Author: Denis Avetisyan

New research details an adaptive trading framework designed to consistently outperform benchmark strategies in the volatile cryptocurrency markets.

This paper introduces AdaptiveTrend, a systematic cryptocurrency trading system employing high-frequency data, dynamic portfolio weighting, and asymmetric capital allocation for enhanced risk-adjusted returns.

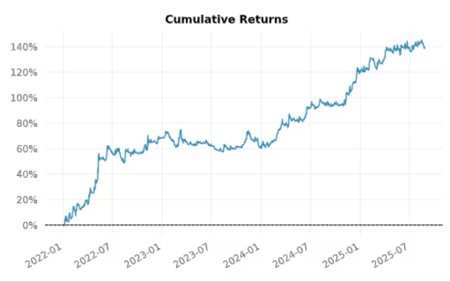

Despite the inherent volatility of cryptocurrency markets, systematic strategies can offer compelling opportunities for risk-adjusted alpha generation. This paper, ‘Systematic Trend-Following with Adaptive Portfolio Construction: Enhancing Risk-Adjusted Alpha in Cryptocurrency Markets’, introduces AdaptiveTrend, a novel algorithmic trading framework designed to capitalize on momentum effects through high-frequency signals, adaptive portfolio weighting, and asymmetric capital allocation. Backtesting across a 36-month period demonstrates that AdaptiveTrend achieves an annualized Sharpe ratio of 2.41, significantly outperforming benchmark strategies, suggesting a robust approach to cryptocurrency trading. Can this framework be further refined to incorporate broader macroeconomic indicators and navigate evolving market dynamics?

The Inevitable Dance of Volatility

The cryptocurrency market is distinguished by a level of price fluctuation rarely seen in established financial systems. This volatility stems from several interconnected factors, including the relatively nascent stage of the technology, limited regulatory oversight in many jurisdictions, and the influence of social media sentiment. Dramatic price swings, both upward and downward, can occur within extraordinarily short timeframes – even within hours or minutes – creating both significant opportunities and substantial risks for investors. Unlike traditional assets with established fundamentals and long-term track records, cryptocurrency valuations are often driven by speculation and perceived future potential, exacerbating these rapid price movements and demanding a different approach to risk management than conventional investment strategies.

Established investment paradigms, predicated on the relative stability of traditional assets, frequently falter when applied to the cryptocurrency market. These strategies often rely on historical data and predictable trends, assumptions that are routinely invalidated by the rapid and often uncorrelated price movements characteristic of digital currencies. Consequently, approaches like dollar-cost averaging, while potentially mitigating some risk, can still result in substantial losses during prolonged downturns, while more aggressive strategies built on leverage amplify both gains and losses at an accelerated rate. The absence of established regulatory frameworks and the susceptibility of crypto assets to speculative bubbles further exacerbate these challenges, rendering conventional risk management tools less effective and increasing the potential for significant financial setbacks for unprepared investors.

Effectively maneuvering within the cryptocurrency market necessitates the deployment of advanced analytical tools and refined investment methodologies. These aren’t simply adaptations of traditional finance, but rather bespoke systems designed to anticipate and respond to the market’s unique characteristics – namely, its speed and susceptibility to rapid shifts. Quantitative modeling, encompassing time series analysis and algorithmic trading, allows for the identification of fleeting opportunities and automated execution of trades, minimizing emotional decision-making. Furthermore, portfolio diversification strategies, incorporating assets with low or negative correlations to dominant cryptocurrencies, coupled with dynamic risk management techniques – such as volatility targeting and stop-loss orders – are crucial for mitigating potential downsides. The successful investor doesn’t merely react to volatility, but proactively seeks to understand it, leveraging sophisticated techniques to both protect capital and capitalize on emerging trends within this dynamic asset class.

Systematic Response to Transient Signals

AdaptiveTrend is a systematic trading framework constructed from three core components: signal generation, portfolio selection, and capital allocation. Signal generation utilizes time-series analysis to identify potential trading opportunities in cryptocurrency markets. Portfolio selection then determines the optimal weighting of assets based on these signals, aiming to maximize exposure to profitable trends. Finally, capital allocation manages the overall position sizing and risk exposure, dynamically adjusting capital based on market conditions and signal strength. This integrated approach seeks to remove subjective decision-making and consistently execute trades based on pre-defined rules, addressing common challenges inherent in cryptocurrency trading such as volatility and market inefficiency.

