The change occurs as anticipation grows for a more welcoming regulatory environment under the new administration, which will take office on January 20, 2025, led by former President Donald Trump.

Indeed, on Tuesday evening, Brad Garlinghouse, Ripple‘s CEO, shared a picture of him together with President Trump. During their get-together, they were joined by Stuart Alderoty, the General Counsel at Ripple.

The Trump Effect

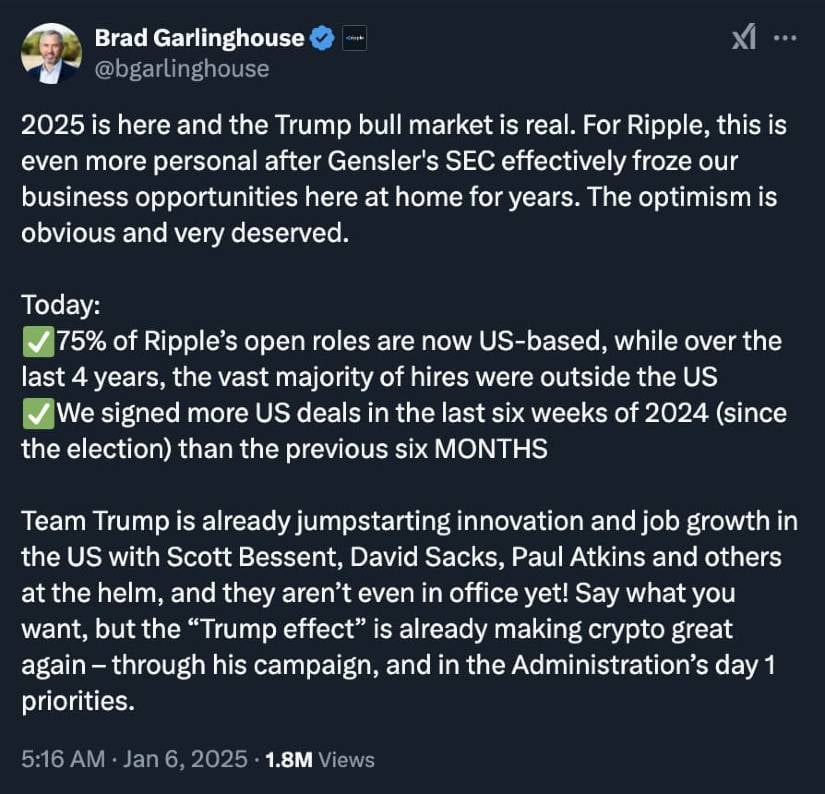

Towards the start of this month, Ripple’s CEO, Brad Garlinghouse, shared that their recent recruitment strategy is tied to what he terms as the “Trump effect.” This phrase refers to the supportive stance towards cryptocurrencies and potential regulatory easing in policies.

On social media platform X, Garlinghouse expressed that Team Trump is sparking innovation and job creation in the U.S., instilling a newfound optimism within blockchain and cryptocurrency companies. The executive also noted that the U.S. Securities and Exchange Commission (SEC), under former Chair Gary Gensler, had hindered Ripple’s domestic prospects for several years. However, the company is hopeful for a shift in this situation following the November 2024 election results.

Ripple is focusing on filling vacant roles, particularly in engineering and product development, as part of their overall plan to invest more within their domestic market. Observers have pointed out that this shift represents a significant change from the past when the company contemplated moving its main office overseas due to regulatory challenges. In its global expansion phase, Ripple revealed that 95% of its client base was based abroad, indicating the company’s previous concerns about unpredictable U.S. regulations.

The upcoming roles seem promising for the value trend of Ripple’s XRP token. By 2025, it’s anticipated that XRP will demonstrate strong performance, as numerous forecasts suggest substantial growth for XRP under the Trump administration.

Ripples Beyond Ripple

Besides Ripple, other industry players are taking action, sensing a supportive attitude towards cryptocurrencies under the second Trump administration. For example, Hive Digital, a mining company, has decided to move its headquarters from Vancouver, Canada, to San Antonio, Texas. In a statement, the firm expressed optimism about Trump’s stance on digital assets, suggesting that the U.S. environment might be more favorable for expansion and innovation.

As an analyst, I’m observing a potential shift in the digital finance landscape. Morgan Stanley, a globally recognized financial institution, is contemplating the inclusion of cryptocurrency trading on its E-Trade platform. This move could be influenced by signs from the incoming administration that are supportive of blockchain technology development. The relaxation of regulations might ignite a flurry of corporate mergers, acquisitions, and growth in digital finance solutions. Optimists look forward to Bitcoin and other cryptocurrencies reaching substantial price milestones by 2030, driven by what some investors refer to as “pro-innovation” measures.

Warnings have been issued that significant hurdles persist for cryptocurrencies. Their development is influenced by factors such as market volatility, the need for regulatory clarity, and public opinion. Issues vary from environmental concerns linked to mining operations to uncertainties about how digital assets may interact with current financial systems. On the other hand, supporters believe that new policy guidance in Washington could facilitate a more productive dialogue between digital asset companies and regulators.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- 30 Best Couple/Wife Swap Movies You Need to See

- Persona 5: The Phantom X Navigator Tier List

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

2025-01-08 11:42