Palantir Technologies (PLTR), once a niche contractor for government agencies, now stands as a titan in the enterprise software industry. Its remarkable journey has transformed it from obscurity to becoming an integral player in the AI-driven world. The company’s AI platform, a central component of both government and private sector digital infrastructure, has propelled its market capitalization to an astonishing $400 billion-surpassing even stalwarts like Salesforce, Adobe, and SAP.

However, the trajectory of such rapid growth, though striking, cannot continue unchecked. In the next five years, two other companies stand poised to eclipse Palantir in market value, albeit through very different routes. One is a retail giant, ready to capitalize on a rebound in housing and infrastructure. The other is a semiconductor innovator, vying to disrupt the AI hardware market.

Home Depot: The Silent Beneficiary of Economic Rebound

If Palantir represents the digital backbone of AI, then Home Depot (HD) stands as the physical counterpart in this technological ecosystem. The retail giant, which has long been a staple in home improvement, finds itself uniquely positioned to benefit from a pending economic rebound. While housing affordability has reached historic lows due to years of restrictive monetary policy, the winds of change are now blowing. Interest rates are expected to fall gradually, unlocking a dormant demand for homes and igniting a surge in renovations and construction projects. The implications for Home Depot are clear.

Yet, the company’s future prospects are not solely tied to this cyclical recovery. It also finds itself poised to capitalize on the booming $7 trillion AI infrastructure build-out. Massive investments in data centers, such as the Stargate Project, are driving demand for construction materials and skilled labor-sectors in which Home Depot thrives. With its vast supply chain, robust digital investments, and unparalleled brand loyalty, Home Depot stands at the intersection of housing, infrastructure, and industrial growth, making it a potent, albeit underappreciated, player in this evolving market.

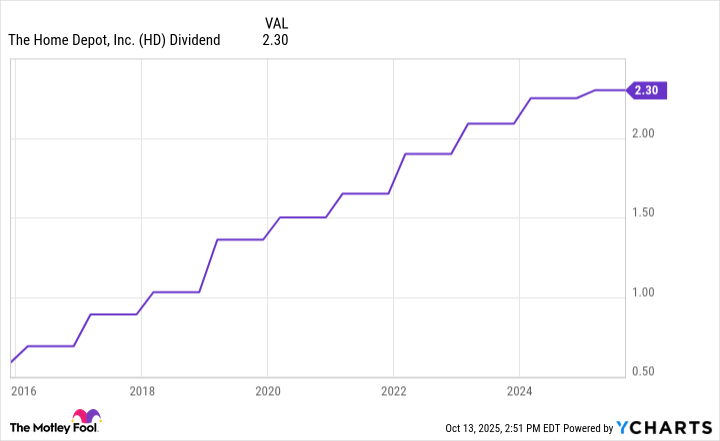

Home Depot’s dual exposure to residential and commercial sectors provides it with the resilience to weather economic cycles. Its consistent dividend growth and potential for capital appreciation position it as a likely contender for long-term shareholder value. As infrastructure spending accelerates, its valuation could expand significantly in the years ahead.

AMD: The Rising Challenger to Nvidia’s Dominance

In the realm of AI hardware, Advanced Micro Devices (AMD) has long played second fiddle to Nvidia. However, as the demand for AI computing power intensifies, AMD’s fortunes are beginning to shift. Major cloud players such as Microsoft, Oracle, Meta Platforms, and OpenAI have started to incorporate AMD’s MI300 and MI400 graphics processing units (GPUs) into their data centers, a deliberate move to diversify away from Nvidia’s ecosystem.

This shift reflects a broader trend in the tech industry: as AI workloads become more complex, the need for flexibility in hardware solutions is paramount. The rapid development of multiplatform architectures is essential to mitigate supply chain risks, and AMD’s GPUs are increasingly seen as a critical component in this evolution. By offering a viable alternative to Nvidia’s dominance, AMD positions itself as a key enabler of the AI infrastructure revolution.

AMD’s rise is not simply about competing with Nvidia; it is about creating a sustainable presence in the rapidly expanding market for AI accelerators. As hyperscalers push the limits of their processing capabilities, AMD is positioned to provide the hardware that powers the next wave of AI innovation.

The Real Foundations of Innovation

Palantir’s meteoric rise is a testament to the power of software intelligence and data-driven insights. However, its valuation may soon be reaching its zenith. Looking forward, the companies most likely to deliver substantial returns are those that operate beneath the surface, building the essential infrastructure that sustains the broader technological cycles.

Home Depot stands to benefit from a renewed industrial and residential construction boom, while AMD is carving out a pivotal role in the development of next-generation AI computing hardware. These companies, though less glamorous, may hold the keys to long-term value creation, and they could very well surpass Palantir in market value by 2030.

The real innovators, as history often reveals, are those who construct the bedrock upon which entire industries are built. This is why Home Depot and AMD-two companies seemingly unrelated to the world of pure software or artificial intelligence-may, in the end, prove to be the true architects of the next great economic cycle. 🛠️

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-10-16 15:46