Now, Micron Technology, a perfectly respectable firm, has been causing a bit of a stir lately, shooting up like a rocket, as it were. A 339% jump in a year! Quite the performance, and all down to a rather healthy appetite for memory chips. One couldn’t help but notice. But what’s even more intriguing is that Micron isn’t alone in this little boom. Oh no, there’s another player, a Sandisk, who’s been rather outdoing everyone, if you please.

Sandisk, you see, manufactures these data storage solutions – rather clever bits of kit for computers, telephones, gaming consoles, and all sorts of modern contraptions. And their share price? A positively astonishing 1,840% leap! It rather leaves Micron looking a bit… pedestrian, doesn’t it? One wonders what all the fuss is about, and whether Sandisk might just be the next big thing in the memory market.

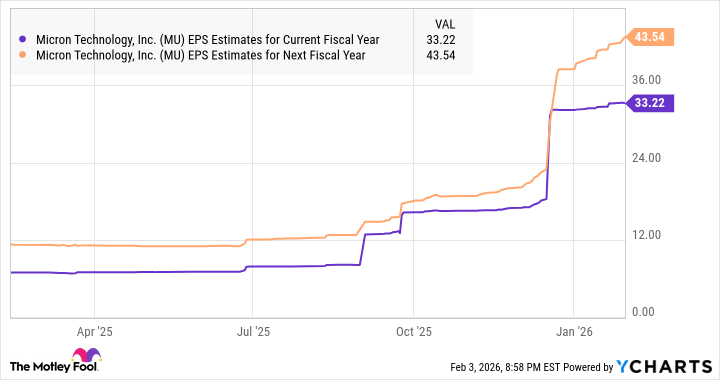

The demand for both storage and computing memory has been, shall we say, rather robust. It’s given Micron a jolly good boost, with earnings expected to quadruple. A shortage of these dynamic random access memory and NAND flash chips, you see. A bit of a pickle for some, but a golden opportunity for others. And Sandisk, bless their inventive souls, are seizing it with both hands.

These memory chips are all the rage in data centers, where they’re desperately needed for all this artificial intelligence malarkey. It seems everyone wants to build a super-brain, and that requires a tremendous amount of computing power and storage. Micron gets a goodly portion of its income from DRAM chips, which are being stuffed into these AI accelerators to whizz data about at an alarming rate. They’ve even sold out their 2026 capacity, which is rather a testament to the demand.

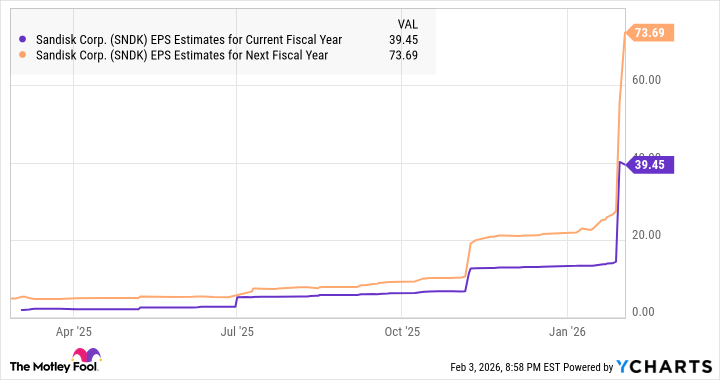

Sandisk, however, specializes in NAND flash technology. They were the fifth largest player in the NAND flash market last June, with a 12% share – a smidge below Micron’s 13%, but they are steadily gaining ground. Their revenue shot up a whopping 61% year on year in the last quarter, to just over $3 billion. Nearly triple the jump Micron managed with their NAND revenue! Quite the feat, wouldn’t you say? They’ve been doing rather well across the board – data centers, consumers, and even those little edge devices.

Their earnings, too, have been on a tear, jumping more than fivefold to $6.20 per share. Not surprising, really, when the demand for their flash memory products is outstripping supply. This NAND flash shortage is expected to continue, fueled by all these AI data centers loading up on storage solutions. It’s driving prices up, you see, and Sandisk is perfectly positioned to benefit. Phison Electronics, a rather knowledgeable firm, reckons this shortage could last for a decade, all thanks to this AI business. A jolly good outlook for Sandisk, wouldn’t you agree?

Sandisk themselves were predicting a decent increase in NAND demand, somewhere in the high teens annually through 2028. But their latest results suggest they’re on track for something far more substantial. They’re expecting $4.6 billion in revenue next quarter, a 172% jump! And their bottom line is expected to land at $13 per share, a vast improvement over the loss they posted last year. Consensus estimates are projecting a tenfold increase in earnings this year, to $39.45 per share. Well above Micron’s anticipated increase, and with another jolly good jump expected next year.

A Rather Promising Ascent

We’ve established that Sandisk is leaving Micron in the dust when it comes to earnings growth. This explains the stellar returns they’ve clocked up. Their forward earnings multiple is a bit higher than Micron’s – 44 versus 13 – but that premium is perfectly justified by the much stronger growth they’re delivering. In fact, Sandisk’s earnings are poised to become significantly larger than Micron’s by next year.

Now, if Sandisk trades at just 26 times earnings by the end of next year – in line with the tech-laden Nasdaq-100 index – their stock price could jump to $1,915 per share. That’s a 175% jump from where they are now! So, for investors looking for the next big AI stock, Sandisk is a rather promising sort, with tremendous upside to offer. One might even say it’s a bit of a steal at the current price. A most agreeable investment, wouldn’t you say?

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- Why Nio Stock Skyrocketed Today

- Gold Rate Forecast

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- EUR TRY PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

2026-02-06 21:32