As a seasoned analyst with over two decades of experience in the volatile world of cryptocurrencies, I’ve seen market trends come and go like the tides. The recent surge of Ripple (XRP) has piqued my interest, as it’s reminiscent of the wild west days of Bitcoin back in 2017.

In just the last month, the value of Ripple (XRP) has skyrocketed by more than 230%, reaching heights not seen since 2018. The robust upward trend, backed by optimistic signals such as RSI and CMF, hints at potential for even greater increases.

If the ongoing trend persists, it’s possible that XRP could climb to around $1.90 and potentially push towards $2, which would represent a 16% increase from its current value. Conversely, if the trend falters, there’s a risk that XRP might correct downwards to support levels at either $1.21 or $1.05, indicating a possible drop of 39%.

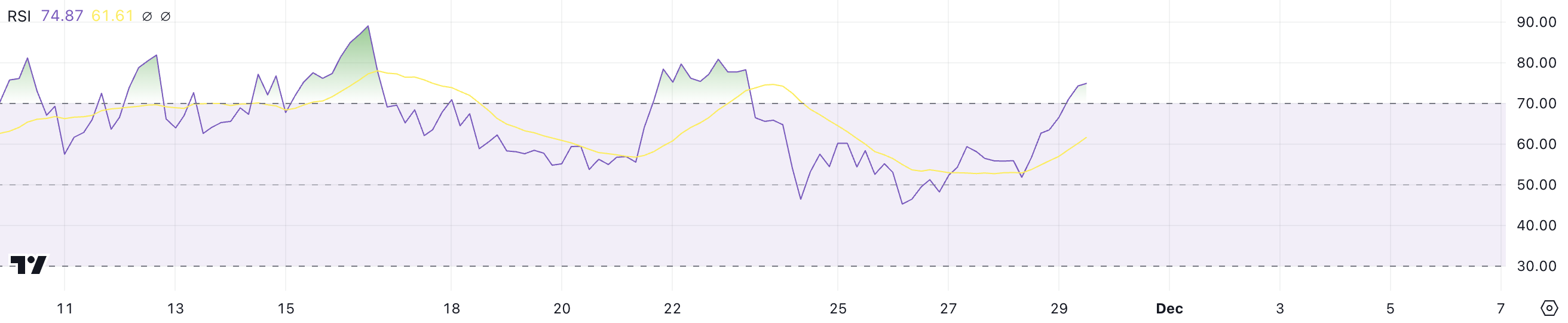

XRP RSI Is Overbought, but the Uptrend Could Continue

Right now, the RSI (Relative Strength Index) for Ripple is at 74.8, showing robust bullish energy after its recent upswing. The RSI gauges the pace and intensity of price fluctuations within a range of 0 to 100. Numbers above 70 signal overbought conditions, hinting that a correction might be imminent, while readings below 30 indicate oversold conditions, suggesting possible recovery.

With XRP trading above the 70 mark on the Relative Strength Index (RSI), this indicates a surge in buying activity, potentially suggesting a need for investors to exercise caution due to the increased likelihood of a potential price correction.

Historically, the Relative Strength Index (RSI) of XRP has surpassed 70 on several occasions, occasionally rising to 80 or even 90. After these peaks, adjustments or corrections usually follow.

Even though Ripple is currently in an area where prices have climbed too high (overbought territory), there’s a possibility that it might continue rising in the near future. If the present trend persists, Ripple’s price increase could extend even more before a notable drop takes place. Therefore, keeping a close eye on the Relative Strength Index (RSI) movement becomes important.

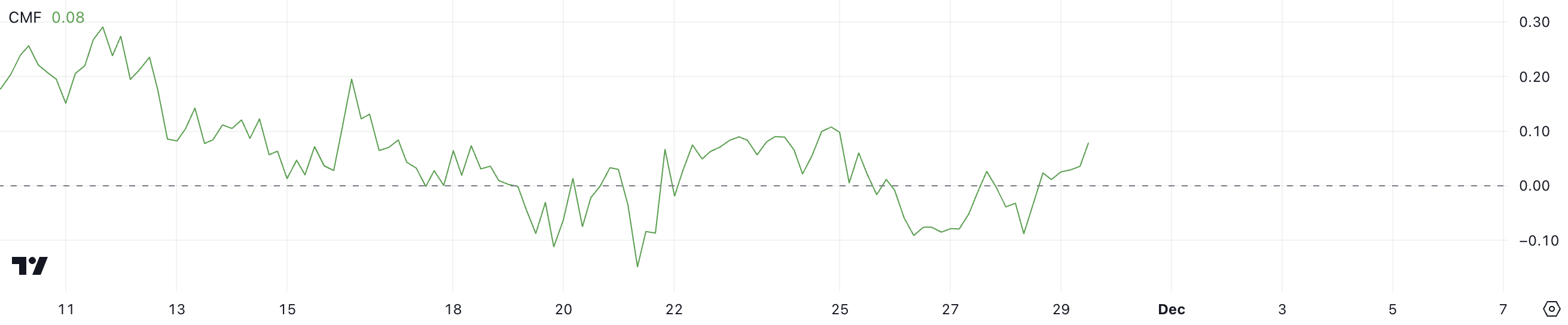

Ripple CMF Is Now Positive, but Not That High Yet

Presently, the Chaikin Money Flow (CMF) for XRP stands at 0.08, showing a significant change from approximately -0.10 the previous day. The CMF calculates the movement of funds into or out of an asset by considering both its price and volume over time, providing insight into the capital flow patterns.

In simpler terms, when Capital Movement Factor (CMF) has a positive value, it signifies that more capital is flowing in than out, along with increased buying pressure. Conversely, negative values imply outflows and higher selling activity. A shift towards positive territory indicates increasing confidence among buyers and reinforces the current price trend’s momentum.

As a researcher, I’ve observed that although the Current Market Flow (CMF) stands at 0.08, this figure remains significantly lower than the levels seen in November, particularly the 0.30 and 0.20 readings witnessed during major bullish phases. This observation implies that while buying pressure is resurfacing, it’s yet to reach the strength experienced during past market surges.

Should Common Money Fund (CMF) persistently increase, it might indicate a potential expansion for XRP’s value, allowing the upward trend to potentially intensify even more over the next few days.

Ripple Price Prediction: Can It Reach $2?

The price of Ripple has climbed to its peak since 2018, fueled by a significant 231.39% surge over the last month. Moving Average Lines suggest that XRP is presently experiencing an upward trend. If this trend persists, XRP could potentially reach $1.90, representing an 11% increase, and even challenge the $2 mark, signifying a 16% growth.

If the upward trend begins to falter, there’s a possibility that the price of XRP may experience a downturn. Important support levels could be found at $1.21 and $1.05. A fall to these points would signify a potential decrease of 39%, underscoring the significance of preserving bullish momentum to prevent a substantial dip.

Read More

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

2024-11-29 22:51