As a seasoned crypto investor with roots deeply embedded in the Russian landscape, I find myself both intrigued and somewhat perplexed by the latest developments in my homeland’s cryptocurrency sector. The rollercoaster of regulations is akin to navigating the treacherous waters of the Caspian Sea during a storm, but I’ve weathered many such storms, so I remain optimistic.

Russia is progressively implementing stricter rules within the cryptocurrency industry. Last month, President Vladimir Putin made cryptocurrency mining legal. Since then, they have established fresh regulations aimed at synchronizing crypto-mining operations with the nation’s energy requirements.

New rules being implemented soon involve a mix of permanent prohibitions and temporary limitations during certain seasons, starting early next year.

Russian Government Approves List of Regions Banned from Crypto Mining

According to Russia’s primary state news outlet, TASS, it appears that Russia intends to implement a six-year prohibition on cryptocurrency mining starting from January 1, 2025, in a total of ten regions. These regions are Dagestan, Ingushetia, Kabardino-Balkaria, Karachay-Cherkessia, North Ossetia, Chechnya, Donetsk (within Russia), Lugansk (within Russia), Zaporizhzhia (within Ukraine), and Kherson (within Ukraine).

In certain regions such as Irkutsk, Buryatia, and the Trans-Baikal Territory, Russia has chosen to limit mining activities rather than completely prohibit it. These areas will temporarily halt mining operations from January 1 to March 15, 2025, and from November 15 to March 15 in future years.

According to TASS, the government views the current list of regions with restrictions on energy usage as potentially changeable, depending on recommendations from the committee overseeing energy sector advancement. The government’s goal is to ensure fair and equitable energy distribution by implementing these new policies.

In simpler terms, Sergei Kolobanov explained to TASS that “interregional cross-subsidization” refers to a situation where regions with lower electricity costs due to regulated contracts are balanced out by producers and consumers in other areas. This happens because the cost is redistributed. After market liberalization, these restrictions may be removed if there’s enough energy capacity available.

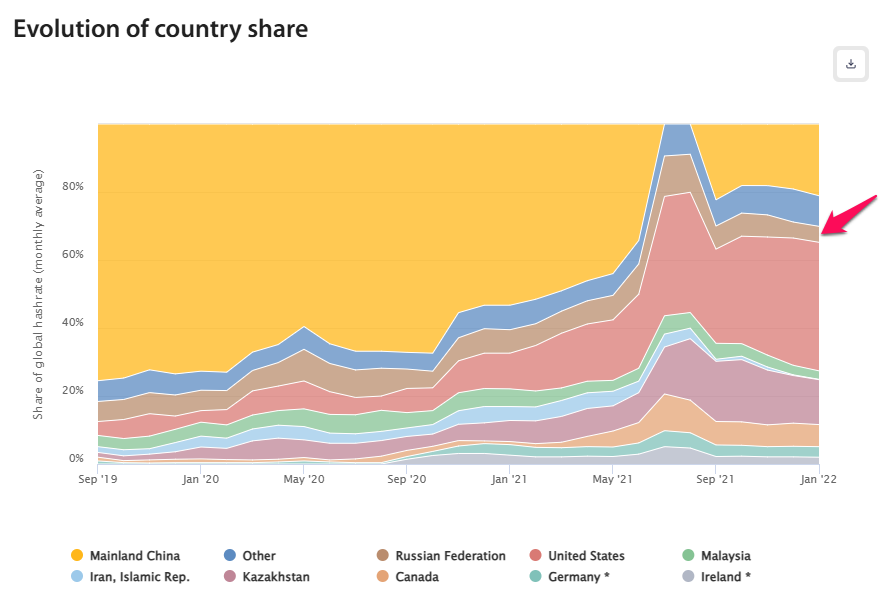

Data from Cambridge University indicates that Bitcoin mining in Russia makes up approximately 4.7% of the total worldwide mining capacity, which is lower than its 11% share in August 2021. Conversely, miners based in the United States currently account for the largest portion of the global hashrate at around 37.8%.

According to Cambridge’s data, the typical miner in Russia has seen a decrease in their monthly computational power from 13.6 Exahashes per second (Eh/s) to 8.7 Eh/s. Contrary to expectations, the legalization of mining within Russia has not led to substantial expansion in mining operations across the country.

By 2024, the Russian government seems to be adopting a more welcoming approach towards cryptocurrencies. This includes allowing cross-border transactions using cryptocurrencies and planning to establish state-sponsored cryptocurrency exchanges. Furthermore, there have been proposals from Russian legislators suggesting that Bitcoin could be held as part of the nation’s reserves to bolster financial stability.

Read More

- Does Oblivion Remastered have mod support?

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Everything We Know About DOCTOR WHO Season 2

- Luck stat in Oblivion Remastered, explained

- Elder Scrolls Oblivion: Best Bow Build

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Elder Scrolls Oblivion: Best Healer Build

- Persona 5: The Phantom X Navigator Tier List

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

2024-12-25 12:27