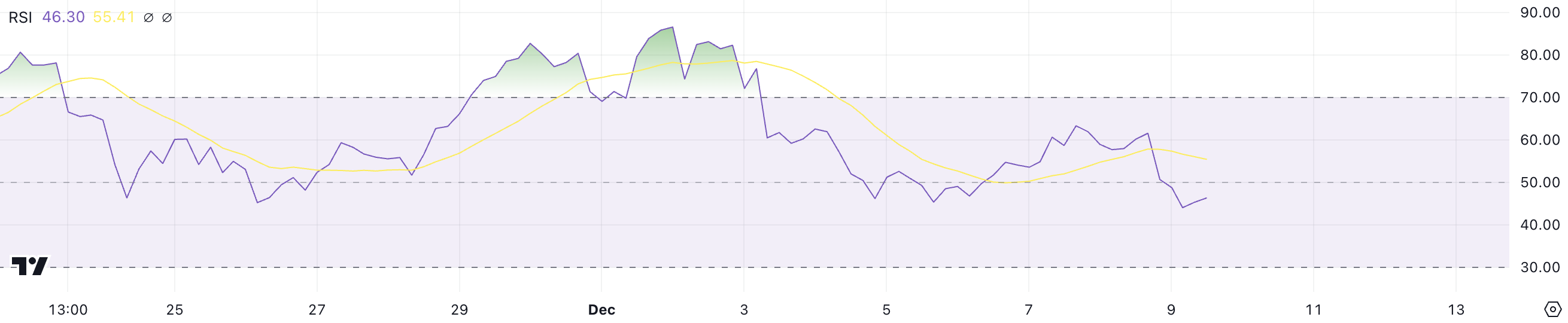

As a seasoned crypto investor with a knack for deciphering market trends and a portfolio that has weathered multiple bull and bear cycles, I’ve learned to read between the lines when it comes to RSI and CMF indicators. The recent surge of XRP, reaching its highest levels in 6 years, was indeed impressive, but the current neutral market sentiment as indicated by the XRP RSI at 46 and the weak selling pressure suggested by the XRP CMF at -0.01 is a clear call for caution.

In just the last month, the value of Ripple (XRP) has skyrocketed over 330%, even outperforming Solana’s market capitalization and reaching a six-year high. Yet, it’s important to note that its Relative Strength Index (RSI) currently stands at 46 – this is a significant decrease from the overbought levels above 70, which were observed between November 29 and December 3 when XRP reached around $2.90, a price point not seen since 2018.

This trend indicates that the initial excitement (bullish momentum) is subsiding, leaving the market feeling neither overly optimistic nor pessimistic (neutral or slightly bearish). Consequently, XRP might experience a phase of stabilization or gentle decreasing trends prior to any possible rebound.

XRP RSI Is Neutral After Consecutive Days Above 70

The Relative Strength Index (RSI) of XRP has recently dipped to 46, marking a notable decline from the overbought zone above 70 that persisted between November 29 and December 3, during which its price reached a peak of approximately $2.9, the highest it’s been since 2018.

The decrease in RSI indicates that the previous bullish trend might have weakened, leading us into a potentially neutral or moderately bearish market scenario.

The Relative Strength Index (RSI) is a tool used in finance that quantifies the rate and direction of price changes. It scores between 0 and 100, with readings exceeding 70 often pointing towards an overbought market, while figures below 30 might signal an oversold one.

Having an RSI (Relative Strength Index) of 46 for XRP means it’s neither excessively bought (overbought) nor excessively sold (oversold), signifying a neutral market feeling. If this pattern persists, the price of Ripple might undergo a phase of stabilization or gentle decline before possibly bouncing back.

Ripple CMF Is Now Around 0

right now, the Composite Money Flow (CMF) for XRP is showing a value of -0.01, which is a change from a brief positive reading of 0.04 that occurred a few hours ago. The CMF peaked at a negative level of -0.25 on December 6, following a stretch of positivity that lasted from November 29 to December 5.

This change in the Capitalization Market Factor implies that the future direction of XRP remains unpredictable, as the asset continues to struggle with maintaining its upward trajectory.

The Chaikin Money Flow (CMF) is a financial indicator that quantifies the buying and selling activity of an asset over a certain timeframe. It considers both the price and volume data. CMF values greater than zero imply accumulation, or buying pressure, while values less than zero suggest distribution, or selling pressure. The scale for CMF ranges from -1 to +1.

As a crypto investor, I’m observing a Current Market Force (CMF) of -0.01, which points to a moderate selling pressure. This suggests that while there was an effort to reverse the negative trend, it lacked the strength to maintain the positive momentum. If this pattern persists, it might signal more downward pressure for XRP prices in the short term.

