The air is thick with talk of quantum computation, a realm of possibilities that seems to promise a reshaping of existence itself. Amongst the hopefuls, Rigetti Computing emerges—a name whispered with a mixture of anticipation and, if one dares to observe the market with a clear eye, a certain melancholy. The company has known moments of illusory ascent, a brief flowering before the inevitable return to a more sober valuation. To speak of gains in this nascent field feels akin to noting the ephemeral beauty of a frost flower—lovely, certainly, but destined to vanish with the first warmth of the sun.

The question, then, is not whether Rigetti possesses promise—many such ventures do—but whether it possesses the fortitude, the very character, to navigate the treacherous currents that lie ahead. It is a company adrift in a sea of giants, competing with established powers like Alphabet’s Google and the venerable IBM, institutions that possess not only deep pockets but a certain… inertia. A weight that, while sometimes hindering, also provides a measure of stability. Rigetti, by contrast, is all velocity, all aspiration—a condition that, while admirable, is not always conducive to long-term survival.

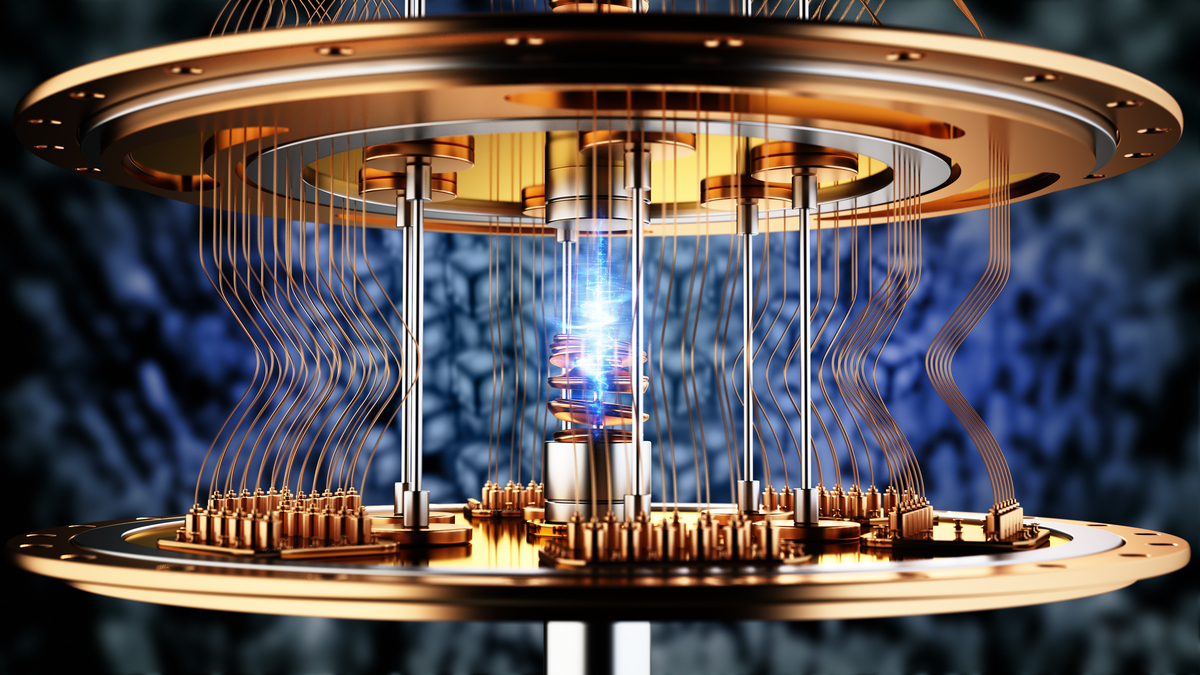

The pursuit of quantum supremacy, as it is grandly termed, rests upon a triad of virtues: speed, accuracy, and scale. To accelerate the manipulation of quantum particles, to minimize the inevitable errors, and to expand the very architecture of these delicate systems—these are the challenges that consume the engineers and the investors alike. Yet, it is a cruel paradox that as one strives for greater scale and speed, accuracy tends to falter. The more ambitious the design, the more fragile the execution. It is a lesson learned repeatedly throughout history, in fields ranging from architecture to politics.

Rigetti boasts impressive gate speeds, a swiftness that suggests a certain… impatience. Its 108-qubit system, a considerable achievement, operates at a remarkable pace. However, this velocity comes at a cost. The median accuracy, while respectable, is not yet sufficient to quell the anxieties of a discerning observer. A mere 99% may sound impressive to the uninitiated, but in the realm of quantum computation, even the smallest imperfection can be catastrophic. It is akin to a flawlessly painted canvas marred by a single, jarring brushstroke.

The company’s smaller systems exhibit greater fidelity, a comforting sign. Yet, it is IonQ that currently holds the advantage in accuracy, achieving a remarkable 99.99% fidelity in its 100-qubit system. IonQ, however, operates at a more deliberate pace, a measured approach that perhaps reflects a greater appreciation for the inherent fragility of the quantum realm. Rigetti’s Dr. Kulkarni speaks of achieving 99.5% fidelity in the near future, a laudable goal. But even if achieved, it remains a considerable distance from the levels required for true commercial viability.

The demands of a commercially viable quantum computer are, frankly, staggering. At least one million physical qubits, coupled with an accuracy approaching perfection—99.99%, or even higher. We are, it seems, decades away from such a reality. Rigetti envisions a 1,000-qubit system by 2027, with 99.7% fidelity. IonQ, meanwhile, aims for 10,000 qubits by the same year, and a staggering 2 million by 2030. Should Rigetti maintain a similar trajectory, it might surpass the one million qubit threshold by 2031. But to predict such outcomes with certainty is to indulge in a folly. The future, as always, remains shrouded in mist.

The market, of course, is captivated by the promise of quantum computing, envisioning a potential market of $72 billion by 2030. Rigetti, if it can secure a sufficient share of this pie, could indeed prove to be a lucrative investment. But to rely on such projections is to succumb to a dangerous optimism. Many companies have risen and fallen on the tides of speculation. It is a lesson that the seasoned investor never forgets.

Therefore, is Rigetti a buy? For the most speculative of investors, perhaps. But for those who seek a measure of prudence, it is a venture best approached with caution. A small stake, alongside other quantum computing companies, or an investment in a diversified ETF—these are strategies that offer a degree of protection. And above all, one should never invest more than one can afford to lose. The pursuit of innovation is a noble endeavor, but it is not without its risks. And in the end, it is often the quiet, unheralded companies—the ones that focus on incremental progress rather than grandiose pronouncements—that ultimately prevail.

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-02-09 00:03