Okay, let’s talk Sandisk. Because honestly, if your portfolio isn’t already flashing with this stock, you’re basically still using a flip phone. They’re up 166% this year, which, in stock market terms, is like winning the lottery while simultaneously finding a perfectly ripe avocado. It’s rare. And yes, it’s mostly thanks to everyone suddenly needing a ridiculous amount of flash memory. Apparently, we’re all secretly filming TikToks of our cats and storing them everywhere.

The thing is, Sandisk isn’t just benefitting from our collective digital hoarding. It’s also, dare I say, cheap. Like, suspiciously cheap for a company fueling the AI revolution. It’s like finding a designer handbag at a garage sale – you immediately check for a hidden camera. But in this case, the only thing hidden is how long this good fortune can last. Still, while it lasts, it’s a good time.

Sandisk’s Catalysts: It’s Not Just About Cat Videos

So, what’s Sandisk actually making? Flash storage. For everything. Gaming consoles, laptops, phones, tablets… basically anything that needs to remember things. And they’re not just making it, they’re crushing it. Revenue up 61%? Earnings up five times? That’s not a growth spurt, that’s a full-blown financial puberty.

The reason? A supply shortage, naturally. It’s always a supply shortage. Apparently, AI data centers are vacuuming up flash storage like it’s oxygen. And everyone wants more storage on their phones because, let’s be real, we’re all digital pack rats. It’s a perfect storm of demand, and Sandisk is sitting right in the eye of it.

They’re so busy, they told investors their factories are running at full capacity. Which, in corporate speak, means “we’re working ourselves to the bone.” But hyperscalers—those fancy data center companies—are willing to pay a premium. It’s like the velvet rope at a nightclub, except instead of celebrities, it’s terabytes of data.

Rumor has it they’re doubling the price of their fancy 3D NAND solid-state drives. Which, let’s be honest, sounds terrifyingly technical, but basically means they’re getting away with it. And with 2026’s manufacturing capacity reportedly sold out, those prices are only going up. Their latest earnings guidance? A vast improvement over last year’s loss. It’s the kind of turnaround that makes Wall Street salivate.

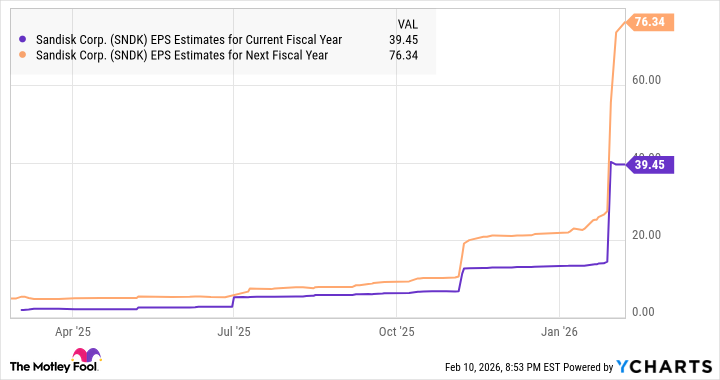

Analysts are predicting a jump in earnings, from $2.99 per share to $39.45. That’s not a jump, that’s a leap. Like a frog on a caffeine bender. And they expect that momentum to continue.

The Stock is Likely to Keep Skyrocketing (Don’t Blame Me If It Doesn’t)

They’ve already earned $7.55 per share this half-year. And analysts think they could pull in another $31.90 in the next half. That puts them on track for $70.07 per share for the year. It’s enough to make even the most seasoned investor feel a little… giddy.

Now, let’s do some math (please bear with me). Sandisk is currently trading at 15 times forward earnings. The Nasdaq-100? A whopping 24.7. If Sandisk were to trade at just 20 times earnings, its stock price could jump to $1,401. Yes, you read that right. One thousand, four hundred and one dollars. I’m not saying it will happen, but it’s definitely within the realm of possibility. And if it does, I expect a finder’s fee.

Look, I’m just saying, if you’re looking for an AI stock that’s growing at a ridiculous pace and trading at a reasonable price, Sandisk is worth a look. It’s a rally that’s likely to continue. And if it doesn’t? Well, I never promised you a rose garden. I just pointed out a potentially lucrative stock.

Read More

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- Wuthering Waves – Galbrena build and materials guide

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The Best Directors of 2025

- Games That Faced Bans in Countries Over Political Themes

- 📢 New Prestige Skin – Hedonist Liberta

- The Most Anticipated Anime of 2026

- SEGA Sonic and IDW Artist Gigi Dutreix Celebrates Charlie Kirk’s Death

2026-02-14 23:52