In a most unexpected turn of events, the appointment of the pro-crypto Mr. Uyeda is anticipated to herald a most significant transformation in the SEC’s rather rigid stance on the regulation of cryptocurrency. One cannot help but ponder the implications this may have for Ripple’s ongoing legal skirmish with the agency, which has been as thrilling as a Regency novel! 📚

Uyeda’s Appointment Fuels Optimism in Crypto Markets

Mark Uyeda, a gentleman of notable advocacy for clear cryptocurrency regulations, has not shied away from expressing his discontent with the SEC’s previous enforcement-driven approach towards digital assets. “The Commission’s war on crypto must end,” he declared with a flourish in a recent statement. His appointment arrives at a time when the former SEC Chair, Mr. Gensler, has resigned, presumably under the weight of his own decisions. 😏

Market analysts and industry insiders alike are of the opinion that Mr. Uyeda’s ascension will signal the end of the SEC’s appeal, thus ensuring that the final judgment shall not be against Ripple. This has instilled a rather bullish sentiment into XRP, which has been at the center of regulatory discussions since the SEC filed its lawsuit against Ripple Labs in December 2020. How delightful! 🎉

Ripple’s Legal Battle: A New Chapter?

Ripple’s case with the SEC has unfolded with all the drama of a well-penned novel. In August 2024, Judge Analisa Torres ruled that XRP sales to institutional investors had indeed violated securities laws, yet she dismissed the more scandalous allegations of fraud or recklessness. Ripple was ordered to pay a mere $125 million in penalties, a trifling sum compared to the $1 billion initially sought by the SEC. How generous! 😅

The SEC’s recent appeal challenges the classification of XRP’s programmatic sales as non-securities. However, under Mr. Uyeda’s leadership, one might hope for a shift towards a more amiable regulatory approach, potentially leading to a resolution in Ripple’s favor. Fingers crossed! 🤞

XRP Price and Market Trends

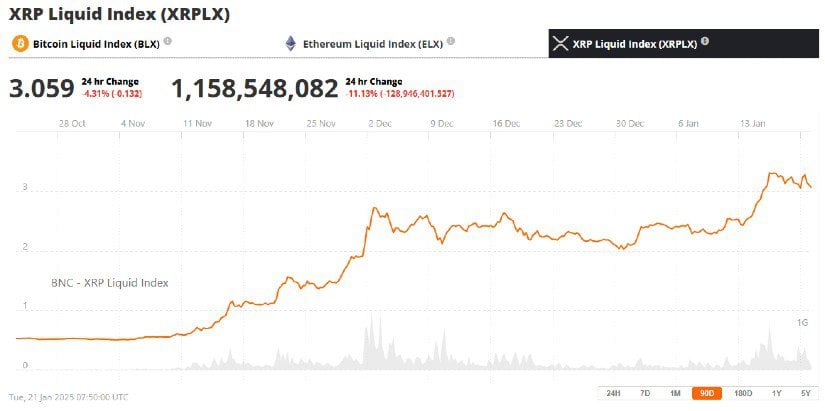

XRP’s price rally to $3.10 on Monday represents a partial recovery from Sunday’s rather disheartening 9.55% decline. Increased on-chain activity and whale transactions have contributed to this uptick, with Santiment data indicating a spike in large-scale XRP purchases. Despite a temporary dip in derivatives market open interest, funding rates for XRP futures have reached a six-week high of 0.0143%, reflecting a growing confidence among traders. How positively thrilling! 📈

Technical indicators suggest further bullish momentum for XRP. Analysts project that if XRP maintains its position above the key support level of $2.90, it could breach its previous all-time high of $3.55 and ascend to $4.22. This target is derived from the height of the recent bullish flag pattern on the 8-hour chart. However, should it falter below $2.90, a retracement to $2.60 may ensue, aligning with the 23.6% Fibonacci retracement level and the 50-day Simple Moving Average (SMA). Such suspense! 😮

Ripple’s Regulatory Outlook Under Uyeda

Mr. Uyeda’s appointment has ignited discussions on broader regulatory reforms. President Trump’s pro-crypto stance, underscored by Uyeda’s selection, is viewed as a step towards fostering innovation in the digital asset space. Industry experts believe this could pave the way for the approval of spot XRP ETFs, which analysts at Standard Chartered estimate could attract a staggering $4.3 billion to $8.4 billion in inflows within a year of launch. Quite the fortune! 💰

Moreover, Mr. Uyeda’s leadership may encourage the SEC to revisit other contentious regulatory policies, such as its strict stance on crypto custody and reporting requirements for financial institutions. This is yet another indication that hope for Ripple’s XRP is on the horizon, though regulatory

Read More

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Save or Doom Solace Keep? The Shocking Choice in Avowed!

- In Conversation With The Weeknd and Jenna Ortega

- Tyla’s New Breath Me Music Video Explores the Depths of Romantic Connection

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

- USD ILS PREDICTION

2025-01-22 21:26