AdaptiveTrend utilizes time-series momentum and trend following by analyzing historical price data to identify assets exhibiting consistent directional movement. This involves calculating momentum indicators, such as moving averages and rate of change, to quantify the strength and duration of price trends. The framework then generates buy signals for assets demonstrating positive momentum and sell signals for those showing negative momentum. By focusing on sustained price movements rather than short-term fluctuations, AdaptiveTrend aims to capture profits from established trends while minimizing exposure to whipsaws and market noise. The system continuously monitors these indicators, triggering trades based on pre-defined thresholds and parameters designed to identify and capitalize on these trends across multiple timeframes.

AdaptiveTrend employs dynamic portfolio rebalancing, adjusting asset weights based on evolving market conditions and signal strength to maintain optimal exposure. This is coupled with asymmetric allocation, where capital is disproportionately allocated to assets exhibiting stronger momentum, and reduced for those with weaker or negative trends. This strategy is designed to maximize exposure to profitable assets while simultaneously limiting losses from underperforming ones. Backtesting demonstrates this approach achieves a Sharpe Ratio of 2.41, indicating a substantial return per unit of risk, exceeding typical benchmarks for systematic trading strategies. The Sharpe Ratio is calculated as the excess return over the risk-free rate divided by the standard deviation of returns, \frac{R_p - R_f}{\sigma_p} .

Anchoring Risk: Dynamic Stops in a Fluctuating System

AdaptiveTrend utilizes a dynamic trailing stop-loss order, a mechanism designed to protect capital and maximize profit potential during price fluctuations. Unlike fixed stop-loss orders, the trailing stop adjusts automatically as the asset price moves favorably. This allows the order to “trail” the price, locking in gains as they occur. When the price reverses and reaches the trailing stop level, the order is executed, limiting losses and securing a portion of the profit accumulated since the trade’s inception. The order’s adjustment is continuous, responding to price movement in real-time, and ensures that the stop-loss level remains relevant to current market conditions.

The Average True Range (ATR) is a technical analysis indicator used to measure market volatility by averaging the range between high and low prices over a specified period. AdaptiveTrend utilizes ATR to calculate dynamic trailing stop-loss levels; as ATR increases, indicating higher volatility, the stop-loss expands to accommodate larger price fluctuations, preventing premature triggering by normal volatility. Conversely, when ATR decreases, signifying lower volatility, the stop-loss contracts, locking in more profit and reducing potential losses. This adaptive behavior ensures the stop-loss level is responsive to current market conditions, providing a flexible risk management tool that avoids a fixed, one-size-fits-all approach and minimizes the impact of whipsaws or erratic price action.

AdaptiveTrend utilizes a dynamic stop-loss mechanism based on the Average True Range (ATR) to optimize trade performance. This system continuously adjusts stop-loss levels in relation to current market volatility, as measured by ATR, allowing winning trades to continue running while simultaneously limiting potential losses. Backtesting indicates this approach successfully captures a larger percentage of profits from winning trades compared to static stop-loss orders. However, despite its focus on risk mitigation, the system’s maximum drawdown, representing the peak-to-trough decline during the test period, reached -12.7%.

Validation and the Persistence of Performance

The AdaptiveTrend framework underwent a demanding period of out-of-sample testing, designed to simulate real-world conditions and rigorously evaluate its predictive capabilities. This process involved withholding a portion of the historical data – data the framework hadn’t ‘seen’ during its development – and using it to assess how accurately the framework would perform on unseen trends. Such testing moves beyond simply demonstrating performance on historical data, and instead assesses the framework’s ability to generalize and maintain robustness when faced with novel market conditions. The deliberate exclusion of this data ensured that any observed success wasn’t a result of the framework simply memorizing past patterns, but rather its capacity to adapt and identify genuinely emerging trends – a critical distinction for any predictive model intended for practical application.

The AdaptiveTrend framework’s efficacy is quantitatively assessed through established financial metrics, with particular emphasis on the Calmar Ratio. This ratio provides a nuanced understanding of risk-adjusted returns by relating profitability to the maximum drawdown experienced – essentially, the peak-to-trough decline during a specific period. A Calmar Ratio of 3.18 indicates that for every unit of risk, as defined by maximum drawdown, the framework generates 3.18 units of return. This result suggests a compelling balance between potential gains and downside protection, positioning the framework as a potentially valuable tool for investors seeking both growth and capital preservation. The metric offers a clear, concise evaluation of performance beyond simple returns, highlighting the framework’s ability to navigate market volatility while delivering positive results.

