The market, in its infinite and unknowable wisdom, occasionally deigns to notice the existence of quantum computing ventures. These notices, however, are fleeting, like the half-remembered instructions delivered by a distant bureaucrat. The current disinterest is not, perhaps, a judgment, but a simple acknowledgment of a timeline. Significant industrial impact, it is projected, will not materialize until approximately 2030. This is not a period of development, but a prolonged state of pre-existence, akin to a document awaiting an indefinite stamp of approval. To invest now is to fund a potentiality, a ghost in the machine, whose ultimate form remains obscured by layers of probabilistic uncertainty.

A decline in valuation, then, may stem from one of three equally unsettling possibilities. The industry itself may be viewed with a justifiable skepticism, a suspicion that the promised revolution is merely a rearrangement of existing inefficiencies. The company in question – in this instance, Rigetti Computing – may be failing to navigate the labyrinthine path towards viable technology, perpetually lagging behind an invisible, ever-shifting standard. Or, most disturbingly, the market may simply be exercising its prerogative to lose patience, to withdraw funding from a project whose returns are perpetually deferred, a process as arbitrary and incomprehensible as the assignment of serial numbers in a vast, uncaring administration.

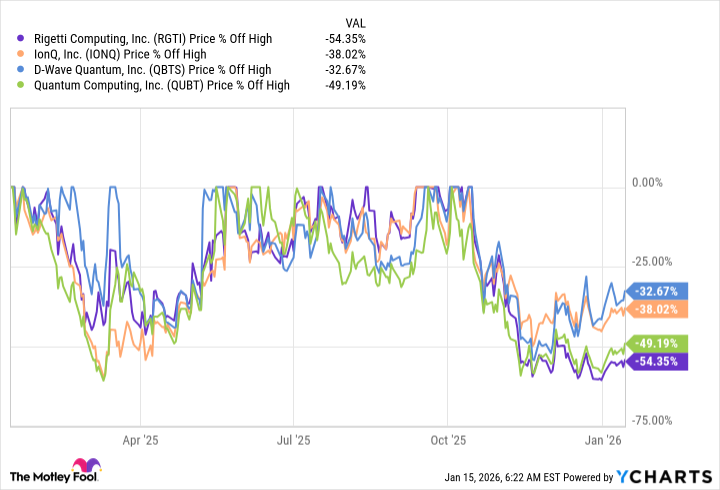

Rigetti Computing, currently valued at approximately eight billion units of currency, represents a curious case. It is a company diminished, having fallen more than fifty percent from its previous peak. Is this a moment of opportunity, a chance to acquire a stake in the future at a reduced price? Or is this merely a predictable consequence of a flawed premise, a natural correction in a market that occasionally, and without explanation, deems certain endeavors unworthy of continued support?

Rigetti and the Pursuit of Ephemeral Superiority

Quantum computing is predicated on a choice of methodologies, each with its own peculiar set of advantages and disadvantages. Rigetti has chosen the path of superconductivity, a technique currently favored for its processing speed, despite a recognized deficiency in accuracy. This is a long-term wager, a belief that speed will ultimately compensate for imperfection. An alternative approach, employing trapped ions – favored by IonQ – offers superior accuracy, but at the cost of diminished speed. The implication is that if superconductivity can achieve comparable accuracy, it will prevail, not necessarily because of its inherent superiority, but because of its greater efficiency in the current, imperfect system. The logic is circular, self-referential, and ultimately unsatisfying.

Rigetti is not alone in its pursuit of superconductivity. This is the most common approach, and therefore the most crowded. It finds itself in competition with entities of considerable scale and resources – Alphabet, Microsoft, and International Business Machines – each possessing the capacity to absorb losses and sustain prolonged periods of unprofitability. Rigetti, by comparison, is a small vessel navigating a turbulent sea, its fate uncertain. In the most recent quarter, revenue amounted to a mere 1.9 million units, offset by an operating loss of 21 million. The company possesses approximately 600 million units in reserve, enough to postpone the inevitable for a time, but hardly sufficient to withstand a sustained assault from its larger, more powerful competitors. It is a matter of scale, a simple arithmetic of resources.

The question, therefore, remains: is Rigetti still worthy of consideration at its current, diminished price? The answer, after careful consideration, is… ambiguous. It is not a matter of inherent unworthiness, but of unfavorable odds.

A Comparative Lack of Appeal

While the entire sector of quantum computing pure-plays has experienced a decline, Rigetti appears to be among the most significant losers. This may be a premature reaction to its challenges, a hasty judgment based on incomplete information. However, if one is compelled to invest in this sector, it would be prudent to focus on the leaders, those with the deepest pockets – Microsoft or Alphabet – or on companies pursuing alternative technologies, such as IonQ. The logic is not one of superior insight, but of risk mitigation. To invest in Rigetti is to accept a higher degree of uncertainty, a greater probability of loss.

No one can predict the ultimate winner in this nascent field, nor can anyone foresee what the technology will look like five years hence. A diversified approach – spreading investments across companies of different sizes and employing different techniques – is therefore advisable. Rigetti, however, does not fit neatly into this mold. It is a small, vulnerable entity competing in a resource-intensive industry. It is, in essence, a statistical anomaly.

For those inclined to create a broad portfolio of quantum computing stocks, several exchange-traded funds offer exposure to the major players, alongside a selection of smaller, more speculative ventures. Rigetti, however, faces an uphill battle. While it may yet prevail, the odds are stacked against it. As a result, it is our considered opinion that there are more promising investments to be found elsewhere. The pursuit of quantum supremacy, it seems, is not a path to guaranteed returns, but a journey into the realm of perpetual uncertainty.

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-01-19 14:33