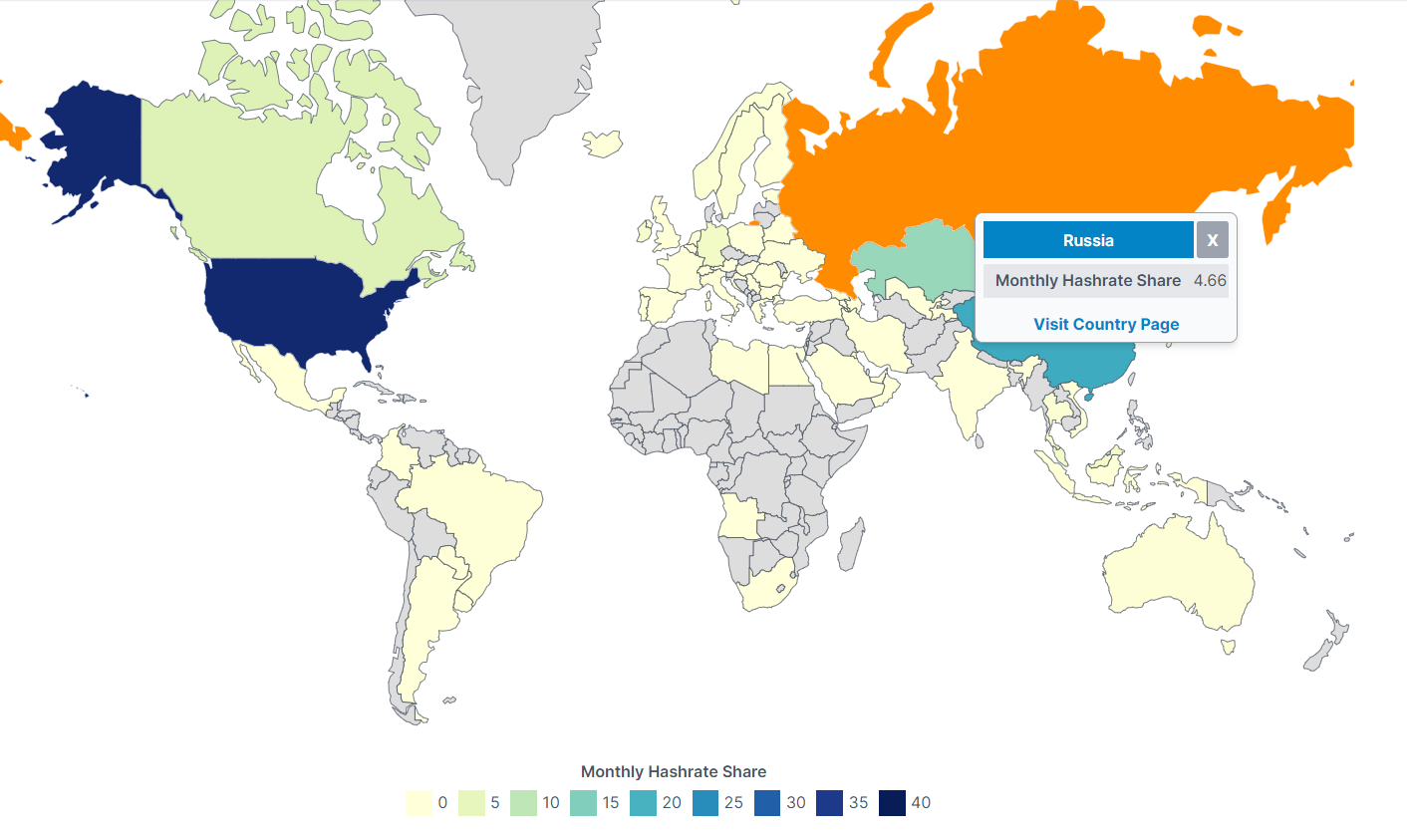

As an analyst with years of experience navigating the complex world of global finance, I find Russia’s approach to cryptocurrency mining and regulation intriguing. While the energy concerns are valid, the long-term ban on mining activities in certain regions seems extreme and may have unintended consequences.

Russian officials intend to outlaw cryptocurrency mining in territories they occupy in Ukraine, signifying a fresh regulatory move, given that the conflict has persisted for over 1,000 days.

Alexander Novak, Russia’s Deputy Prime Minister, gathered key government figures for a discussion aimed at resolving the nation’s electricity shortages during the busy autumn and winter periods. A significant part of the conversation revolved around the energy complications resulting from cryptocurrency mining, especially in areas with minimal power resources.

Russia’s Crypto Mining Restrictions Can Last Till 2031

As per news from the Moscow Times, the suggested prohibition is planned to encompass regions governed by Russia, such as Donetsk, Lugansk, Zaporizhia, and Kherson. The administration intends to limit mining operations in these areas due to their influence on local power systems.

Beginning in December 2024, there will be a complete prohibition on mining activities in the North Caucasus and areas of Ukraine currently under occupation.

Additionally, cryptocurrency mining in Siberia will be temporarily halted from December 1st, 2025, to March 15th, 2026, and this suspension will occur annually between November 15th and March 15th until the year 2031.

From December 2024, Russia’s Energy Ministry is tightening restrictions on cryptocurrency mining operations in regions experiencing energy shortages such as Irkutsk, Chechnya, and DPR. The implication is straightforward: energy is not unlimited, and miners may have to find covert methods or switch strategies. Maria Nawfal expressed this idea on platform X (previously known as Twitter).

Over the last couple of months, the Russian administration has been mulling over potential adjustments to their cryptocurrency policies. This upcoming legislation is expected to grant authorities direct control over mining operations, while maintaining a supportive stance on utilizing cryptocurrencies as a means of payment.

Last week, the government revised its crypto taxation policy. Under the new rules, cryptocurrency is classified as property for tax purposes. Income from mining will be taxed based on its market value at the time of receipt.

In addition, miners are allowed to claim operational costs, reducing some of the financial strain within the sector. Meanwhile, transactions involving cryptocurrencies will not incur Value-Added Tax (VAT).

Rather than having a separate tax structure, the earnings from cryptocurrency will be taxed similarly to those from securities. This means that the maximum personal income tax for crypto-related income is set at 15%.

Furthermore, it’s been reported that Russia is making progress towards setting up domestic cryptocurrency trading platforms. It’s expected these platforms will operate from cities such as St. Petersburg and Moscow.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2024-11-20 02:40