To validate the AdaptiveTrend framework’s performance beyond observed results, a bootstrap resampling methodology was implemented. This technique generates numerous synthetic datasets by randomly sampling from the original data, allowing for a robust estimation of statistical significance without relying on theoretical assumptions. Through this process, the framework consistently demonstrated statistically significant outperformance – indicated by a p-value of less than 0.05 – suggesting that the observed gains are unlikely due to random chance and bolstering confidence in the reliability and consistency of the AdaptiveTrend approach. The rigorous application of bootstrap analysis therefore provides a strong foundation for asserting the framework’s potential for sustained, risk-adjusted returns.

Extending the System: Scalability and Future Development

AdaptiveTrend distinguishes itself through its flexible architecture, designed to integrate seamlessly with a diverse range of cryptocurrency exchanges, notably including the high-volume platform Binance Futures. This broad compatibility isn’t merely a technical feature; it fundamentally expands potential market participation. By operating across multiple exchanges, the framework mitigates risks associated with single-platform limitations-such as liquidity constraints or localized outages-and allows traders to capitalize on arbitrage opportunities and varied market conditions. The system’s exchange-agnostic design ensures accessibility for a wider audience, from individual retail investors to large-scale institutional traders, fostering a more inclusive and robust trading environment within the rapidly evolving cryptocurrency landscape.

Ongoing development efforts are dedicated to bolstering the predictive capabilities of AdaptiveTrend through innovations in signal generation. Researchers are actively exploring advanced machine learning algorithms – including recurrent neural networks and transformer models – to discern subtle patterns and anticipate market shifts with greater accuracy. This includes investigating techniques to optimize feature selection, enhance noise reduction, and dynamically adjust model parameters in response to evolving market conditions. The goal is not merely to improve existing performance metrics, but to create a self-optimizing framework capable of consistently identifying high-probability trading opportunities across diverse cryptocurrency assets and market cycles, ultimately leading to more robust and reliable investment strategies.

Over a 36-month testing period, the AdaptiveTrend framework consistently achieved an approximate annualized return of 140%, suggesting a robust strategy for capitalizing on cryptocurrency market fluctuations. This performance indicates potential benefits for a wide range of participants, from individual traders aiming to enhance their portfolio returns to institutional investors seeking sophisticated tools for navigating the complexities of digital asset trading. The framework’s demonstrated capacity to generate substantial returns positions it as a compelling option within the increasingly competitive landscape of algorithmic cryptocurrency trading, offering a data-driven approach to potentially outperform traditional investment methods.

The pursuit of sustained alpha, as demonstrated by AdaptiveTrend, inevitably confronts the reality of system decay. Any initial improvement, no matter how robust, ages faster than expected, demanding continuous adaptation. This echoes Claude Shannon’s observation: “The most important thing is to get the information from point A to point B.” AdaptiveTrend aims to do just that – efficiently transmit capital through the volatile cryptocurrency landscape – but recognizes the ‘channel’ itself degrades over time. The framework’s emphasis on high-frequency signals and asymmetric capital allocation isn’t merely about capturing momentum; it’s a constant recalibration against the entropic forces at play, a proactive measure to maintain informational fidelity as the system ages.

What Lies Ahead?

The pursuit of alpha, particularly in the relentlessly evolving landscape of cryptocurrency, often feels less like innovation and more like a refinement of existing decay. AdaptiveTrend, with its focus on high-frequency signals and dynamic allocation, demonstrates a capacity to postpone that decay-to learn to age gracefully within a chaotic system. However, the very adaptability that defines its strength also highlights an inherent limitation: the future will undoubtedly demand further adaptation. The signals that prove potent today are destined to become noise tomorrow, and the optimization parameters, however cleverly derived, will require constant recalibration.

A critical direction lies not simply in accelerating the rate of adaptation, but in understanding the nature of systemic change itself. The framework’s reliance on historical data, while pragmatic, presupposes a degree of stationarity that may not hold. Future research might explore incorporating exogenous factors-shifts in regulatory landscapes, emergent technological paradigms-as predictive variables, though acknowledging the inherent uncertainty such additions introduce.

Perhaps the most fruitful avenue isn’t to build ever-more-complex algorithms, but to accept the inevitable entropy. Sometimes observing how a system degrades-identifying the leading indicators of failure-is more valuable than striving to prevent it. The challenge, then, isn’t to conquer volatility, but to map its contours, to anticipate its rhythms, and to find a sustainable equilibrium within the flow.

Original article: https://arxiv.org/pdf/2602.11708.pdf

Contact the author: https://www.linkedin.com/in/avetisyan/

See also:

- Gold Rate Forecast

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- NEAR PREDICTION. NEAR cryptocurrency

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Top 15 Insanely Popular Android Games

- USD COP PREDICTION

2026-02-13 09:45