As a seasoned crypto investor with over a decade of experience in this dynamic digital frontier, I find myself increasingly intrigued by Ripple‘s latest move to launch its RLUSD stablecoin. Having weathered numerous market fluctuations and witnessed the rise and fall of countless projects, I can confidently say that this development is not just another flash in the pan.

On Tuesday, December 17th, Ripple is set to officially debut its RLUSD stablecoin. This action represents a major stride for the blockchain firm, as they broaden their range of services within the digital assets sector.

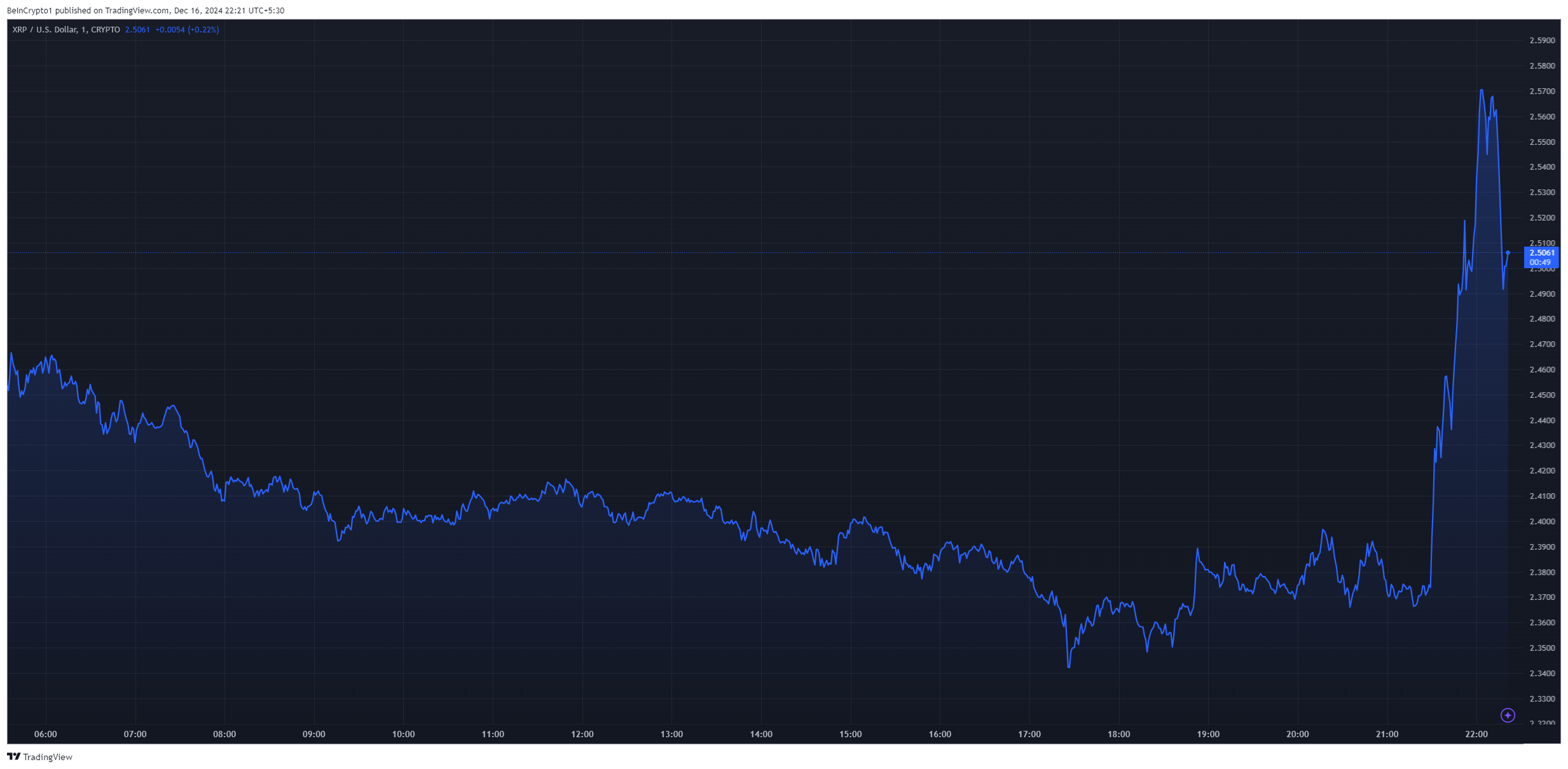

XRP has jumped nearly 8% in the past hour following this announcement.

