As someone who has spent a significant part of my career navigating the ever-evolving world of finance and technology, I find myself deeply intrigued by the intersection of artificial intelligence (AI) and blockchain in trading platforms. This fusion promises to bring about a new era of efficiency, security, and inclusivity in financial markets, making it more accessible to a wider audience.

The realm of finance is being dramatically transformed as artificial intelligence (AI) reshapes how trades are carried out, risk is assessed, and strategies are devised. Previously relying on conventional techniques and human intuition, trading is now being molded by sophisticated AI-powered systems, offering unparalleled speed, accuracy, and adaptability.

Willy Chuang, the COO of WOO X and an ardent promoter of AI’s creative uses in trading, offered insightful thoughts on the benefits and hurdles associated with incorporating AI into trading systems.

Smarter Tools for Faster Decisions

As an analyst, I find one of the most significant benefits that AI brings to trading lies in its capacity to swiftly process vast quantities of information at the drop of a hat. By employing AI, these platforms can scrutinize diverse sources such as market data, financial news, and social media trends, enabling them to foresee price fluctuations and pinpoint lucrative opportunities with remarkable precision.

Rapid-fire trading strategies, capable of executing multiple transactions in a fraction of a second, outpace human traders in both swiftness and accuracy due to their advanced programming.

In simpler terms, Chuang stated that AI has significantly changed the trading landscape. It’s no longer just about basic neural networks; it’s about complex Language Model-based systems that can analyze diverse data from markets, social media, and other resources. These advanced tools are now being used by quantitative funds to gain a deeper understanding of market trends, enabling them to make wiser decisions.

