So, electric cars. Everybody’s got to have one, right? It’s the future. Except, it feels like the future is consistently delayed by… logistics. And frankly, a complete disregard for common sense. Rivian, this company, is trying to make these… trucks. And SUVs. Fancy ones. Which, okay, fine. But they’re losing money at a rate that should be illegal. And people are seriously considering buying the stock at under $17? It’s like watching someone willingly walk into a poorly lit alley.

They talk about ‘disruption.’ Disruption! It’s a buzzword. What’s disruptive about building a car that costs as much as a small house? It’s exclusionary. It’s… rude, frankly. And then they expect dividend hunters like me to get excited? I’m looking for income, not a social statement. The whole thing just feels…off.

The Factory, the Software, the… Everything

Apparently, they’re building a factory in Georgia. A factory. Like that solves everything. It’s always a factory. And they’re promising self-driving software. Self-driving! As if the roads aren’t chaotic enough. And you have to pay 50 bucks a month for it? Fifty dollars! For a computer to drive your car? I’m starting to think I’d rather just drive the car myself. It’s a skill, you know. A lost art. And frankly, I don’t trust anything that requires a monthly subscription to function properly.

They’re talking about scaling up. ‘Scaling up.’ It’s always ‘scaling up.’ It’s like they think saying it makes it happen. They delivered some vehicles, sure. But then they delivered more vehicles than they produced? What is that? Some sort of accounting trick? It’s unsettling. It feels like they’re trying to pull the wool over your eyes. And I, for one, am not wearing wool.

The government is throwing money at them – 6.6 billion dollars. Six. Point. Six. Billion. Dollars. That’s my retirement fund, probably. And for what? To build more expensive cars that nobody can afford? It’s a racket. A complete and utter racket.

Cash Flow? More Like Cash Outflow

They’re saying their cash burn is ‘improving.’ Improving! It’s still a massive hole in the ground! They lost over $3.4 billion last year. Billion. With a ‘b’. And they expect me to believe this is a good investment? I’ve seen better returns from leaving money under my mattress. And at least the mattress doesn’t require a software update.

They’re partnering with Volkswagen. Volkswagen! The company that brought us… well, never mind. It just feels… incongruous. Like mixing oil and water. Or trusting a politician. It’s just not going to end well.

Should You Buy Rivian? Are You Kidding Me?

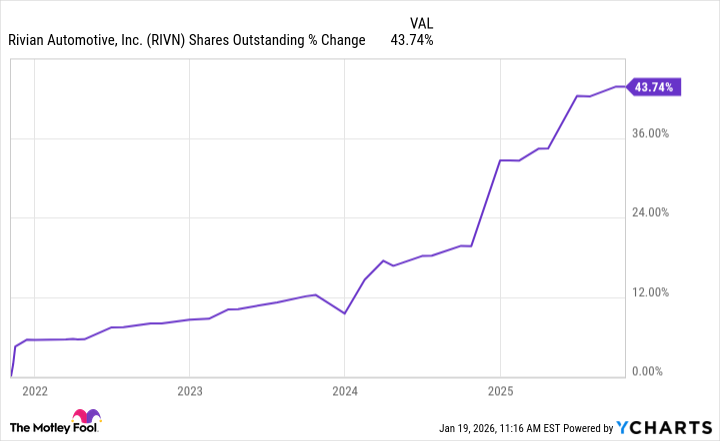

The stock jumped after their ‘Autonomy Day.’ Autonomy Day! As if a single day can solve all their problems. It’s back down now, thankfully. But people are still considering buying it at under $17? It’s madness. Pure, unadulterated madness. They’ve diluted the shares by 44% in the last five years. 44%! It’s like they’re actively trying to make investors lose money.

Look, Rivian is… a thing. A complicated, expensive, money-losing thing. And as a dividend hunter, I’m looking for something a little more… predictable. Something that actually generates income. Something that doesn’t require a leap of faith the size of the Grand Canyon. Frankly, I’d rather just stick to bonds. At least with bonds, you know what you’re getting. And you don’t have to worry about a self-driving car crashing into a tree. It’s just common sense. And apparently, common sense is in short supply these days.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- DOT PREDICTION. DOT cryptocurrency

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- NEAR PREDICTION. NEAR cryptocurrency

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Top 15 Insanely Popular Android Games

- USD COP PREDICTION

2026-01-21 02:33