It seems that after a brief fling with Nvidia, retail investors are saying “thank you, next.” Reports are rolling in, showing that many who purchased Nvidia shares on the dip are now selling them off like hotcakes. The burning question on everyone’s mind: will these traders take their hard-earned profits and ride the crypto wave? 😏

According to Vanda Research, retail investors jettisoned a cool $258 million worth of Nvidia stock during the week ending June 4. Meanwhile, institutions remain unfazed, continuing their quiet accumulation of the tech giant’s shares. Seems like retail’s trying to play it smart, but will their next move be in the direction of crypto?

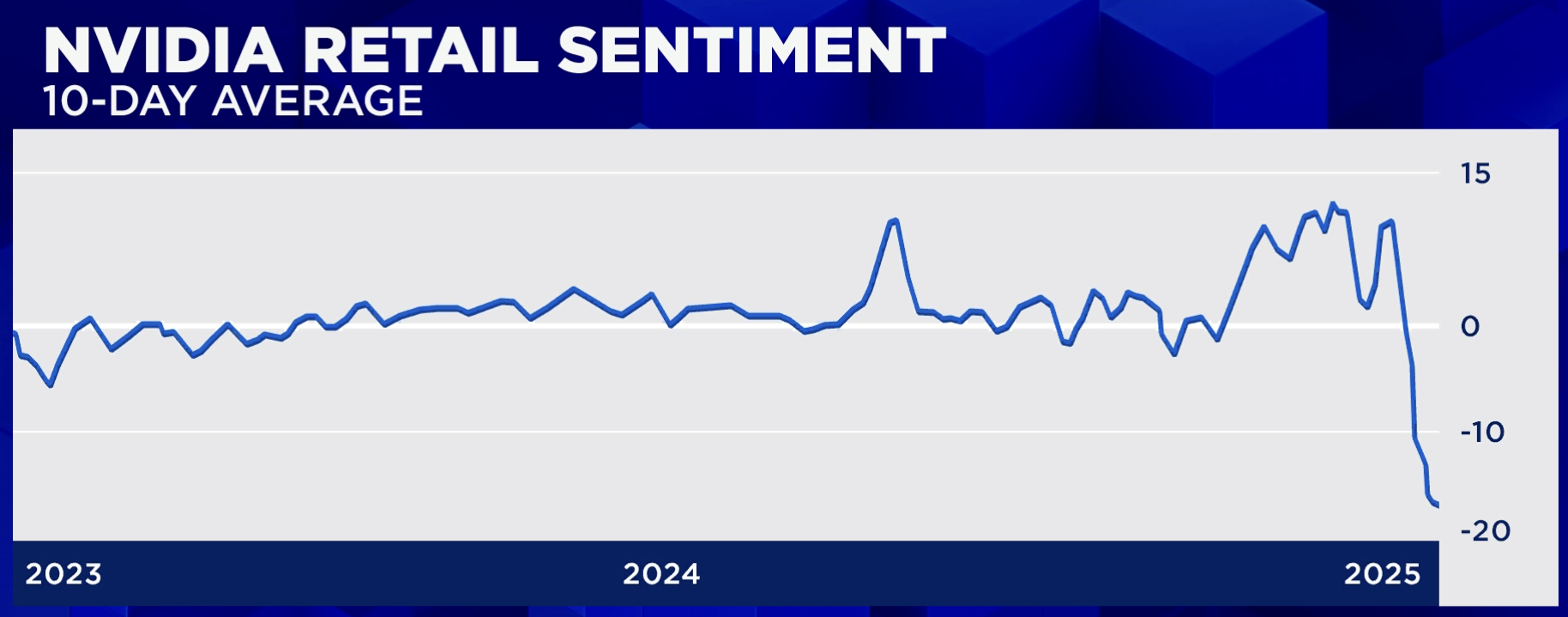

From 2023 to 2024, many retail investors made themselves quite comfortable with Nvidia, enjoying a cozy little profit. However, it seems that the winds have shifted in 2025, with retail sentiment dropping sharply. A Vanda Research survey shows a dramatic change: from a modest “let’s buy more” vibe to a resounding “sell, sell, sell.” Talk about a plot twist! 📉

This trend aligns with another report from Sherwood, which found a jaw-dropping $4.9 billion in retail outflows during the third week of May. It was the largest dollar outflow for Nvidia since 2015. Can we say “record-breaking?” And the two-week selling streak? Longest since March 2022. It appears Tesla wasn’t spared either, as retail investors decided to give it the cold shoulder as well.

Why Are Retail Investors Bailing on Nvidia?

It turns out that those retail investors who jumped on Nvidia when its stock took a dive post-DeepSeek launch are now looking for new, juicier opportunities. Analyst Ben Bajarin suggests that Nvidia has already priced in much of its growth potential. In other words, the low-hanging fruit has been picked, and investors are now searching for the next big thing. 🧐

But that’s not all. Many investors are also fretting about the impact of U.S. tariffs and chip restrictions on China. It’s a murky landscape, and higher-risk investors are running toward AI stocks and, believe it or not, crypto. Vanda Research points out that retail investors are now eyeing small-cap AI stocks, hoping for some serious gains—because why settle for modest when you can dream big?