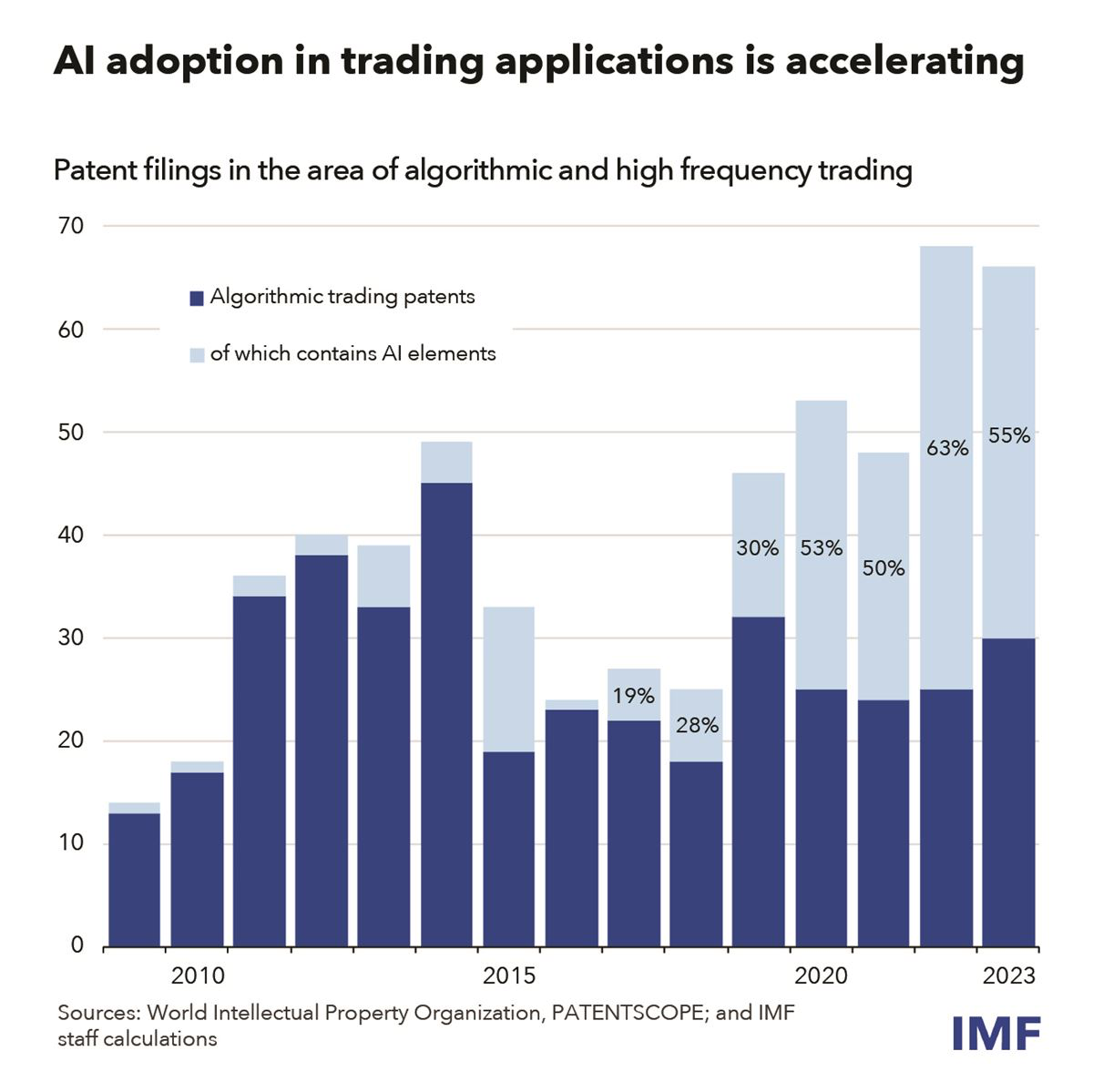

The surge in interest towards AI technologies in stock trading can be observed by examining US patent filings. Since the debut of large language models (LLMs) in 2017, there has been a significant rise in AI-related content within patent applications for automated trading systems. In fact, since 2020, this proportion has consistently exceeded 50%, indicating a marked upsurge in innovation related to AI technology in the field of algorithmic trading.

This evolution has also made trading more precise. Advanced tools now analyze patterns in market behavior and adjust strategies dynamically as conditions shift. Machine learning models continuously improve by learning from historical data, enabling them to adapt more effectively to new situations.

However, Chuang emphasizes that these tools do not substitute for human intelligence; instead, they collaborate with it. This collaboration allows traders to concentrate on broader strategic considerations, leaving the intricate details to be managed by the computer systems.

In this context, human traders aren’t being phased out but are transitioning their responsibilities. They now spend more time developing and supervising AI-based strategies, monitoring risks, and upholding ethical standards. This synergy between AI and humans, where the latter act as overseers, enhances decision-making capabilities and encourages collaboration among various fields of expertise,” he explained.

AI Is Tackling Unpredictability in Trading

As a crypto investor, I’ve learned that even the most sophisticated trading tools can struggle when markets behave erratically, as was evident during extraordinary events like the COVID-19 pandemic in 2020. These “black swan” events, unexpected and significant in their impact, often catch market systems off guard, leading to massive disruptions. If trading platforms don’t adapt quickly enough, it can result in substantial losses for investors like myself.

Chuang suggests that for AI systems to stay adaptable in unpredictable situations, two vital strategies are essential. Primarily, it’s crucial to improve the clarity of models, as this makes AI decisions more transparent, enabling traders to better grasp and separate factors influencing market volatility. This usually means using a combination approach, where people team up with AI to develop agile experimentation frameworks that can swiftly adjust to new data.

Furthermore, enhancing adaptability could involve incorporating reinforcement learning, which allows systems to consistently adjust their approaches and react more efficiently to unforeseen alterations in their environment.

Chuang explained, ‘Take for instance, having two AI systems work together to handle sudden incidents that cause instability. This setup allows our system to adapt its reactions swiftly in real-time. The AI agents assess the situation, make necessary adjustments, and save useful information for future use. In doing so, the AI is always improving by learning from every unforeseen event.’

As a crypto investor, I can’t stress enough the importance of verifying the data that trading platforms use. Top-notch, dependable data is the lifeblood of AI-powered trading, but finding and maintaining it isn’t an easy task.

A significant challenge lies in unifying data from multiple marketplaces and quote systems into a cohesive, synchronized platform, all while maintaining swiftness to prevent any undue delays. Even minor discrepancies or lags could substantially influence trading strategies, particularly in rapidly changing market conditions.

To handle the massive amount of data streaming in real-time, a strong and adaptable system is essential – one that can swiftly process and save information with precision. Building flexible Software Development Kits (SDKs) that work seamlessly across multiple platforms introduces an extra level of difficulty, as these SDKs must strike a balance between speed, compatibility, and security,” he noted.

Overcoming these obstacles is essential for maximizing AI’s capabilities within the trading sector. By providing accurate and prompt information, trading systems can empower their users to make more intelligent choices and stay ahead in rapidly changing financial landscapes.

Opening the Door for All Traders

For a long time, sophisticated trading resources were predominantly accessible to big financial corporations with substantial budgets and skilled personnel. Consequently, smaller traders frequently resorted to using antiquated techniques or underpowered tools that fell short in comparison.

Today, I’m witnessing a shift in the trading landscape. A plethora of platforms are now making it possible for individuals like me to participate in complex trading processes at affordable or even no cost. For instance, these days, there are apps equipped with automated trading bots, market analysis tools, and personalized suggestions tailored to traders of all skill levels. These innovative features level the playing field, enabling smaller-scale traders to compete effectively – something that would have been unthinkable a few years back.

