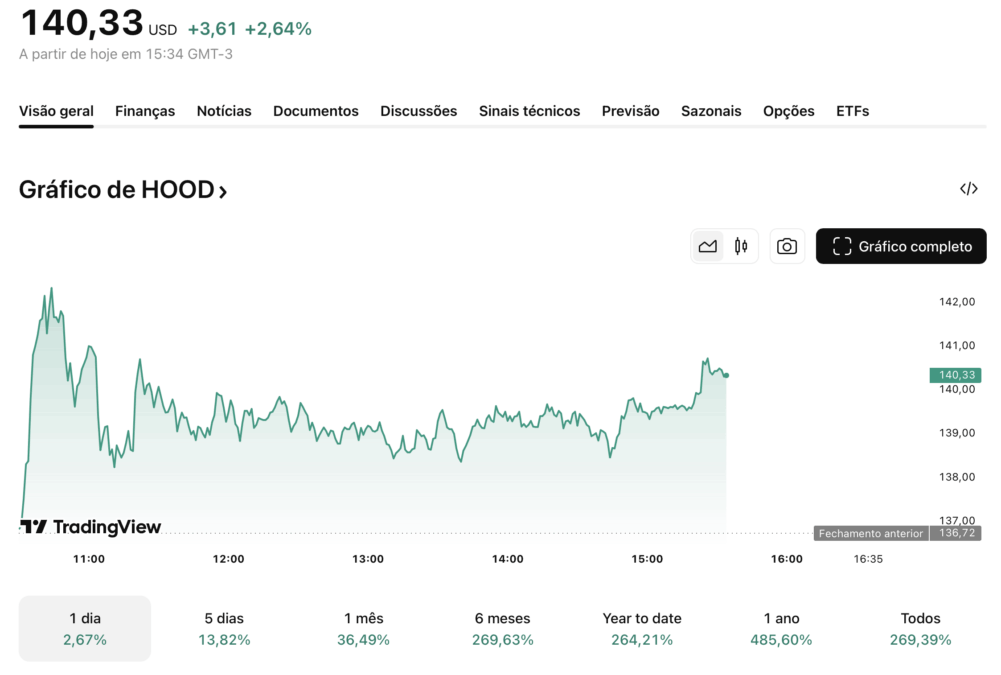

Robinhood, the company that somehow turned day trading into a Netflix series, is now plotting to conquer Europe with its “prediction markets.” Because why gamble on sports when you can gamble on geopolitics? Their stock hit $142 this week-probably because investors thought, “Sure, let’s bet on this app that crashed during GameStop’s chaos.”

CEO Vlad Tenev, the man who once bet on a llama to win the Kentucky Derby, claims users have traded 4 billion event contracts. That’s 4,000,000,000 reasons to question their life choices. And yes, they’re talking to the UK’s Financial Conduct Authority. Good luck explaining “event contracts” to someone who still thinks the euro is a cheese.

“4 billion contracts traded? That’s just 4 billion regrets waiting to happen.” – Me, probably

Robinhood’s strategy? Take meme stock madness, add crypto, sprinkle in election speculation, and call it “financial innovation.” Their Q2 revenue jumped 45% (because 12% more expenses is clearly a problem). HOOD stock is up 275% this year-congrats, everyone’s now a Wall Street genius!

Oh, and they want to let retail investors buy into private equity deals now. The SEC’s probably busy deciding if this is genius or a regulatory dumpster fire. Meanwhile, Robinhood’s tokenized stock in OpenAI and SpaceX? Great, now we’re all one tweet away from owning a rocket ship… that crashes like my marriage.

So here’s the plan: Flood Europe with event-based gambling, challenge the SEC with a “retail fund,” and call it a “democratization of finance.” Or, as I’d call it: “How to Lose Friends and Money in 10 Easy Steps.” 🎲

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The Best Actors Who Have Played Hamlet, Ranked

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-09-30 23:11