Royal Caribbean. The name itself feels like a promise, or maybe a carefully constructed illusion. They’re the second biggest player in the floating-hotel business, trailing Carnival, yet their market cap dwarfs the competition. Twice the size. That’s not luck; it’s spending power. Their clientele aren’t looking for a bargain basement getaway; they’re looking for a manufactured experience, and they’re willing to pay for it. The market understands this, and that’s a fact you can bank on.

The question isn’t whether this stock has legs. It’s whether those legs will carry it past the next squall. A long-term hold, or just a quick dip in the water?

The Current Tide

The long view, as always, is the clearer one. Royal Caribbean has ridden the wave of revived demand like a seasoned captain. The numbers don’t lie. 112% occupancy. They define full as two bodies per cabin. That’s efficient. And in the first nine months of ’25, they hauled in over $3.5 billion in net income. A 51% jump year-over-year. That kind of cash buys a lot of breathing room, and a lot of new steel.

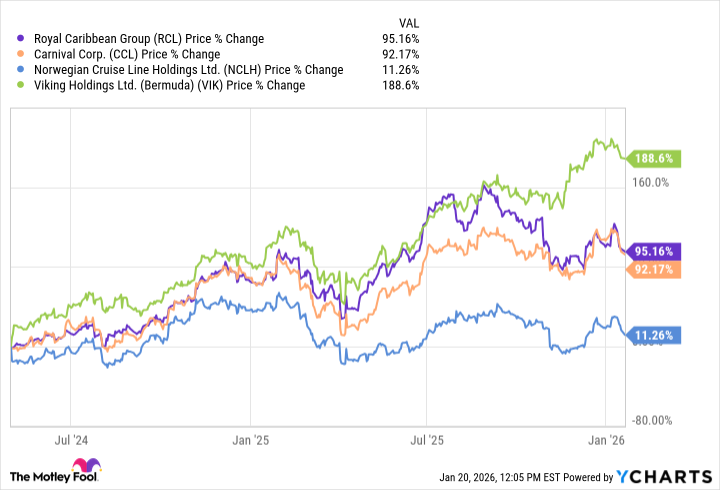

They’re not just patching holes; they’re building bigger boats. The Star of the Seas launched this year, and three more are on the horizon. Demand is strong, and they’re responding. Simple as that. The stock has outperformed the S&P 500 over the last five years, a solid enough performance in a world where even solid ground feels like shifting sand.

The valuation isn’t outrageous, either. A P/E of 18. A little higher than Carnival’s 16, and Norwegian’s 14, but a world away from the S&P 500’s bloated 31. They’re not asking for a king’s ransom, just a fair price for a well-run operation.

But there’s always a current pulling in the opposite direction. Viking Holdings. A new player, aiming for the high end of the market. Smaller ships, curated experiences. They’re nibbling at the edges, generating over 4% of industry revenue with less than 1% of the passengers. A lean, efficient predator. Since their IPO in May ’24, they’ve left the other cruise lines in their wake. Their P/E of 32 suggests investors are willing to pay a premium. Whether that holds is another question entirely.

The Long Haul or a Quick Voyage?

I’ve seen enough cycles to know that chasing trends is a fool’s game. Royal Caribbean isn’t a perfect ship, but it’s a sturdy one. They’ve grown larger than Carnival with a smaller customer base, and they’ve consistently outperformed the market. That’s not accident. It’s execution.

Viking is a challenge, no doubt. A sleek, well-financed competitor. But even if they manage to stay afloat, they’re unlikely to sink the Royal Caribbean liner. The ocean is big enough for both, but Royal Caribbean has the ballast to weather most storms.

So, is it a long-term hold? I’d say so. It’s not a glamorous investment, but it’s a rational one. In a world obsessed with disruption, sometimes the most reliable strategy is simply staying the course. The sea is full of wrecks, and most of them were chasing something shiny.

Read More

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- Wuthering Waves – Galbrena build and materials guide

- The Best Directors of 2025

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Games That Faced Bans in Countries Over Political Themes

- SEGA Sonic and IDW Artist Gigi Dutreix Celebrates Charlie Kirk’s Death

- The Most Anticipated Anime of 2026

- Top 20 Educational Video Games

- Most Famous Richards in the World

2026-01-25 12:42