Many years later, as the algorithms began to weep digital melancholy, old Mateo remembered the fever dream of 2022, when Robinhood, a name that once echoed with the promise of democratic wealth, ascended like a phantom ship on a sea of meme stocks. He recalled the scent of burnt coffee and desperation clinging to the air, the frantic tapping on screens, the illusion of control over forces far beyond understanding. It was a time when fortunes were made and lost before breakfast, and the market itself seemed possessed by a restless spirit. Now, the stock, once a beacon, has lost nearly a third of its altitude, a fall that whispers of hubris and the fickle nature of prosperity. The question isn’t simply whether to buy the dip, but whether we’ve learned anything from the ghosts of booms past.

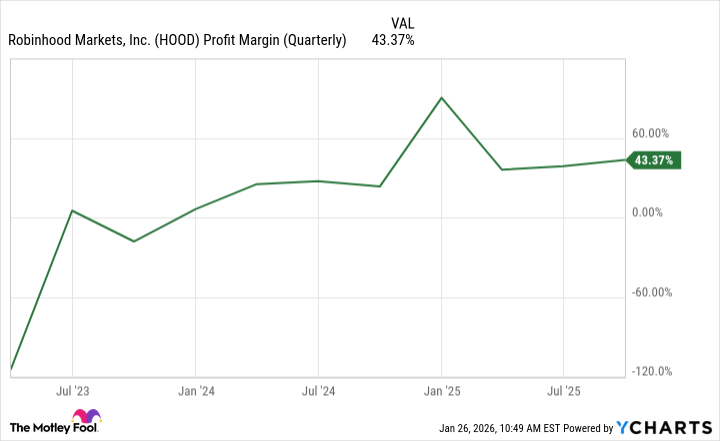

Robinhood’s growth, it must be said, has been a thing of peculiar beauty. It’s a vine that sprouted from barren soil, nurtured by the impatience of a new generation. While others measured risk in spreadsheets and quarterly reports, Robinhood offered a different currency: access. In the last quarter, ending September 30th, 2025, the company doubled its revenues, a surge that felt less like calculated strategy and more like a prophecy fulfilled. Profits, too, blossomed, tripling from a modest $150 million to a considerable $556 million. These numbers, however, are merely the surface of a deeper current, a restlessness that suggests both opportunity and peril. The margins are improving, yes, but even the most vibrant blossoms eventually wither.

The expansion into prediction markets is a curious gamble, a flirtation with the art of divination. It’s as if Robinhood, having mastered the illusion of control over present fortunes, now seeks to predict the future, to capture the whispers of fate itself. But even the most astute soothsayer is fallible, and the market, like a jealous lover, often punishes those who presume to know her secrets. The question, then, isn’t whether Robinhood can predict the future, but whether it can navigate the present, a treacherous landscape of shifting allegiances and unpredictable storms.

The current price-to-earnings multiple of 45, however, casts a long shadow. It’s a premium, certainly, a reflection of the market’s optimism, but also a potential trap. Compared to the S&P 500’s more modest 27, it feels like a reckless wager, a gamble on a future that may never arrive. The analysts, those self-proclaimed oracles, offer a consensus price target of $136.62, suggesting a potential upside of 27%. But their predictions are as ephemeral as the scent of jasmine in a hurricane, easily swept away by the winds of circumstance. A strong business, improving margins, and a platform that attracts the young – these are all favorable signs, yes, but they do not guarantee immunity to the inevitable ebb and flow of the market.

To buy Robinhood now, on this dip, is to acknowledge the inherent absurdity of it all. It’s to admit that we are all, in the end, merely players in a grand, unpredictable game, driven by hope and fear, illusion and reality. It’s a gamble, yes, but a calculated one, a wager on a future that, despite all the risks, still holds a glimmer of promise. If you are willing to hold on, to weather the storms, to embrace the chaos, then this may be a growth stock worth considering. But remember, the market is a fickle mistress, and even the most carefully laid plans can be undone by a single, unforeseen event. The scent of damp earth, the oppressive heat, the sound of rain – these are the signs of a changing world, and only time will tell whether Robinhood can navigate its treacherous currents.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- 17 Black Actresses Who Forced Studios to Rewrite “Sassy Best Friend” Lines

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Elden Ring’s Fire Giant Has Been Beaten At Level 1 With Only Bare Fists

- Here Are the Best TV Shows to Stream this Weekend on Hulu, Including ‘Fire Force’

- Anime Series Hiding Clues in Background Graffiti

2026-01-29 00:13