In a move that will surely shake up Canada’s chilled crypto landscape, American financial titan Robinhood has announced its decision to acquire WonderFi, a leading Canadian fintech and crypto platform, for a modest $178.9 million (250 million CAD). The deal will see Robinhood snatch up WonderFi’s shares at the oh-so-generous price of $0.26 (0.36 CAD) each. What a steal! 🤑

The announcement, made on May 13, signifies a bold step in Robinhood’s relentless quest to conquer international markets. Specifically, it’s a headlong dive into the frosty Canadian cryptocurrency market. I’m sure Canadians are just thrilled. 🍁

Robinhood Crashes the Canadian Crypto Party

In an official statement that will have all the regulatory bodies on high alert, Robinhood revealed that it plans to finance this acquisition with cold, hard cash. No word yet on whether it’s the ‘Canadian money’ type of cash, which I imagine would be as colorful and puzzling as the rest of this deal. The transaction is slated to close sometime in the second half of 2025, pending approval from all the usual bureaucratic suspects — regulatory bodies, courts, and, of course, WonderFi’s shareholder consent. Because what’s a deal without the full circus of legal approvals? 🎪

For those keeping score, WonderFi is no slouch. It currently manages over 2.1 billion CAD in assets. Not to mention it runs two Canadian-regulated digital asset exchanges, Bitbuy and Coinsquare, because why not add a couple more ways to lose money? In 2024, the platform boasted a trading volume of 3.57 billion CAD and revenue of 62.1 million CAD. It’s safe to say that WonderFi has built a reputation as a formidable force in the Canadian crypto world. 💰

“WonderFi has built a formidable family of brands serving beginner and advanced crypto users alike, making them an ideal partner to accelerate Robinhood’s mission in Canada,” said Johann Kerbrat, SVP and GM of Robinhood Crypto. Or as he probably said in real life: “We need more Canadians on board to make this whole crypto thing actually work!”

For Robinhood, this is clearly a strategic move to expand its range of services in Canada — a market that’s not just growing but practically begging for the madness of crypto. This acquisition will allow Robinhood to leverage WonderFi’s impressive tech stack, which includes crypto trading, staking, and custody services. Truly, what could go wrong? 🚀

Despite the acquisition, WonderFi’s leadership team, including President and CEO Dean Skurka, will stick around like a comfy Canadian winter jacket, continuing to run the show while Robinhood’s Canadian workforce of over 140 employees — based primarily in Toronto — joins forces with them. They’re all going to cozy up together in the frosty north. ❄️

“WonderFi and Robinhood are united in our visions of making crypto accessible and bringing more people into the crypto space,” Skurka proclaimed, probably while sipping a Tim Hortons coffee. ☕

