SafeMoon’s price has been on a rollercoaster ride, climbing over 25% in the past week. But hold on to your hats, folks, because the sellers are taking over and threatening to erase some of SFM‘s recent gains.

Profit-taking and increased selling pressure are now threatening to erase some of SFM’s recent gains. This analysis provides the details.

SafeMoon’s Sellers’ Party Threatens to Ruin the Fun

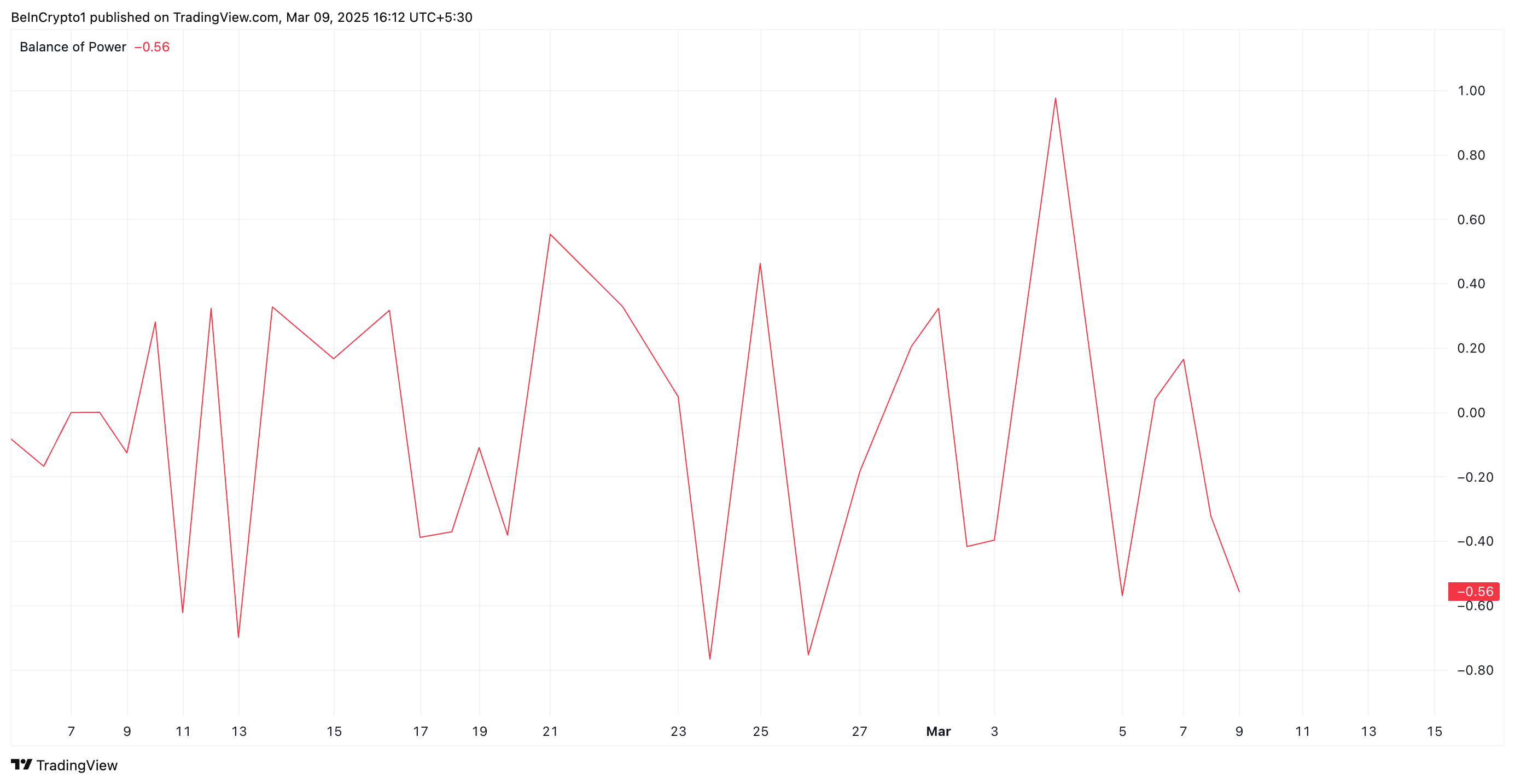

An assessment of the SFM/USD one-day chart highlights the growing selling pressure within SFM’s spot markets. A notable indicator of this trend is the token’s negative Balance of Power (BoP), which is at -0.96 at press time.

An asset’s BoP indicator compares buyers’ and sellers’ strengths by analyzing price movements within a given period. When its value is negative like this, it indicates that sellers have more control, meaning downward pressure is stronger, and the asset is likely experiencing a bearish trend.

This suggests weakening bullish momentum among SFM holders and hints at declines if selling pressure continues.

Furthermore, SFM’s price has dropped 8% over the past 24 hours, causing the altcoin to trade near its 20-day exponential moving average (EMA).

This moving average measures an asset’s average price over the past 20 trading days, giving more weight to recent prices to identify short-term trends.

As with SFM, when an asset’s price is poised to break below the 20-day EMA, it signals increased selling pressure. It is a sign of weakening bullish momentum and a shift toward a bearish trend.

SFM Finds Key Support at $0.000061

A successful breach of the dynamic support offered by SafeMoon’s 20-day EMA at $0.000061 would strengthen the bearish trend. In this scenario, the altcoin’s price could plummet further to $0.000047.

However, a spike in new demand would invalidate this bearish outlook. If spot inflows rally, it could drive SFM’s price above the resistance at $0.000068 toward its multi-year high at $0.000011.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-03-09 17:27