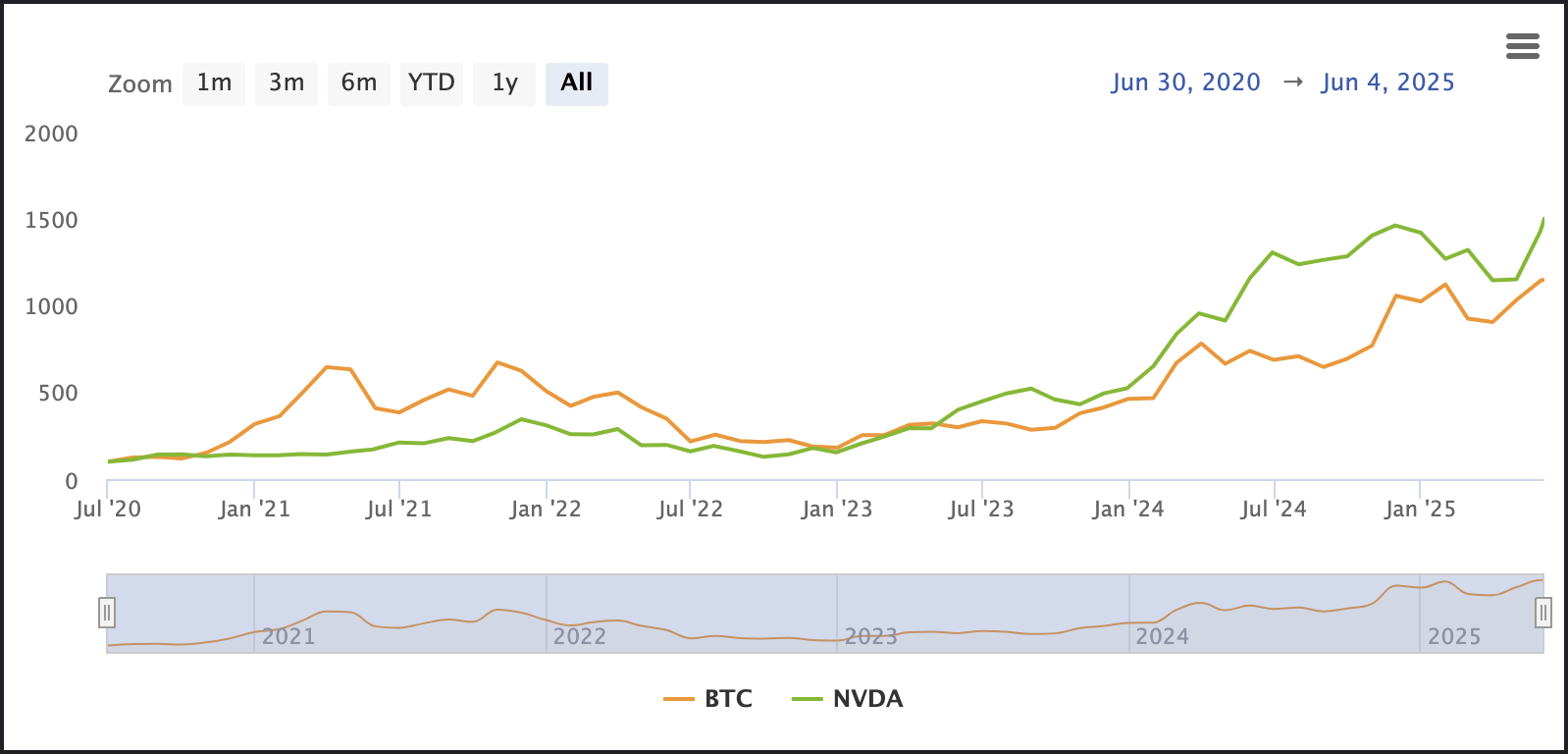

Nvidia and Bitcoin have long shared a curious relationship. A 2024 study discovered a solid correlation between the two, hovering above 0.80. This connection is largely attributed to Nvidia’s role in powering crypto mining infrastructure. So, it’s not a stretch to say that many Nvidia investors are already crypto-savvy. 🪙

Still, while retail investors have been sitting on the sidelines as institutions gobble up Bitcoin, there’s no clear indication that they’ll make a full-on pivot from Nvidia to Bitcoin just yet. Sure, historical correlations are intriguing, but right now, it’s all speculative. Who knows? The fate of these retail traders’ next move might hinge on broader macro factors like interest rates, regulations, and trade policies.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Gold Rate Forecast

- Every Minecraft update ranked from worst to best

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2025-06-05 16:50