Nvidia reigns supreme within the lofty echelons of Wall Street, a veritable monarch of the high-performing graphics processing unit (GPU) realm, the veritable lifeblood of artificial intelligence (AI) and intricate language models. Over the past three years, the stock has skyrocketed, bringing with it a staggering rise of nearly 1,500%. With a market capitalization of $4.6 trillion, Nvidia sits at the pinnacle of global valuations, poised to eclipse the $5 trillion threshold with a regal flourish.

Yet, as this king savors another successful year, marked by a commendable 41% gain, an unheralded challenger lurks in the shadows-an AI stock whose performance eclipses even that of our ambitious sovereign, one indispensable to the very success of Nvidia and myriad other titans of the semiconductor realm.

A Rival More Dashing than Nvidia

Taiwan Semiconductor Manufacturing (TSM), affectionately known as TSMC, is the unrivaled commander of semiconductor fabrication worldwide. Though it lacks the flair for design, it indulges in the craftsmanship of manufacture within its esteemed foundries, producing chips for illustrious patrons like Broadcom, Advanced Micro Devices, Apple, and Tesla.

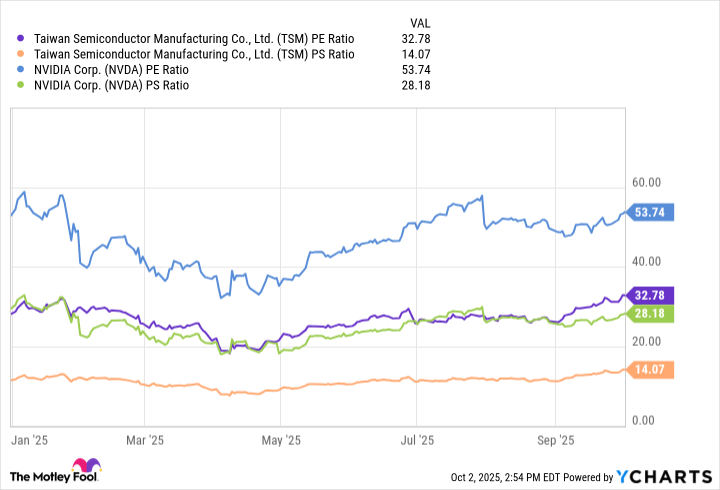

Ah, the stock of TSMC has flourished, up by a scintillating 45% this year alone, triumphing spectacularly over Nvidia’s more modest ascent. Not only does it climb higher, but it also does so upon a valuation that whispers sweet nothings of price-to-earnings and price-to-sales ratios far more palatable than its rival’s commensurate figures.

Yet, let us sweeten the pot. Nvidia’s own commanding officer finds himself a willing admirer of TSMC, recently doffing his cap to this indomitable foundry. “They are a world-class foundry and cater to a diverse clientele,” the sagacious Jensen Huang remarked, “One cannot overstate the sorcery that is TSMC.”

The Machinery of TSMC

The enterprise of Taiwan Semiconductor thrives upon the production of chips measuring an exquisite 3-nanometers and 5nm. An impressive 60% of its revenue is garnered from this very pursuit.

In the rarefied company of elite fabricators, TSMC’s mastery of the coveted 3nm chips at scale bestows it with a significance that cannot be overstated. The allure of reduced transistor sizes allows luminaries like Tesla and Nvidia to enfold ever-greater power within their silicon confines. Not to be outdone, TSMC also harbors grand plans for mass-producing a dazzling 2nm wonder this very year.

Further embellishing its portfolio, TSMC fabricates semiconductors for smartphones, enabling the masses to indulge in the splendors of 5G connectivity-an era where enjoying the illustrious grandeur of high-definition streaming and remote labors becomes but a fingertip affair.

A sliver of revenue is derived from enchanting devices within the Internet of Things, those modern marvels of contrivance including smart home ephemera and wearable technologies. The company also fashions chips for electric vehicles, driver-assistance sorcery, and the bewitching realms of vehicular infotainment.

In the second quarter alone, TSMC reaped revenues of $30.07 billion-an increase of 44.4% year-over-year, accompanied by a splendid net profit margin of 42.7%. Each tick of the clock suggests the forthcoming quarter may yield even brighter treasures, with projections between $31.8 billion and $33 billion.

Moreover, TSMC embarks on an ambitious expansion, dedicating a princely sum of $165 billion to the establishment of new fabrication plants and facilities in Arizona. Such endeavors serve to fortify TSMC against tariffs and economic headwinds, a strategy befitting a chivalrous warrior navigating the treacherous landscapes of the market.

Cloaked Purchases: Nvidia or TSMC?

Should one, in all sincerity, be compelled to choose but a single stock in this grand masquerade, I would emphatically cast my lot with TSMC. The company claims an impressive 70% market share within the foundry arena, as noted by the erudites at TrendForce, cultivating a moat more formidable than the defenses of any beleaguered castle. In a semiconductor industry poised to burgeon from a $600 billion enterprise to a trillion-dollar juggernaut by 2030, the prospects for TSMC loom large like the sun on a summer’s day.

What’s more, TSMC bestows upon its loyal investors a dividend-an offering rather rare among its AI brethren. With a yield of 1.2% and a delightful payout of $3.34 per share, it may not render one fabulously wealthy, but offers a feast far superior to Nvidia’s trifling $0.04 annual gesture.

In summation, TSMC presents itself as the more judicious investment-affordable yet indispensable to the semiconductor and AI realms. However, should your appetite for risk allow, to acquire both would transform your portfolio into a veritable powerhouse, an undeniable duo in this age of artificial intelligence. 🧐

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gay Actors Who Are Notoriously Private About Their Lives

- The Weight of Choice: Chipotle and Dutch Bros

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-10-07 05:12