One does occasionally dabble, you know. A little flutter here, a cautious investment there. Last year, I rather fancied Roku. Seemed to have a bit of bounce, a certain je ne sais quoi. It rose, as it were, in a market positively brimming with mediocrity. A 46% gain. Not exactly a fortune, darling, but certainly preferable to watching paint dry. Though, frankly, some shades are rather engaging.

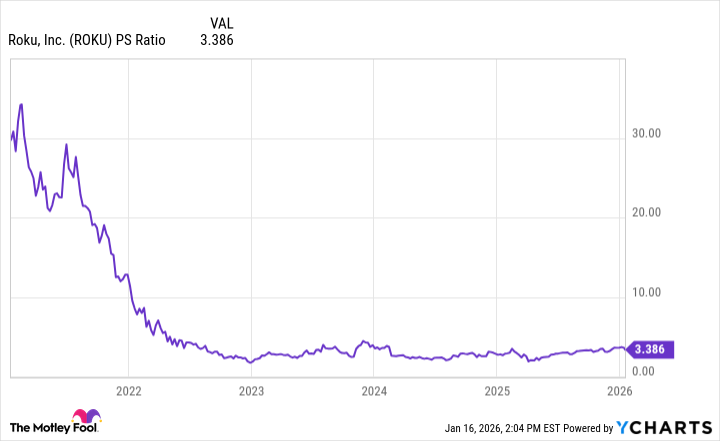

Naturally, everyone assumed this meant it was destined for greatness. One hears such nonsense constantly. The stock, of course, remains a good 78% below its peak from 2021. A rather precipitous drop, wouldn’t you agree? Still, a rise is a rise, and I took my profits. One doesn’t linger where the champagne is losing its fizz.

Now, however, I’m feeling a touch less enthusiastic. A slight chill has entered the air, if you will. I suspect Roku may underperform the S&P 500 this year. A thoroughly tiresome prospect, but one must be realistic.

The Brief Moment of Optimism

My initial wager rested on a few simple premises. Growth was picking up, cash flow was, shall we say, less anaemic, and the valuation wasn’t entirely outrageous. A rare combination, I assure you. Roku did deliver on the growth front, at least for a time. Their platform revenue – the sensible bit of the business, naturally – increased by a respectable 17-18% each quarter. The device side? A hopeless drain, but one learns to overlook certain vulgarities.

And the cash flow did improve, blessedly. Management, to their credit, managed to keep operating expenses relatively stable. A feat of budgetary wizardry, or perhaps simply a lack of imagination. Either way, it allowed profits to climb. They boasted a trailing twelve-month free cash flow of $443 million. A substantial sum, though one shouldn’t get carried away.

The Clouds Gather

I exited my position last year, and with good reason. The monetization strategy is… concerning. The numbers look pleasant enough, but advertising revenue isn’t keeping pace with viewership. They claim to be reaching 100 million households, and viewers are consuming 36.5 billion hours of content. It’s rather impressive, I suppose, but what’s the point if they can’t extract sufficient funds from the experience?

Apparently, Nielsen data suggests Roku’s viewership now exceeds that of traditional broadcast television. A curious development, but hardly a cause for unrestrained jubilation. The problem, as I see it, is pricing. Their president, Charlie Collier, insists they don’t have a supply issue. Well, darling, that leaves only one other possibility: a distinct lack of demand. Advertisers don’t seem particularly eager to throw money at Roku’s ad slots. A rather damning indictment, wouldn’t you agree?

Amazon and Walmart, naturally, are making rather a nuisance of themselves in the advertising space. And Walmart’s acquisition of Vizio? A blatant attempt to muscle in on the connected TV market. One can hardly blame them. Competition, after all, is the spice of life. Or, at least, the source of endless irritation.

A Glimmer of Hope?

Perhaps there’s a method to their madness. Collier suggests they’re prioritizing volume over immediate profit, onboarding advertisers at lower prices to demonstrate the value proposition. A perfectly plausible explanation, though one suspects it’s more a case of desperate optimism. They’re partnering with Amazon and The Trade Desk, which is encouraging, but it’s hardly a guarantee of success.

Their international growth is also a factor. Those markets naturally have lower monetization rates, which obscures the overall picture. Still, one can’t dismiss the potential for long-term growth. If advertising pricing improves, Roku could surprise us all. Big screens are undeniably attractive to advertisers, and Roku clearly has the viewership. If they can prove their value proposition and generate a surge in advertising demand, the stock could reach new heights. Though, frankly, I wouldn’t hold my breath.

One always hopes for the best, of course. But one also prepares for the worst. And in the world of finance, the worst is usually far more interesting.

Read More

- Top 15 Insanely Popular Android Games

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-01-20 22:12