Robert Kiyosaki, renowned for his top-selling book “Rich Dad Poor Dad,” has sounded an alarm that a historic stock market collapse is around the corner. According to his prediction, investment assets such as real estate (homes), gold, silver, and Bitcoin are expected to be heavily discounted soon.

Robert Kiyosaki’s comments emerge amidst steep declines in the crypto market, which some experts link to the downward trend in American stocks such as Nvidia and Tesla.

Robert Kiyosaki Anticipates Bitcoin Sell-Off

Kiyosaki used social media platforms to restate his previous forecasts about an impending crash, stating that this outcome is due to choices made during the 2008 financial crisis. He emphasized that leaders such as former Federal Reserve Chair Ben Bernanke focused more on saving banks instead of regular citizens.

As a financial analyst, I had previously shared my insights in the publication titled “Rich Dad’s Prophecy” back in 2013, where I forecasted what would be the largest stock market crash in history. Now, I am regretfully confirming that this predicted crash has indeed materialized.

Robert Kiyosaki cautioned that by 2025, there could be a significant downturn in various sectors including automobiles and real estate, restaurants, retail businesses, and even wine sales. Moreover, he expressed concern about the impending global conflict, which in his view, would exacerbate these issues further.

Kiyosaki suggested, ‘Use your intelligence. There are numerous valuable items going on sale. I plan to acquire more tangible assets using counterfeit U.S. dollars.’

The price of Bitcoin has decreased significantly, falling from approximately $101,700 on Tuesday to $95,370 at the moment I’m writing this. This drop equates to almost a 7% decrease in value since the market opened on Wednesday.

Despite his concerns, Kiyosaki showed a positive outlook, indicating his plans to take advantage of the market downturn by purchasing more Bitcoin.

Bitcoin prices dropping, which is excellent news for me as it means I’m purchasing Bitcoin at a discount. The saying goes, ‘Buy low… and HODL.’ There are still less than 2 million Bitcoins left to be mined,” he noted.

Experts Link Bitcoin and Crypto to Stocks

Currently, some experts are connecting the recent drop in the cryptocurrency market with a decline in U.S. stock prices. This observation was made by Greeks.live, an analysis platform specializing in crypto options, as stated in a tweet.

As a researcher examining the cryptocurrency market, I observed a significant correction in the values of various digital assets. This correction appears to be linked to the dramatic decline in US stock prices, particularly those of Nvidia and Tesla. Notably, Bitcoin dipped below the $100,000 mark once more, while altcoins experienced an even steeper drop.

Regardless of the current situation, analysts from Greeks.live continue to be optimistic about the ongoing bull market. Under these circumstances, they advise investors to seize the opportunity presented by this correction and purchase Bitcoin at reduced prices. If you decide to invest now, the short-term call for Bitcoin reaching $100,000 is a relatively affordable option.

Eric Balchunas, a senior ETF analyst at Bloomberg, made remarks that mirrored this viewpoint. He emphasized the apparent link between Bitcoin’s performance and that of the stock market.

The struggles in the U.S. stock market… I’m not forecasting this, but I’m pointing out that poor stock performance could negatively affect Bitcoin. Despite this, my doubts remain about Bitcoin’s potential to rise when stocks are falling.

When questioned about the potential of Bitcoin remaining robust during stock market drops, Balchunas suggested such resilience could signify a significant transformation of Bitcoin from a high-risk investment into a safe haven. However, he still expresses doubt.

In addition to the ongoing discussion, crypto analyst Adam Cochran voiced his opinion, pointing out that although he believed cryptocurrencies were primed for a surge, the possible uptrend could be constrained by broader economic constraints.

“Large funds don’t move out the risk curve during a downturn,” he added.

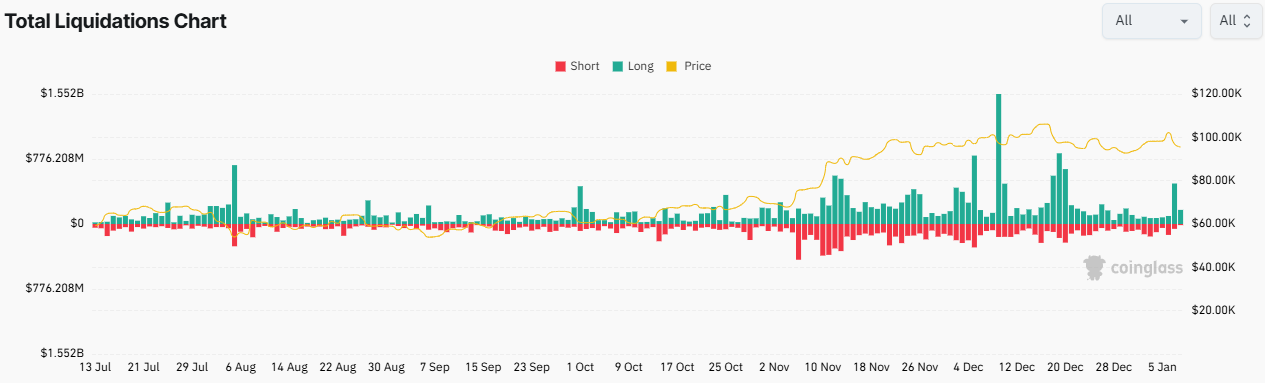

At present, a drop in Bitcoin’s price has led to numerous forced sales (liquidations), as reported by Coinglass. In the last day alone, approximately 236,481 traders were affected, resulting in a total of $693.52 million being liquidated.

As a researcher studying cryptocurrency markets, I’ve observed a significant downward trend in the prices of Bitcoin and other altcoins, which seems to be indicative of a more widespread pessimism within the financial market. This gloomy outlook appears to stem from a strengthening U.S. dollar and persistent volatility in traditional stock markets.

The ongoing behavior of the cryptocurrency market is causing debate about its links to conventional financial systems. Some investors view the current dip as a chance to buy assets at reduced costs, while others express concern due to broader economic risks.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- 30 Best Couple/Wife Swap Movies You Need to See

- Persona 5: The Phantom X Navigator Tier List

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

2025-01-08 12:30