As a seasoned analyst with over two decades of experience in the tech industry, I’ve witnessed the evolution of blockchain technology from its infancy to the powerful force it is today. The launch of sBTC on Stacks Mainnet is a monumental step forward in the world of Bitcoin and decentralized finance (DeFi).

The primary development team for Stacks, known as Bitcoin L2 Labs, declared the successful debut of a programmable asset that is directly tied to Bitcoin (1:1), called sBTC. This significant milestone brings us closer to creating a Bitcoin-centric on-chain economy and comes after the Nakamoto Upgrade in October, which improved transaction speeds and ensured complete finality for Bitcoin transactions within the Stacks network.

For the broader Bitcoin community, this is more than just a milestone — it signals a new era of programmable Bitcoin. The world’s most secure blockchain can now actively participate in decentralized finance (DeFi).

sBTC Debuts on Stacks Mainnet

sBTC is designed to unlock Bitcoin (BTC) liquidity and comes after Stacks initiated the Nakamoto Upgrade in late August. It will enable BTC holders to access DeFi opportunities while retaining Bitcoin’s unmatched security principles.

Users have the opportunity to interact with Decentralized Finance (DeFi) platforms, which encompass activities such as lending and borrowing via systems like Zest, decentralized exchange services such as Bitflow and ALEX, and even intelligent tools such as aiBTC.

Muneeb Ali, the founder of Stacks, stated in a press release sent to BeInCrypto that unlike securing BTC through proof-of-stake systems, sBTC is versatile and fosters an on-chain Bitcoin economy. It empowers decentralized lending platforms, DEXs (Decentralized Exchanges), AI bots, and other applications, all while maintaining the same level of 100% security from Bitcoin’s hash power.

One of the main characteristics of sBTC includes a 1-to-1 backing by Bitcoin, meaning that each sBTC token is fully backed by an equivalent amount of Bitcoin. Additionally, it boasts an institutional signer network, which minimizes dependence on individual entities, thus increasing overall trust.

Moreover, sBTC boasts complete Bitcoin confirmation, which relies on Bitcoin’s hash power for robust security. Additionally, it features publicly accessible source code, providing clarity and assurance for both developers and users as they verify its functionality.

Nevertheless, the current mainnet phase introduces deposit-only functionality, capped at 1,000 BTC. Despite this limitation, this cap will provide initial liquidity for developers and enable further integrations with institutional custodians and ecosystem partners.

As an analyst, I’m sharing that the withdrawal functionality won’t be accessible until Q1 2025, as our system undergoes a shift towards a fully open and permissionless signer environment. Notably, depositors stand to earn annual rewards of up to 5% in sBTC for keeping their assets, which presents an exceptional yield prospect for Bitcoin owners.

Unlocking Bitcoin’s Full Potential

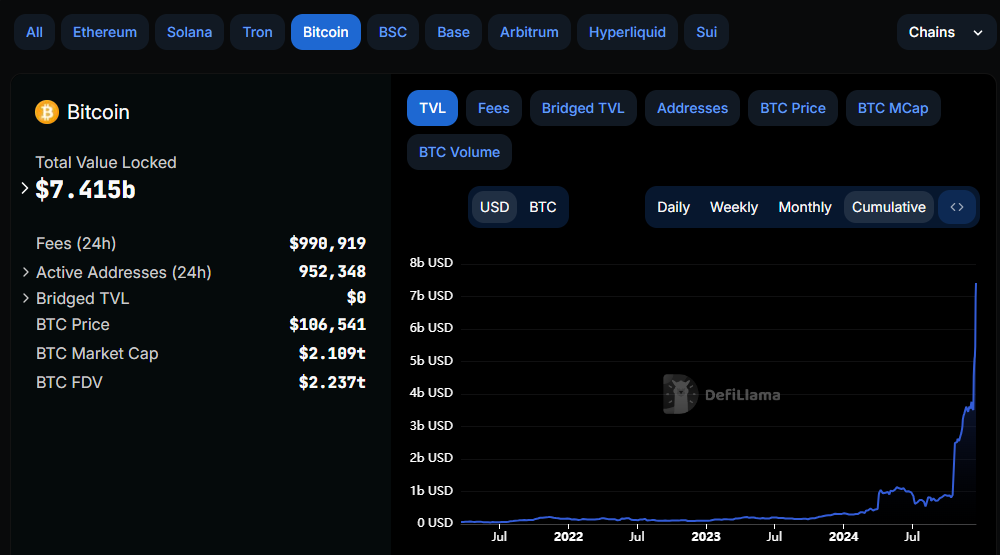

In the near future, the introduction of sBTC could narrow the gap between Bitcoin and Ethereum‘s influence in the Decentralized Finance (DeFi) sector. Currently, Ethereum’s dominance is evident with a Total Value Locked (TVL) nearing $80 billion, as shown by DefiLlama statistics. However, Bitcoin is rapidly catching up after surpassing Binance Smart Chain (BSC).

The smooth launch of sBTC establishes a robust infrastructure for a more dynamic Bitcoin ecosystem on Layer-2. As the BTC limit is gradually removed, withdrawals are introduced, and the system moves towards a signer network without restrictions, it may encourage broader acceptance. With sBTC, Bitcoin transforms from a simple store of value into a multifaceted asset suitable for decentralized applications (dApps).

Andre Serrano, Head of Product at Bitcoin L2 Labs, highlighted that with sBTC, Bitcoin transcends its role as just a store of value, enabling BTC to fully realize its potential in decentralized apps,” is one possible way to paraphrase the original statement.

Furthermore, this advancement opens up more chances for developers working within the DeFi sector. To illustrate, Zest Protocol offers users a chance to collect extra incentives simply by holding sBTC.

Increase your Zest points by simply holding sBTC. The Stacks rewards system offers a 5% return on this action. On top of that, with Zest, you can significantly boost your earnings from sBTC,” the platform emphasized.

With more funds moving from Bitcoin into Decentralized Finance (DeFi) platforms, creators, programmers, and participants can enjoy improved liquidity and cutting-edge financial resources.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- SD Gundam G Generation ETERNAL Reroll & Early Fast Progression Guide

- Jurassic World Rebirth: Scarlett Johansson in a Dino-Filled Thriller – Watch the Trailer Now!

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- How a 90s Star Wars RPG Inspired Andor’s Ghorman Tragedy!

2024-12-17 09:40