So, Sandisk. SNDK, if you must. Apparently, it’s the hottest thing since sliced bread. Or, you know, whatever they’re calling “hot” these days. Solid-state memory. Big deal. They were doing this stuff in the nineties. The nineties! And it took thirty years to get to… what, five billion? It’s like they were deliberately trying to be… unremarkable. Honestly, the whole thing feels off. Like, they were trying to be a quiet success. Is that even possible? It’s infuriating.

Now, it’s suddenly a star. Included in the S&P 500. Doubled year-to-date. Of course. Because now everyone notices. It’s the principle of the thing. You spend decades being perfectly adequate, then suddenly you’re a genius. It’s like waiting thirty years for a table at a restaurant, and then they finally call your name and the food is just… okay. Just okay! What was the point?

Was it an obvious buy when Western Digital spun it off? No. Of course not. And is it an obvious sell now that it’s gone up a ridiculous amount in a month? Also no. It’s just… exhausting. It’s a reminder that investing isn’t about finding brilliance, it’s about navigating a series of increasingly irritating compromises. It’s like trying to find a parking spot. You circle the block, you get frustrated, you finally find one that’s slightly too small, and you just… deal with it. That’s investing. That’s life.

What’s So Hard About This Whole Thing?

Everyone talks about “intrinsic value.” Buffett and all that. Calculating future cash flows. As if you can predict the future! It’s absurd. It’s like trying to predict what your neighbor is going to paint their house. You can make an educated guess, but you’re probably wrong. And then you have to look at that color every day. The whole thing is just… unsettling. And this Sandisk, with its memory chips… who knows how much money they’ll make? It’s a crapshoot. A beautifully packaged, heavily promoted crapshoot.

Remember Nvidia? Up a thousand percent, then another five hundred. Because apparently, people really, really wanted graphics cards. Or whatever it was. The point is, these things happen. Randomly. It’s not about skill, it’s about luck. Pure, unadulterated luck. And I, for one, am deeply suspicious of luck. It’s just… unfair.

They’re saying demand for memory is exploding. Inference, AI, all that. Apparently, it requires a lot of memory. Fine. But what happens when the AI decides it doesn’t want memory? What then? Are we all stuck with a warehouse full of useless chips? It’s a legitimate concern. No one is addressing this.

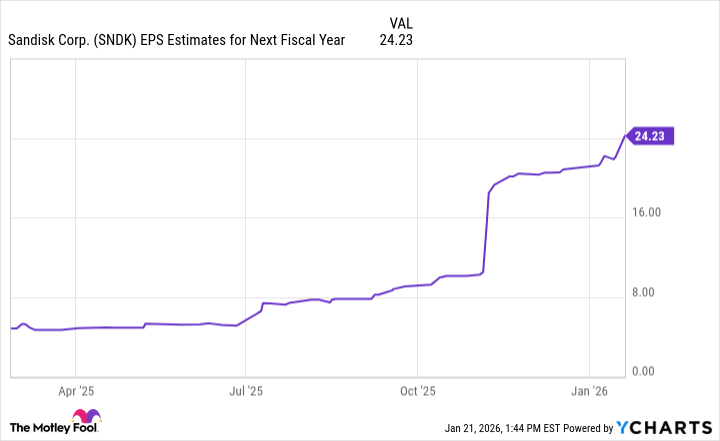

Demand is outpacing supply, margins are up, analysts are scrambling to revise their estimates. It’s a beautiful, self-fulfilling prophecy. Everyone gets excited, the price goes up, and then… what? It plateaus? It crashes? Who knows? It’s like a crowded subway car. Everyone is pushing and shoving, trying to get where they need to go, and then the train stops unexpectedly. And you’re just… stuck.

So, here’s the takeaway: we can’t predict the future. We can make assumptions, but they’ll probably be wrong. We can invest in “high-quality businesses,” but that doesn’t guarantee anything. We’ll make mistakes. Lots of them. But if we hold on long enough, maybe, just maybe, we’ll offset some of those mistakes. It’s a long shot. A very long shot. But what else are you going to do? Sit at home and watch television? No, that’s even more depressing. So, invest. And complain. Mostly complain. Because that’s the only truly reliable strategy.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- 20 Movies to Watch When You’re Drunk

- 10 Underrated Films by Ben Mendelsohn You Must See

- Anime That Should Definitely be Rebooted

- The 10 Most Underrated Mikey Madison Movies, Ranked (from Least to Most Underrated)

2026-01-24 22:52