As a researcher with a background in financial markets and meme stock phenomena, I find myself both intrigued and cautious as I observe the recent surge in activity surrounding GameStop and other meme stocks. The events of 2021, when GameStop’s price soared to unprecedented heights following a grassroots movement of retail traders on social media, left an indelible mark on the financial world.

This week, there’s been a surge in meme stock action on Wall Street, bringing back memories of the thrilling episodes connected to GameStop Corp (NYSE: GME) in 2021.

As an analyst, I’ve noticed an influx of retail traders making a notable impact on GameStop’s stock price once again. This company, famously known for its remarkable rally two years ago, has garnered extensive media attention as a result. In fact, there have been Netflix series and movies produced about this phenomenon. However, the intense interest and scrutiny have led to substantial financial consequences for those who struggled to keep pace with the volatile market fluctuations, ultimately resulting in significant losses.

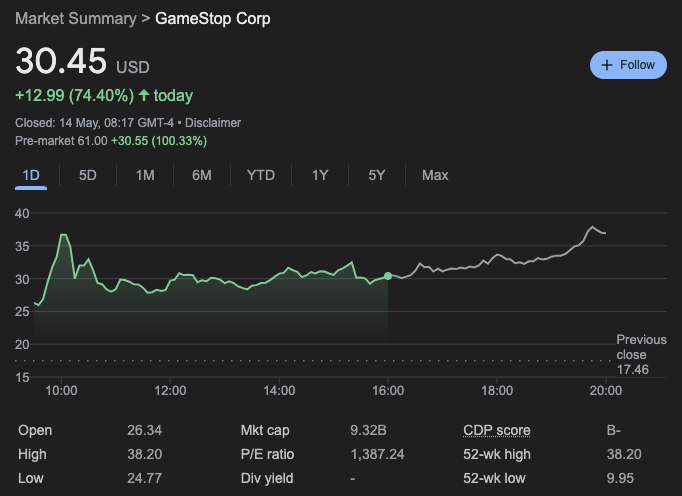

Today before the market opened, GameStop’s stock has seen a significant surge, rising by 74.4%. This comes after an impressive gain of 70% on Monday. Consequently, the company’s market worth has experienced a substantial boost, adding billions to its value.

AMC Entertainment, the publicly traded movie theater company (NYSE: AMC), and several less-recognized cryptocurrencies linked to Roaring Kitty and GameStop saw comparable surges in value.

The resurgence of GameStop’s popularity can be attributed to Keith Gill, alias Roaring Kitty, who came back to social media platforms after a three-year hiatus. On Monday evening, he shared cryptic video messages on his X channel, leading to renewed excitement around the shares he had previously advocated for. Although he didn’t explicitly mention GameStop, his comeback ignited a wave of activity reminiscent of the meme stock mania from 2021 and 2022, during which stocks such as GameStop and AMC experienced unprecedented price jumps of over 1,000%.

According to a report in The New York Times, Steve Sosnick, the chief strategist at Interactive Brokers, revealed that investors have been purchasing a large volume of GameStop call options. This move indicates their belief in further price increases for the stock. However, Sosnick pointed out that this trend wasn’t instigated by any newsworthy developments concerning GameStop or AMC, but rather from the renewed buzz generated by Roaring Kitty’s social media platform. Sosnick voiced his doubts about the longevity of this rally based on his past encounters with similar market occurrences.

As a researcher studying market trends, I’ve observed an unexpected surge in GameStop’s stock prices, leading to substantial financial setbacks for short sellers. Initially optimistic about a potential decline, these investors now face losses totaling approximately $852 million by the end of Monday, according to Ihor Dusaniwsky, managing director at S3 Partners. Their earlier profits of around $392 million have been nearly doubled in magnitude due to this market reversal.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gold Rate Forecast

- Every Minecraft update ranked from worst to best

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2024-05-14 15:35