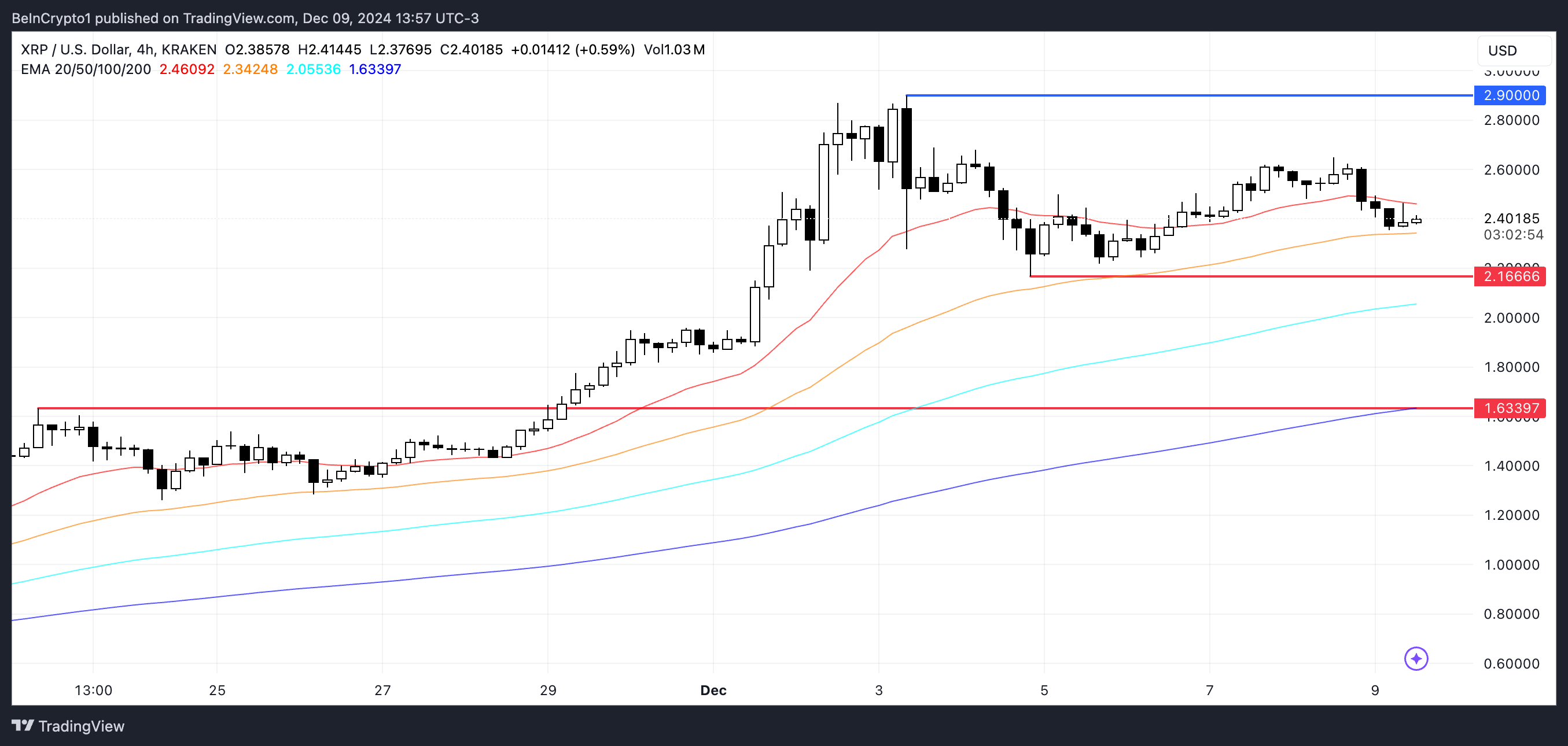

XRP Price Prediction: Can Ripple Go Below $2?

As a crypto investor, I’m observing a bullish outlook for Ripple, where my short-term Exponential Moving Averages (EMAs) are sitting comfortably above my long-term EMAs. This alignment indicates a general upward trajectory in the market, which is music to my investing ears.

On the other hand, the present price lies beneath the shortest horizontal line, suggesting a potential shift in trend and possibly a decline in the bullish energy.

As I analyze the current market trends, it appears that if a significant downtrend materializes for XRP, its price might be tested at the support level of approximately $2.16. Should this crucial support fail to withstand the pressure, we could witness a potential drop, reaching as low as $1.63. This potential correction represents a possible 32% decline in the XRP price.

If Ripple’s price trend continues upward, as indicated by its over 330% increase in the past month, it might challenge the $2.90 mark again and even aim for $3 – a value last reached on January 7, 2018.

Read More

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

2024-12-10 00:39