are worried that reappointing Crenshaw might perpetuate a regulatory strategy seen as limiting innovation and hampering the U.S.’s ability to compete globally in this field.

Read More

- Does Oblivion Remastered have mod support?

- Thunderbolts: Marvel’s Next Box Office Disaster?

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion Remastered: Best Paladin Build

- Demon Slayer: All 6 infinity Castle Fights EXPLORED

- Everything We Know About DOCTOR WHO Season 2

2024-12-07 23:28