The question of disruption, that restless ghost of the technological age, has been a frequent companion of late. Which industries will wither under the chill of artificial intelligence, and which will find a strange, new bloom? I confess, I do not possess a crystal ball, only the cautious observation of a gardener tending a difficult crop. But I believe cybersecurity, that bulwark against the encroaching darkness, is a necessity, a fundamental element, and thus, less susceptible to being swept away by the winds of change.

And within this field, those who understand the very nature of the coming storm – the artificial intelligence itself – are best positioned to thrive. This brings me to Rubrik (RBRK +2.46%). The market has, with a characteristic impatience, marked it down – more than 45% from its peak, as if a promising sapling had been carelessly pruned. Yet, beneath the surface, the roots run deep, and the growth is undeniable. It presents, to my eye, a compelling opportunity.

The Keeper of Lost Things

Rubrik doesn’t seek to prevent the inevitable storm, but to safeguard what remains after it passes. They offer enterprises a haven for their data, a means of resurrection should the inevitable breach occur. It is a curious strategy, to accept the fallibility of defenses, but one that carries a certain wisdom. Others in the field chase the phantom of perfect security, and suffer the sting of reputation when their promises are broken. Rubrik, instead, prepares for the aftermath, a quiet custodian of lost things.

The company’s services are gaining traction, like a slow, persistent thaw. Annual recurring revenue grew 34% year over year to $1.35 billion in the third quarter of 2025, driven by those enterprises investing at least $100,000 annually – a testament to the value they perceive. It’s not a sudden burst of spring, but a steady, reliable unfolding.

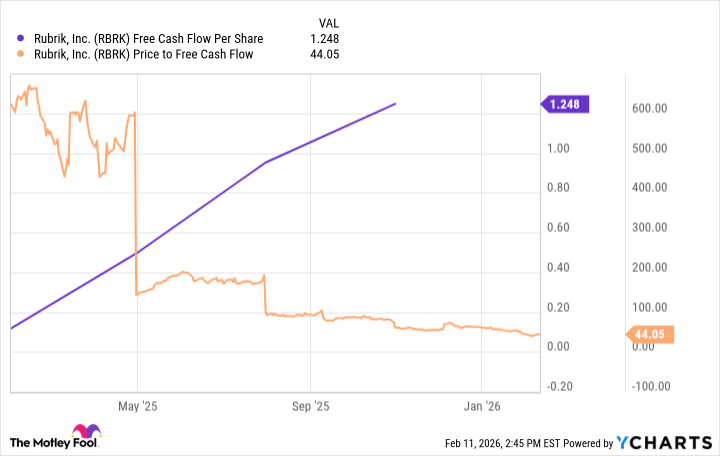

Rubrik generates positive free cash flow, a rare bloom in this often barren landscape. And the stock, at 44 times that flow, is not inexpensive. But to focus solely on the price is to miss the essential truth: this is a company that is growing rapidly, and that growth, in my estimation, justifies the valuation. It is a seed worth nurturing.

Some may deem it expensive, and perhaps they are right. But I find myself drawn to Rubrik’s trajectory, its commitment to a vital service, its ability to generate profit. It is a rare combination, and one that I believe will be rewarded.

The Echo of Automation

The next wave, it seems, will be driven by AI agents – autonomous entities capable of performing complex tasks. They promise efficiency, innovation, but also carry a hidden risk. They are, after all, extensions of ourselves, and as such, vulnerable to the same flaws. They access our data, our applications, and with that access comes a responsibility. Rubrik has anticipated this, building into its platform the ability to approve or deny access to these agents, a subtle but essential safeguard.

Moreover, they offer a means of reversing potential mistakes, a safety net for the inevitable errors of automation. It is a comforting thought, given the often-unpredictable nature of these new technologies. Based on experience, reassurance is a valuable commodity.

Cybersecurity, therefore, seems less a field disrupted by AI, and more one shaped by it. The challenges will evolve, of course, but Rubrik appears well-positioned to adapt, to offer proactive solutions. It is a company that doesn’t fear the future, but embraces it, with a quiet confidence.

Rubrik projected approximately 40% year-over-year revenue growth for the fourth quarter. A strong forecast, certainly. But even more encouraging was the preliminary report indicating that those results would exceed expectations. The roots, it seems, are growing deeper, the sapling is flourishing.

Therefore, it appears that the business remains on track, and Rubrik stock, in my view, represents a compelling investment opportunity. It is a seed planted in the digital winter, a promise of spring to come.

Read More

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The Best Directors of 2025

- Games That Faced Bans in Countries Over Political Themes

- TV Shows Where Asian Representation Felt Like Stereotype Checklists

- 📢 New Prestige Skin – Hedonist Liberta

- SEGA Sonic and IDW Artist Gigi Dutreix Celebrates Charlie Kirk’s Death

- The Most Anticipated Anime of 2026

2026-02-15 22:44