The venerable Roku, a maestro of media streaming, now dances in the spotlight of financial triumph. Ah, the folly of those who abandoned their shares in yesteryears! Yet lo, even the most obstinate investor now finds their portfolio slightly buoyed, a testament to the capricious nature of fortune.

As of Sept. 29, the stock had gained 33.6% in 52 weeks, a feat rivaling the most dramatic of stage entrances. It trades 90.4% above the annual low, a resurrection from the depths of April’s fleeting dip. I, too, have cast my lot with Roku, only to watch my investments languish for years. Yet even my most beleaguered holding, acquired in April 2020, now sneers at the void with a 4% gain. A curious irony, this: the very company that once mocked patience now rewards it.

And I, ever the optimist, posit that Roku’s stock shall climb further still. The No. 1 reason? Its business, once a shadow of its potential, now thrives with the vigor of a man who has shed his shackles. Earnings, once a ghostly specter, now swagger with confidence, promising a future of unrelenting ascent.

Roku’s Profits: A Curtain Call to Victory

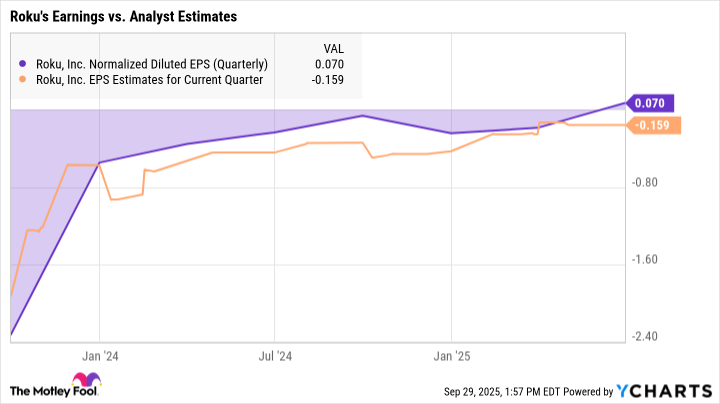

After years of hardship, Roku has mastered the art of defying expectations. Behold, the company has exceeded consensus revenue forecasts in each of the last 12 quarters, a streak of triumph that would make even the most jaded critic blush. The bottom line, once a source of despair, now gleams with seven consecutive victories. And the surprises grow bolder: in July’s Q2 2025 report, Roku’s adjusted earnings, after years of struggle, finally breached the realm of positivity-while the average analyst, blind to opportunity, anticipated a $0.15 loss per share.

From Inflation’s Sacrifice to Prosperity’s Embrace

Behold, the dawn of a new era! Analysts, once skeptical, now foresee double-digit sales growth this year and in 2026. Even the most pessimistic projections hint at earnings that dance with optimism in the coming quarter, with momentum accelerating through the horizon. A radical shift, indeed, from the losses incurred between 2022 and 2024. Roku, in its wisdom, sacrificed short-term gains to secure market share during inflation’s reign-a decision now reaping dividends like a farmer who sowed seeds in barren soil.

Thus, the tale unfolds: a company, once ridiculed, now lauded; a market, once dismissive, now enraptured. A farce, yes, but one where patience and perseverance triumph over the fickle whims of greed.

📈

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- American Bitcoin’s Bold Dip Dive: Riches or Ruin? You Decide!

- 📢 2.5th Anniversary GLUPY LIVE Rewards 🎁

2025-10-01 22:19