In a nutshell, at WOO, we’re dedicated to tackling this issue head-on. Our aim is to democratize sophisticated AI trading tools, ensuring they are within reach for all, even those who might feel sidelined, such as smaller traders. We’re concentrating on crafting customized experiences tailored to traders at every level, breaking down complex AI technologies so that users can concentrate on their objectives without requiring in-depth technical expertise, as articulated by Chuang.

But accessibility isn’t just about cost — it’s also about usability. In the past, products often missed the mark by catering only to either new traders or advanced ones, leaving many users feeling left out.

As a crypto enthusiast, I’ve found that many platforms today provide educational resources such as tutorials and webinars, making it simpler for newcomers like me to dive into the world of trading. These user-friendly interfaces are designed to ensure that more individuals can tap into the potential benefits that cutting-edge trading technology offers.

“User education is key for helping traders make the most of AI-powered tools. Our vision is to create hyper-personalized experiences that cater to each individual’s unique needs, regardless of their experience level. Focusing on personalized education and support helps to ensure that all traders can confidently navigate AI-driven trading,” he noted.

Building Trust Through Transparency

Ensuring regulatory compliance and addressing ethical concerns are essential priorities as artificial intelligence (AI) plays an increasingly integral role in trading systems. Keeping abreast of financial regulations can be especially tough for developers and platforms, given their intricacy and ongoing changes.

In this setting, it’s crucial for platforms to adhere to the rules, all the while keeping things transparent by disclosing their methods and technology choices. By openly discussing how AI operates and acknowledging its boundaries, they can foster trust not only with regulatory bodies but also with their stakeholders.

Similarly crucial, ensuring that the AI project is tightly coordinated with the legal and compliance departments could have a substantial impact. Through collaboration, these teams can exchange innovative thoughts about how laws can adapt to suit a trading landscape dominated by AI more effectively, as stated by Chuang.

Ethical considerations are just as vital. One major issue is the “black box” problem, where it’s hard to understand how AI systems make decisions. To fix this, AI needs to be more transparent so traders and others can clearly see how results are reached.

Ensuring the safety of personal data remains a high concern. It’s crucial to fortify our security systems to shield confidential details and preserve user privacy. Additionally, the data sources employed by AI should be both transparent and morally sound, promoting precision and minimizing biases that might skew or misrepresent outcomes.

“Clear ownership of AI models is also important. This prevents intellectual property disputes and ensures that creators receive proper recognition for their work. Addressing these ethical issues allows developers to create AI-driven trading platforms that are powerful, efficient, trustworthy, and respectful of user rights,” he summed up.

The Path Forward

The future of trading lies in striking the right balance between technology and human expertise. Despite the growing role of automation, human intuition and decision-making remain essential.

Technology excels at managing repetitive tasks and spotting possibilities in an instant, yet it’s human intelligence that offers strategic guidance, originality, and discernment which technology lacks. Though advanced machinery may take care of the bulk work, humans remain essential for comprehensive perspective, innovation, and decision-making.

According to Chuang, while AI agents can take care of most of the demanding tasks, it’s crucial for humans to guide them as they do so. This partnership allows AI to operate efficiently and support traders’ objectives. Although AI is proficient at many tasks, the human ability to make strategic decisions and find creative solutions to complex problems remains invaluable.

In essence, the fusion of blockchain and AI is opening up novel opportunities. Blockchain enhances data security and protects user privacy by reinforcing its integrity, simplifying procedures like onboarding, thereby enabling sophisticated tools to deliver customized insights and enhance operational efficiency. For traders specifically, it envisions a future where financial markets are fortified with secure, accessible systems that foster greater inclusivity and resilience.

Picture an effortless process of joining a platform where blockchain ensures smooth transactions and protects your data, while AI customizes your experience and offers relevant advice. This combination not only boosts the effectiveness and security of financial operations but also makes advanced technology available to all. The merging of AI and blockchain is leading us towards a more modern, democratic, and robust financial system,” he summarized.

With trading platforms addressing challenges such as volatile market conditions and data inconsistencies, the prospects for traders will continue to expand. By combining swift, advanced technology with seasoned human know-how, they are shaping a dynamic trading environment that becomes increasingly dependable, user-friendly, and forward-moving.

Read More

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- 30 Best Couple/Wife Swap Movies You Need to See

- PENGU PREDICTION. PENGU cryptocurrency

- ANDOR Recasts a Major STAR WARS Character for Season 2

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Is a Season 2 of ‘Agatha All Along’ on the Horizon? Everything We Know So Far

- Where To Watch Kingdom Of The Planet Of The Apes Online? Streaming Details Explored

2024-12-18 20:33