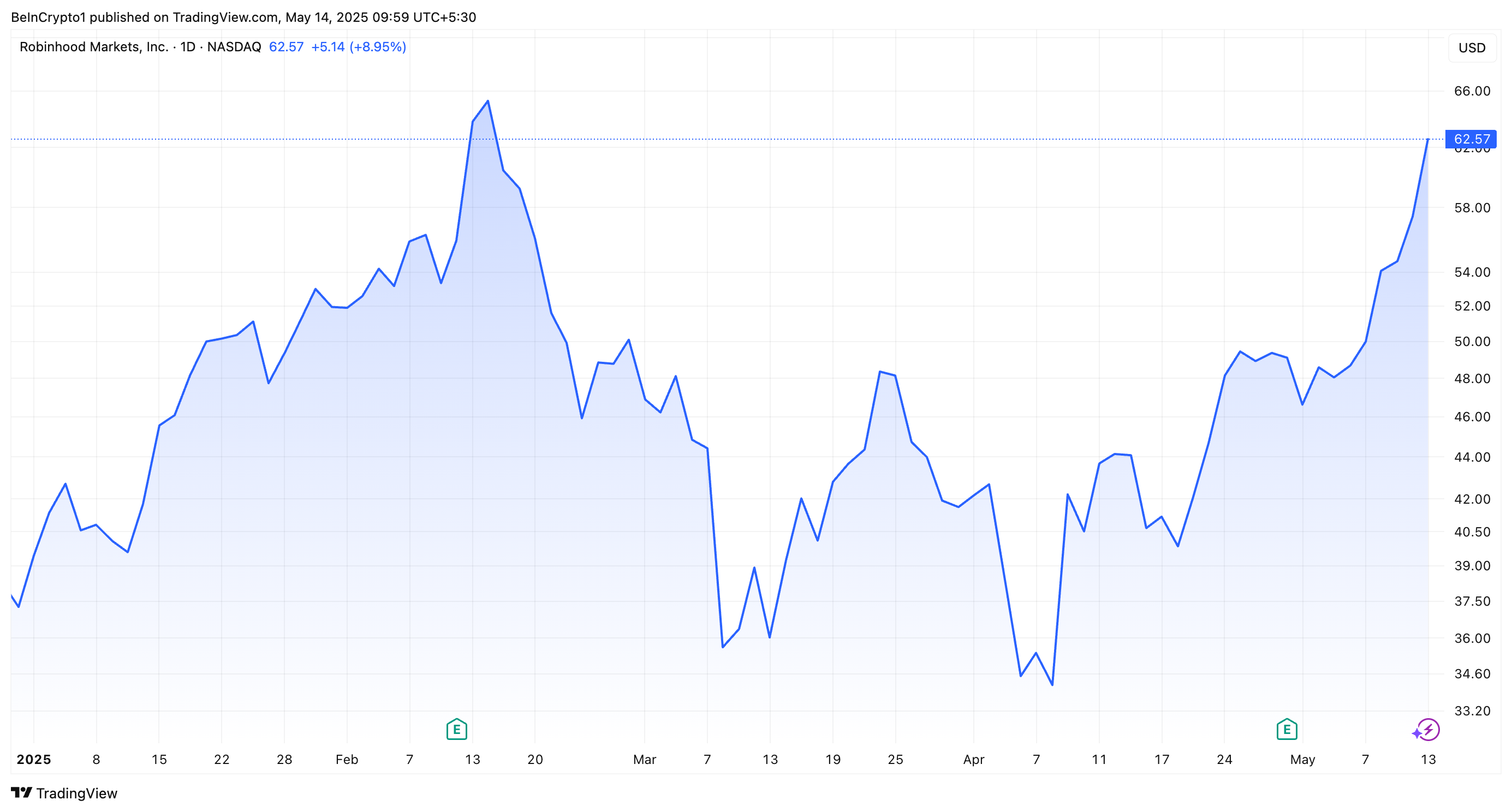

As expected, the announcement of this deal had a positive effect on Robinhood’s stock (HOOD, naturally). According to Yahoo Finance, the stock rose 8.9% to $62.5 at market close. After-hours trading saw a further 0.3% rise to $62.7. Investors clearly love a good crypto acquisition — who knew? 📈

This acquisition fits nicely into Robinhood’s broader global expansion strategy, which, naturally, includes its ongoing $200 million acquisition of Bitstamp, set to wrap up by mid-2025. It’s clear Robinhood’s not stopping anytime soon. In fact, they’re also gearing up to launch a blockchain-based platform for US stock trading in Europe, as reported by BeInCrypto. Because why settle for just one market when you can have them all? 🌍

The world is starting to look a little more crypto-heavy, and Robinhood seems determined to make sure they’re at the helm. The good news is, they’re not entirely alone in this conquest. On May 8, Coinbase made its own splash with a $2.9 billion acquisition of Deribit, while Ripple followed suit with the $1.25 billion acquisition of Hidden Road. Even Kraken jumped into the fray with a $1.5 billion deal to acquire NinjaTrader. It’s like a big, expensive crypto potluck where everyone’s bringing their own shiny new platform. 🥳

As Robinhood continues its merry dance of expansion, we can only wonder if the entire crypto market will eventually be owned by just a few companies with deep pockets and questionable decisions. At least we can all look forward to watching it unfold, as long as there’s still profit to be made. 📊

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2025-05-14 08:28