The esteemed Robinhood Markets (HOOD +0.31%), a name now echoing in the halls of financial history, recently experienced a surge – a veritable rocket launch, one might say. Joining the S&P 500 after turning a profit? A delightful spectacle, certainly. But let us not mistake fireworks for substance. While the masses chase fleeting trends, a seasoned investor – one who appreciates a well-executed scheme, not just a lucky gamble – casts an eye towards more… understated opportunities. Specifically, Tradeweb Markets (TW 0.26%). It lacks the theatrical flair, the populist appeal, but it possesses something far more valuable: a quiet competence. A broker’s broker, if you will, rather than a broker for the hopeful.

A Year of Exuberance (and Exaggeration)

Last year was, shall we say, generous to Robinhood. Revenue doubled, profits soared, funded accounts swelled. A veritable cornucopia of capital! They’ve even dabbled in event contracts and tokenization – embracing the future, they claim. As a shareholder, I concede, they’re pulling the right levers. But let’s be frank: the price has become…ambitious. Forty-two times forward earnings? One begins to suspect the market is valuing hope, not fundamentals. A rather precarious foundation, wouldn’t you agree?

Tradeweb: The Art of the Invisible Transaction

Tradeweb, on the other hand, operates in the shadows, facilitating trades for those who actually know what they’re doing. Professionals, institutions, the quiet movers of capital. They’ve become the dominant platform for U.S. high-grade credit markets, controlling a substantial slice of Treasury trading. No fanfare, no social media blitz, just a relentless focus on efficiency. It’s the difference between a street performer and a master craftsman. One entertains, the other delivers.

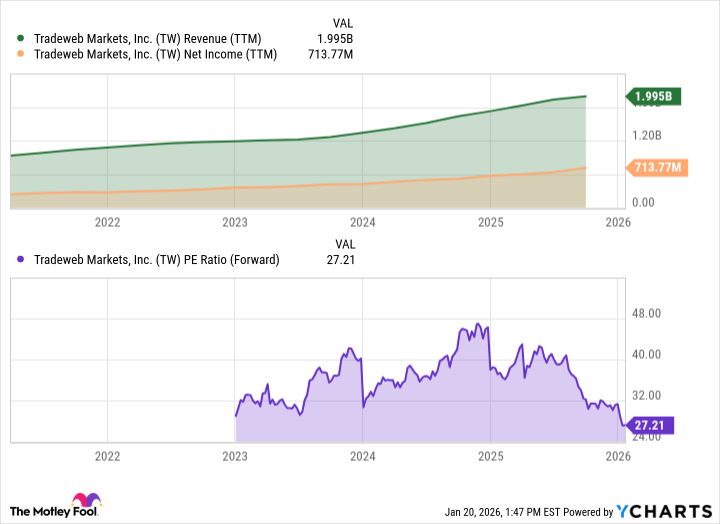

Now, 2024 wasn’t entirely smooth sailing. A 31% dip from April’s peak, triggered by tariff announcements and market volatility. A temporary setback, naturally. The CEO lamented muted volatility stemming from a government shutdown. A curious irony, isn’t it? Bureaucratic inertia hindering even the art of speculation. But volatility, dear readers, is the lifeblood of Tradeweb. And it’s poised to return.

December’s trading volume – a staggering $63 trillion – suggests a resurgence. A 27.5% year-over-year increase speaks volumes. Geopolitical tensions remain high, data is trickling back, and the stage is set for a return to…activity. Tradeweb, unlike its more flamboyant competitor, doesn’t need a bull market to thrive. It merely requires a market with a pulse.

Currently trading at 27 times forward earnings, Tradeweb offers a more reasonable valuation. A strong market position across credit, interest rates, and equities. If, as I suspect, volatility picks up in 2026 – fueled by geopolitical uncertainty and the whims of central bankers – Tradeweb is a solid investment. A quiet game, perhaps, but one with a distinctly higher probability of success. After all, the truly clever schemes are rarely shouted from the rooftops.

Read More

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- NEAR PREDICTION. NEAR cryptocurrency

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Top 15 Insanely Popular Android Games

- USD COP PREDICTION

2026-01-23 16:52