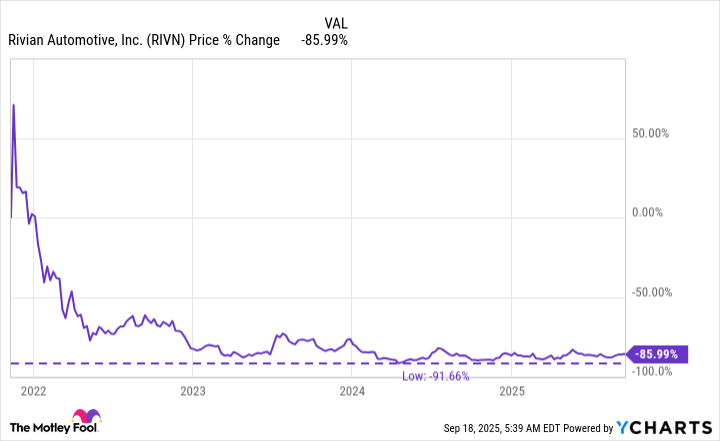

Rivian’s stock has had all the drama of a Shakespearean tragedy-minus the soliloquies and with more spreadsheets. When it debuted on Wall Street, it rode the crest of an EV hype wave so high, it might have been mistaken for a surfboard. But when the tide receded, the company found itself stranded on a beach of post-IPO reckoning. Now, as the sun sets on the EV bubble, the question isn’t just “Is Rivian a buy?” but “Can a startup survive in a world where even your neighbor’s garage is building electric cars?”

Let’s be clear: Wall Street has always had a soft spot for stories that smell like disruption. Tesla, for all its Model S-shaped eccentricities, taught the world that electric cars could be both profitable and cool. Suddenly, every garage band in the auto industry wanted to cover Tesla’s hits. Rivian, bless its pioneering heart, jumped on the IPO express, hoping to cash in on the frenzy before the crowd realized most EV startups were more vaporware than vehicle.

The EV Gold Rush and Its Unlikely Survivors

The EV gold rush was less a race and more a stampede. Automakers, venture capitalists, and even your local Tesla fanboy with a garage and a dream all rushed to mine the glittering ore of investor optimism. But as with all booms, the bust was inevitable. Most startups folded like origami under the weight of unprofitability, while traditional automakers-those lumbering giants of the internal combustion era-finally caught up, bringing their decades of manufacturing know-how to the EV table. Rivian, however, has stubbornly clung to the edge of the cliff, chipping away at profitability with the tenacity of a squirrel trying to crack a nut.

Its survival isn’t just luck. It’s strategy. While many burned through cash on flashy prototypes, Rivian focused on partnerships. Amazon, that e-commerce leviathan, became a critical customer, helping develop a delivery truck that now sells to others. And then there’s Volkswagen, the German titan of gas-guzzlers, now pouring money into Rivian’s R&D pipeline. It’s the EV version of a bridge between old and new-like a Victorian inventor teaming up with a Silicon Valley hacker to build a time machine.

From Red Ink to Green Light?

Rivian’s stock has climbed from the 2024 depths by 66%, a rebound that would make a phoenix envious. But is this a phoenix rising, or just a phoenix with a really good PR team? The company has achieved something rare: it’s generated gross profit twice. That’s like a toddler taking its first steps-wobbly, but undeniably forward motion. True, there’s still the mountain of expenses ahead, but gross profit is the first checkpoint on the path to profitability.

Then there’s the R2, a lower-cost vehicle slated for 2026. If you’ve ever wondered why Tesla started with the Model S and worked its way down to the Model 3, you’re not alone. It’s the classic “start rich, go mass-market” playbook. Rivian is following suit, betting that once it cracks the code for affordability, the masses will follow. It’s a gamble, but then again, so was the idea of selling electric cars in the first place.

Of course, the road ahead is anything but smooth. The EV market is now a crowded circus, with every major automaker juggling electric models. Rivian’s survival depends not just on its own execution but on the broader macro forces: supply chain stability, regulatory shifts, and the eternal question of whether consumers will trade their gas-guzzling SUVs for electric ones. It’s a game of chess played on a horseback ride-unpredictable and prone to spills.

The Final Lap: Will Rivian Make It?

As macro strategists, we don’t bet on individual stocks-we bet on tides. But Rivian’s story is a microcosm of a much larger shift. The EV industry is no longer a speculative novelty; it’s a battleground for the future of mobility. Whether Rivian thrives or falters will depend on its ability to adapt, innovate, and outmaneuver competitors who are both faster and richer. For the aggressive investor, the current valuation offers a tantalizing glimpse into a future where Rivian could be a leader. For the rest of us? It’s a reminder that even in the age of electric dreams, patience is still the ultimate virtue. 🚀

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Gold Rate Forecast

- EUR UAH PREDICTION

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- Why Nio Stock Skyrocketed Today

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- The Weight of First Steps

2025-09-21 13:00