As an analyst with over two decades of experience in the financial markets, I must admit that I’m intrigued by this strategic move by Riot Platforms. The company’s decision to closely follow MicroStrategy’s Bitcoin purchase strategy is a bold one, and it seems to be paying off handsomely thus far.

Cryptocurrency mining company Riot Platforms has bought approximately 667 Bitcoins valued at around $69 million, as disclosed in their latest Securities and Exchange Commission filings. They acquired these Bitcoins at an average price of roughly $101,135 per Bitcoin.

By making this acquisition, Riot now owns a total of 17,429 Bitcoins. Given the current value, these Bitcoins are estimated to be worth around 2 billion dollars.

Riot is Closely Following MicroStartegy’s Bitcoin Purchase Strategy

In 2018, Riot made a change in its main business direction towards Bitcoin mining, based at its Oklahoma location. Since then, the company has broadened its plan, following a similar path as MicroStrategy’s Chairman Michael Saylor in terms of Bitcoin acquisition and implementing share repurchases to augment its crypto holdings.

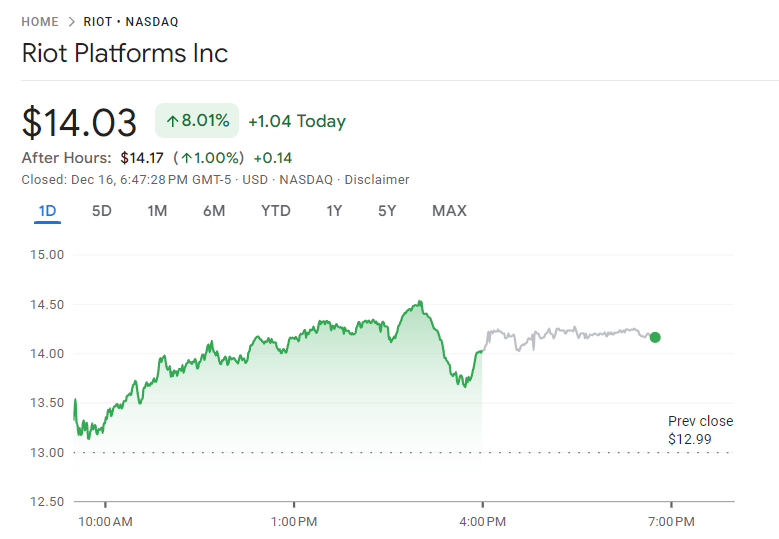

After the recent announcement, Riot’s stock price saw a nearly 8% increase today. Their Bitcoin earnings have been substantially enhanced due to their involvement in Bitcoin mining and strategic Bitcoin purchases.

Furthermore, Riot Games indicated a Bitcoin return of approximately 36.7% for the fourth quarter up until now, and a year-to-date return of 37.2%. This yield figure underscores the increase in Bitcoin assets compared to the impact of share issuance.

The approach of raising capital through share rights for Bitcoin purchases remains a topic of debate. However, major miners like Riot and Marathon Digital (MARA) have continued this practice.

Approximately a week ago, MARA purchased 11,774 Bitcoins at an overall cost of $1.1 billion. This transaction was financed through a zero-interest bond offering.

Today, MicroStrategy also disclosed its recent Bitcoin acquisition. They bought 15,350 Bitcoins for a total of $1.5 billion, which averages out to approximately $100,386 per Bitcoin.

Through this transaction, MicroStrategy now owns approximately $27.1 billion in Bitcoin. In their Q4 report, they declared a Bitcoin return of 46.4% and a year-to-date return of 72.4%, demonstrating their bold approach to acquiring Bitcoin.

As a crypto investor, I’ve noticed that MicroStrategy’s stock (MSTR) has followed Bitcoin’s impressive trajectory this year, surging approximately 500% since the beginning of the year. This phenomenal growth has catapulted Michael Saylor’s company into the exclusive group of the top 100 publicly traded companies in the United States.

Michael Saylor recently stated on X (previously known as Twitter) that each person purchases Bitcoin according to its intrinsic value, and Bitcoin itself doesn’t hesitate; it merely redistributes wealth to those who recognize it.

Saylor advocates for years that public corporations should consider adding Bitcoin to their investment portfolios. However, a recent proposal by him for Microsoft shareholders to incorporate Bitcoin into the company’s treasury was turned down.

On the other hand, shareholders from Amazon’s rival firms hold a contrasting view. They suggest using some of Amazon’s $88 billion in cash reserves to invest in Bitcoin, considering it as a protective measure against potential inflation.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- How a 90s Star Wars RPG Inspired Andor’s Ghorman Tragedy!

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- SD Gundam G Generation ETERNAL Reroll & Early Fast Progression Guide

2024-12-17 03:10