Now, I reckon folks are all a-buzzin’ about these here electric contraptions. Old Man Tesla, bless his inventive soul, lit the fuse on this whole shebang. And now, a newcomer, Rivian Automotive, is tryin’ to follow in his tire tracks. They built a truck, the R1T, and for a spell, folks were throwin’ money at ’em like it grew on trees. But the stock, well, it’s taken a tumble, a proper plummet, losin’ nigh on 90% of its peak value. A cautionary tale, wouldn’t you say? Yet, there’s a glimmer of hope, a wisp of smoke suggestin’ this ain’t a complete lost cause.

They’ve been makin’ some shrewd moves, this Rivian. Not always what you’d expect from these Silicon Valley types. And they’re fixin’ to launch a new vehicle, the R2, this year. Could be a game-changer, they say. But whether it will be, well, that’s the sixty-four-dollar question, ain’t it? Should a fella consider investin’ a few dollars, hopin’ for a return in 2026? Let’s have a look-see.

Rivian’s Finances: A Slow Climb Out of the Hole

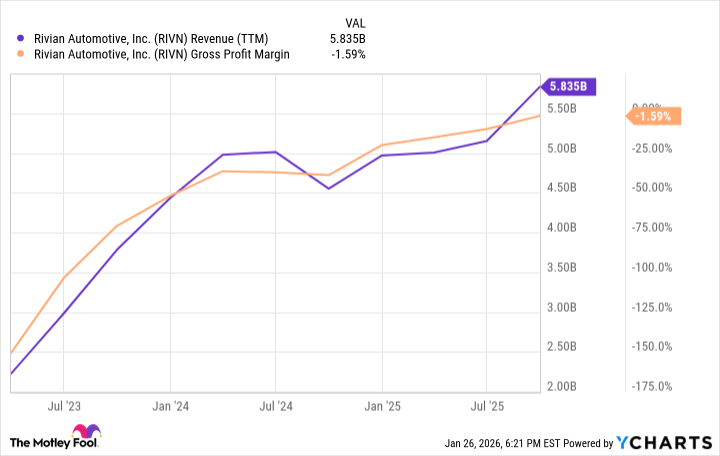

Now, the biggest trouble for any new-fangled automobile company is stayin’ afloat long enough to actually build automobiles. Runnin’ out of money before you sell a single vehicle is a sorry sight, indeed. Rivian’s been improvin’ its profit margins alongside sales, which is a good sign. They’ve made considerable strides since 2024, even if revenue hasn’t exactly skyrocketed.

What happened, you ask? Well, they re-engineered the R1T and R1S models, tinkered with the supply chain, and managed to cut down on manufacturin’ costs. Smart work, I say. They’ve also been gettin’ a bit of extra cash from sellin’ these “EV regulatory credits” and offerin’ software services. Seems everyone’s got a scheme these days.

As a result, their cash burn has slowed down to less than $500 million over the last four quarters. That’s promisin’, considerin’ they still have a hefty $7 billion in the bank. A nice cushion, as they prepare to launch the R2, a mid-size SUV. It’s like buildin’ a raft before you sail into a hurricane, wouldn’t you say?

Can Rivian Rise in 2026? A Cautious “Maybe”

A heap of expectation rests on the R2 launch. They’re aimin’ for a price tag of $45,000, a good deal less than the R1S, which starts around $78,000. Rivian hopes the R2 will propel ’em into the mainstream, allowin’ their factories to operate profitably. Reminds me of what the Model 3 did for Tesla – a real turning point, that was.

Analysts reckon Rivian will pull in about $6.8 billion in revenue this year, then jump to $11.2 billion in 2026, thanks to the R2. The stock is tradin’ at a price-to-sales ratio of 3. Seems like a bargain compared to Tesla’s ratio of 3, but not so much compared to the old-fashioned automobile companies, which trade at less than 1 times sales. Seems everyone’s got their own way of calculatin’ value.

Might be worth takin’ a small gamble on Rivian before the R2 launch, as a speculative investment. A strong launch could bolster confidence and raise the valuation. But remember, folks, understand the downside risk. If Rivian misses its chance to entrench itself in the vehicle market with the R2, well, that investment could vanish quicker than a politician’s promise.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Exit Strategy: A Biotech Farce

- QuantumScape: A Speculative Venture

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

2026-01-31 21:32