As a seasoned crypto investor who has witnessed the rollercoaster ride of digital currencies over the past decade, I find myself both intrigued and cautiously optimistic about Ripple (XRP) at this moment. With its 182.80% surge in the last 30 days and a 30.26% increase in the past week, XRP has certainly caught my attention.

As a researcher, I’ve observed an extraordinary surge in the value of XRP over the past month, with a staggering 182.80% increase within the last 30 days alone. Moreover, the past week has seen a significant rise of 30.26%. However, my analysis reveals that while the Exponential Moving Averages (EMA) lines maintain a bullish stance, with short-term lines hovering above their long-term counterparts, technical indicators such as the Relative Strength Index (RSI) and Chaikin Money Flow (CMF) hint that this upward trend might be starting to tire.

A possible slowdown in momentum for XRP may cause it to re-evaluate the support level of $1.05. If selling pressure intensifies, a dip below $1 might occur. But if buyers regain dominance, XRP could aim for resistance at $1.63 and potentially touch $1.7, its highest price point since 2018.

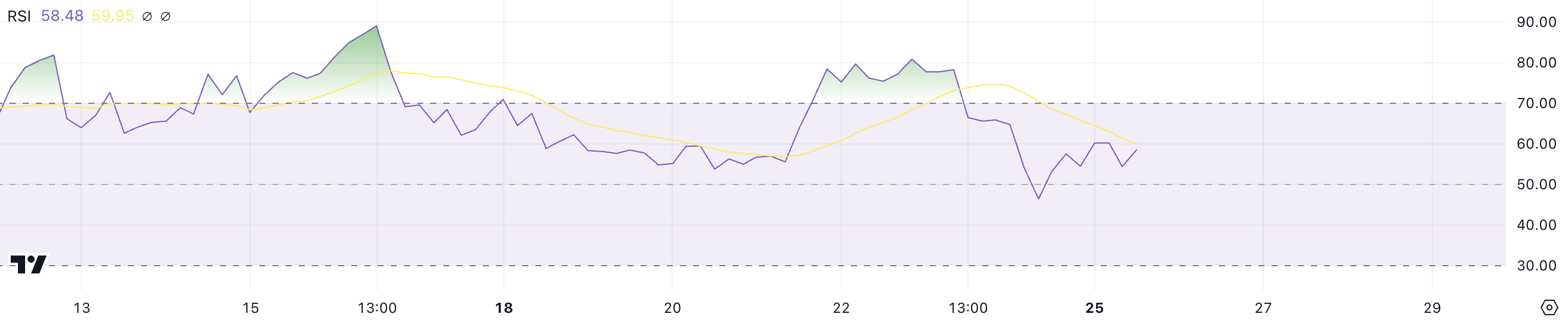

XRP RSI Is In A Neutral Zone

The Ripple Relative Strength Index (RSI) has dropped from more than 70 a few days back to 58 now. This index, known as the RSI, gauges the speed of price fluctuations between 0 and 100, with figures over 70 signaling an overbought state, which might lead to a correction, and numbers below 30 pointing towards oversold conditions that could trigger a price rebound.

As a crypto investor, I’ve noticed a dip from around 70 to 58. This suggests a decrease in the current bullish trend, which might indicate that the recent upward surge could be easing off a bit. However, it’s important to note that we’re not quite in bearish territory just yet.

The Relative Strength Index (RSI) for XRP is currently at 58, suggesting it’s within a healthy range and trending towards optimistic outlook, but with less urgency to buy compared to earlier times. After a significant 30.26% price increase over the past week, the drop in RSI might signal a phase of stability or holding pattern could be coming up next.

As an analyst, I’m observing that the RSI (Relative Strength Index) seems to be on a downward trend. This might suggest heightened selling activity, which could eventually result in a price adjustment. Conversely, if the RSI levels off or even rises, it could indicate a resurgence of buying interest, potentially leading XRP’s price to recover its momentum and aim for further growth.

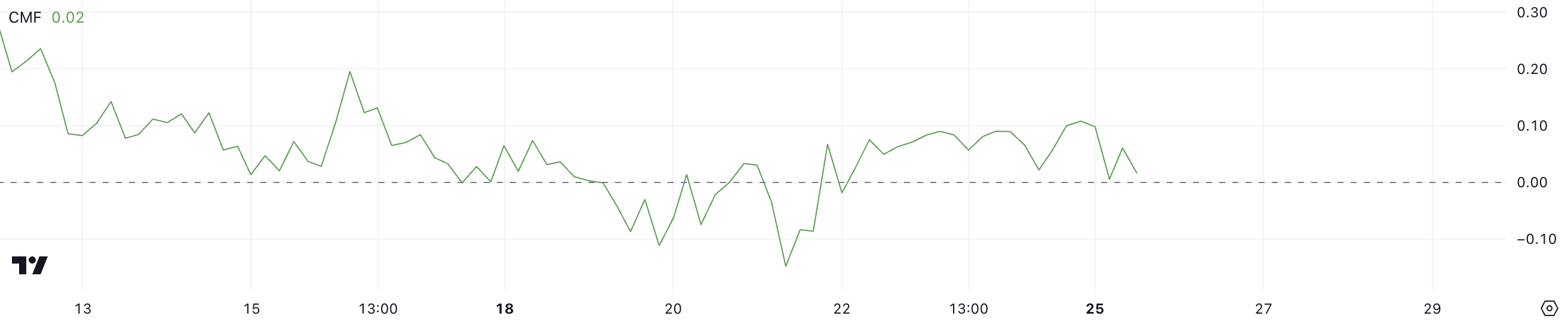

Ripple CMF Is Heavily Declining

As a researcher, I’ve noticed that XRP’s Chaikin Money Flow (CMF) has dropped to 0.02, down from 0.11 just two days ago. This significant decrease suggests a notable reduction in buying pressure. The CMF, or Chaikin Money Flow, quantifies the inflow or outflow of capital into an asset over time. Values above zero indicate net inflows (buying pressure), while values below zero signify net outflows (selling pressure).

Starting from November 22nd, Ripple’s CMF has persistently shown a positive trend, indicating that buyers have kept control, even during the recent market downturn.

With a Capital Movement Formula (CMF) of 0.02, Ripple continues to show a minimal inflow of capital, hinting that bullish sentiment remains, albeit diminishing. If the CMF switches to negative, it might signal a transition to net outflows, possibly implying growing selling pressure and a potential price adjustment or correction.

Currently, the favorable market sentiment for CMF points towards a tentatively hopeful perspective. However, if there’s a continued decrease, this might indicate the initiation of a downtrend in the trajectory of XRP prices.

Ripple Price Prediction: Is $1.7 On The Horizon?

The moving average envelopes for XRP are holding a favorable structure, as the shorter-term lines hover over the longer-term ones, signifying an ongoing positive trend. Nevertheless, other signals such as the Chaikin Money Flow (CMF) and Relative Strength Index (RSI) imply that the upward thrust could be weakening.

Should the upward momentum of XRP weaken even more and give way to a downward trend, the XRP price may encounter significant resistance at approximately $1.05, and there’s a possibility it could drop below $1 if the selling force becomes increasingly strong.

If the upward trend gains momentum again, the price of XRP might surpass its current resistance level at $1.63 and potentially reach $1.7, a level not seen since 2018 and a new high for the cryptocurrency.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- 30 Best Couple/Wife Swap Movies You Need to See

- ANDOR Recasts a Major STAR WARS Character for Season 2

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

2024-11-26 00:36