Ah, dear reader! Gather ’round as we unveil the latest escapade of Ripple, that audacious purveyor of digital currency! With a flourish, they have secured licenses in the illustrious realms of Texas and New York, two bastions of American finance! This bold move not only fortifies Ripple’s standing in these influential markets but also showcases their unwavering commitment to playing nice with the regulators. Who knew compliance could be so thrilling? 🎉

On the fateful day of January 27, the news broke like a fine bottle of champagne! The demand for real-time, cost-efficient global payment solutions is rising faster than a cat on a hot tin roof! “We’re seeing a veritable stampede of interest from banks and crypto businesses eager to harness the magic of blockchain for their cross-border payments,” declared Joanie Xie, Ripple’s Managing Director for North America, with a twinkle in her eye.

Expanding U.S. Reach Through Strategic Licensing

With these shiny new approvals, Ripple now boasts over 55 Money Transmitter Licenses across the United States! Texas, with its booming cryptocurrency mining, and New York, the glittering jewel of financial services, present Ripple with a cornucopia of opportunities to expand its network. Who wouldn’t want to dance with the financial titans of these states?

But wait, there’s more! Ripple’s grand strategy of global expansion is akin to a well-rehearsed ballet. They processed a staggering $70 billion in payments last year—double the previous year’s volume! And their licensing portfolio stretches far and wide, reaching as far as Singapore and the Cayman Islands. Truly, they are the globetrotters of the financial world!

Yet, amidst this whirlwind of progress, legal challenges loom like dark clouds over a sunny picnic. Ripple’s ongoing tussle with the Securities and Exchange Commission (SEC) has become the stuff of legends. In 2024, they were slapped with a $125 million fine for institutional XRP sales that were deemed a tad too adventurous. Brad Garlinghouse, the captain of this ship, expressed his frustration on social media, perhaps while sipping a cup of tea. ☕

Innovation and Regulatory Milestones

But fear not, for Ripple’s innovation pipeline is bursting at the seams! They plan to integrate their RLUSD stablecoin, freshly approved by the New York Department of Financial Services, into their payment platform later this year. It’s like adding sprinkles to an already delightful cake! 🍰

Ondo Finance Brings $185M Treasury-Backed Token to the XRP Ledger

And lo! Ondo Finance, that daring platform specializing in tokenizing real-world assets, has announced the launch of its $185 million U.S. Treasury-backed token, OUSG, on the XRP Ledger! This is not just a token; it’s a ticket to broaden institutional access, as revealed on a fine Tuesday.

The OUSG token is backed by none other than BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL). It allows qualified investors to mint and redeem tokens faster than you can say “blockchain.” Ondo Finance promises that this integration with XRPL will go live within six months—mark your calendars! 📅

Ripple, a generous benefactor of XRPL, and Ondo Finance have provided seed funding for initial liquidity, though the size of these investments remains a tantalizing mystery. 🕵️♂️

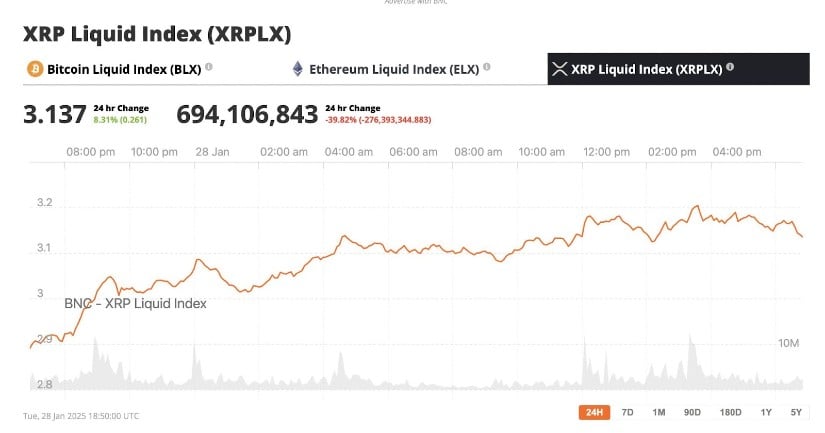

XRP price was up 8% on the news. Source: XRPLX

Tokenization Accelerates on XRPL

Tokenizing real-world assets is transforming finance faster than a magician’s trick! U.S. Treasury-backed tokenized products have quadrupled in the past year, reaching a market size of $3.5 billion. Who knew finance could be so exciting? 🎩✨

“This 24/7 intraday settlement made possible by tokenized assets like OUSG marks a revolutionary shift in capital flow management,” proclaimed Markus Infanger, Senior Vice President of RippleX. “These high-quality, low-risk liquidity solutions provide better accessibility for investors and stability

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-01-29 20:20