The recent years have proven…unyielding for those who placed their faith in Rivian Automotive (RIVN 7.11%). The stock, a fledgling thing in the vast garden of the market, has lost ground – a disheartening ten percent this year alone, and a more profound eighty-six percent since its debut in November of 2021. One observes, with a certain melancholy, the fate of so many ambitious ventures.

Disappointment, as is often the case, stems from a confluence of realities. The pursuit of electric vehicles is a capital-intensive undertaking, a demanding mistress. Growth in the American market, while present, has been…measured. And the shifting winds of governmental incentives, those fickle patrons of innovation, have withdrawn some of their favor. It is a harsh landscape for a newcomer.

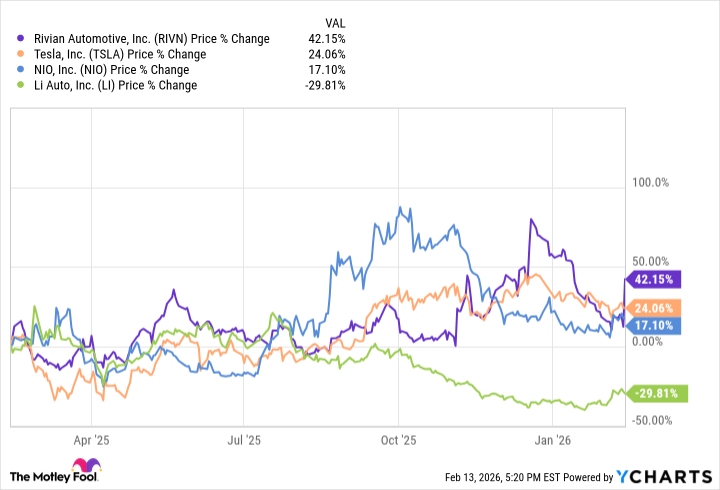

Rivian, still a small player, a modest estate compared to the sprawling domains of the established houses, holds a market capitalization of $21.7 billion. A mere 42,247 vehicles found homes in 2025. A trifle, when contrasted with Tesla’s 1.6 million, a veritable fleet dominating the horizon. Yet, in the past year, Rivian has shown a certain…vitality, outperforming even the mighty Tesla, and other aspirants like Li Auto (LI 0.33%) and Nio (NIO 0.30%). A small victory, perhaps, but a victory nonetheless.

The recent earnings report of February 12th, however, offered a glimmer of optimism, a softening of the prevailing gloom. The stock experienced a notable surge, exceeding twenty-five percent. One wonders if the market, ever prone to fits of enthusiasm, is beginning to perceive a potential…revival.

A Turn in the Tide: $1.3 Billion in Gross Profit Improvement

Rivian has not yet attained the coveted state of profitability, but the trajectory of its gross profit – revenue less the cost of production – is undeniably upward. The company reported a consolidated gross profit of $144 million for the entirety of 2025, a remarkable recovery from the negative $1.2 billion recorded in 2024.

This $1.3 billion turnaround was driven by a $775 million improvement in automotive sales, fueled by higher average selling prices and a reduction in per-vehicle costs. The company notes a rise of approximately $5,500 in the average sales price, coupled with a $9,500 decrease in the cost of goods sold per unit. Furthermore, software and services contributed $576 million to the gross profit, a significant increase from the meager $7 million in 2024.

The R2: A Bid for Broader Shores

Until now, Rivian has focused on a limited number of vehicles, positioned at the higher end of the market. The R1T truck and R1S SUV command starting prices of $72,990 and $76,990, respectively. The CEO, RJ Scaringe, noted that the R1S SUV has become the best-selling premium electric vehicle above $70,000 in several key Californian, Northeastern, and Pacific Northwest markets. A niche success, to be sure.

But in 2026, Rivian intends to expand its reach, to venture onto broader shores with the R2, a more accessible vehicle. The pricing will be revealed on March 12th, but early indications suggest a competitive offering, boasting over 300 miles of range and exceeding 650 horsepower. Scaringe believes the R2 will be a “game changer,” a bold claim in a rapidly evolving landscape. One observes, with cautious optimism, the potential for a wider appeal.

If Rivian can sustain its improvements in profitability and operational efficiency, and if the R2 resonates with electric vehicle buyers, there is reason to believe this stock may yet prove to be a worthwhile wager. The market, after all, is a fickle mistress, but even she occasionally rewards those who dare to dream.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Where to Change Hair Color in Where Winds Meet

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- Is Taylor Swift Getting Married to Travis Kelce in Rhode Island on June 13, 2026? Here’s What We Know

2026-02-18 17:12