Ripple’s RLUSD Stablecoin Influences a Bullish Trigger for XRP

As reported by Ripple, an external auditing company is tasked with verifying the monthly reports of RLUSD’s reserve assets, ensuring openness and accountability.

First off, the RLUSD digital currency is set to debut on various platforms like Uphold, MoonPay, Archax, and CoinMENA. Furthermore, it’s anticipated that other exchanges such as Bitso, Bullish, Bitstamp, Mercado Bitcoin, Independent Reserve, and Zero Hash will quickly follow suit in listing RLUSD.

With stricter guidelines on the horizon for the U.S., Brad Garlinghouse, CEO of Ripple, anticipates a surge in the usage of stablecoins such as RLUSD. These stablecoins provide genuine practical value and have been supported by decades of experience and reliability within the industry.

In the wake of the announcement, XRP’s price has experienced a significant spike, rising approximately 7% within an hour. This surge was accompanied by a substantial increase in daily trading volume, which shot up by nearly 72%. Over the past month, this has led to a remarkable price rise of 130% for XRP.

Next year, Ripple intends to incorporate RLUSD into its payment systems, enabling businesses to execute international transactions. This move underscores Ripple’s dedication to improving the efficiency of cross-border payments for corporate customers.

Moreover, Ripple has enlisted seasoned banking professionals like Raghuram Rajan, a past Governor of the Reserve Bank of India, and Kenneth Montgomery, who used to be the First Vice President and COO of the Federal Reserve Bank of Boston, onto its advisory board for stablecoins.

“Ripple explains that their platform is backed by U.S. dollar deposits, government bonds, and other cash equivalents, with monthly third-party audits. It supports multiple blockchains, is designed for cross-border transactions, integrates with DeFi, and serves as a bridge between traditional fiat currencies and digital assets.

A Strong Q4 for Ripple and XRP

In the recent fourth quarter, Ripple has experienced a remarkably beneficial phase. Notably, Chairman Gary Gensler, who is known for his criticism towards XRP, has recently stepped down from his position at the SEC. Consequently, XRP has reached its highest value in almost six years since then.

As a crypto investor, I’ve noticed an uplift in spirits recently due to Paul Atkins stepping into a leadership role. Ripple, a company that’s been embroiled in a lengthy legal dispute with the SEC over XRP, is seeing this change as a potential game-changer. In past market rallies, the ongoing lawsuit has held back XRP’s growth. However, with Atkins at the helm, there’s hope that resolution might be on the horizon, which could boost XRP’s performance in the future.

Upon its entry into the U.S. market, RLUSD will face competition from established stablecoins such as Tether’s USDt and Circle’s USDC. This debut comes at a time when there is increasing institutional demand for XRP.

To date, four significant investment companies – WisdomTree, Bitwise, 21Shares, and Canary Capital – have submitted requests for exchange-traded funds (ETFs) based on Ripple’s digital token XRP. This action suggests a growing faith in the altcoin among these institutions.

In summary, Ripple’s recent advancements, particularly its introduction of the RLUSD stablecoin, mark a significant turning point for both the company and its environment. This development could pave the way for further expansion and acceptance.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- SD Gundam G Generation ETERNAL Reroll & Early Fast Progression Guide

- Jurassic World Rebirth: Scarlett Johansson in a Dino-Filled Thriller – Watch the Trailer Now!

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

2024-12-16 20:14