As a seasoned researcher with over two decades of experience in the crypto market, I have seen numerous bull runs and bear markets. The recent surge in RENDER has certainly caught my attention, but I must admit that it’s not all sunshine and roses for this AI-focused coin.

As a crypto investor, I’ve been thrilled to see the impressive 48% surge in RENDER’s price over the past month. This growth has not only boosted my portfolio but also solidified its status as the dominant player in the artificial intelligence coin market with a staggering $4.1 billion market cap. It’s clearly outpacing its rivals, TAO, FET, and WLD, which speaks volumes about the increasing fascination surrounding AI-focused assets. The growing interest in RENDER is a testament to its potential and future prospects.

Nevertheless, even though this significant surge is evident, dwindling whale activity and waning trend signals hint at possible obstacles down the line. It remains to be seen whether RENDER will maintain its ascent or encounter a downturn, contingent upon how market trust unfolds in the near future.

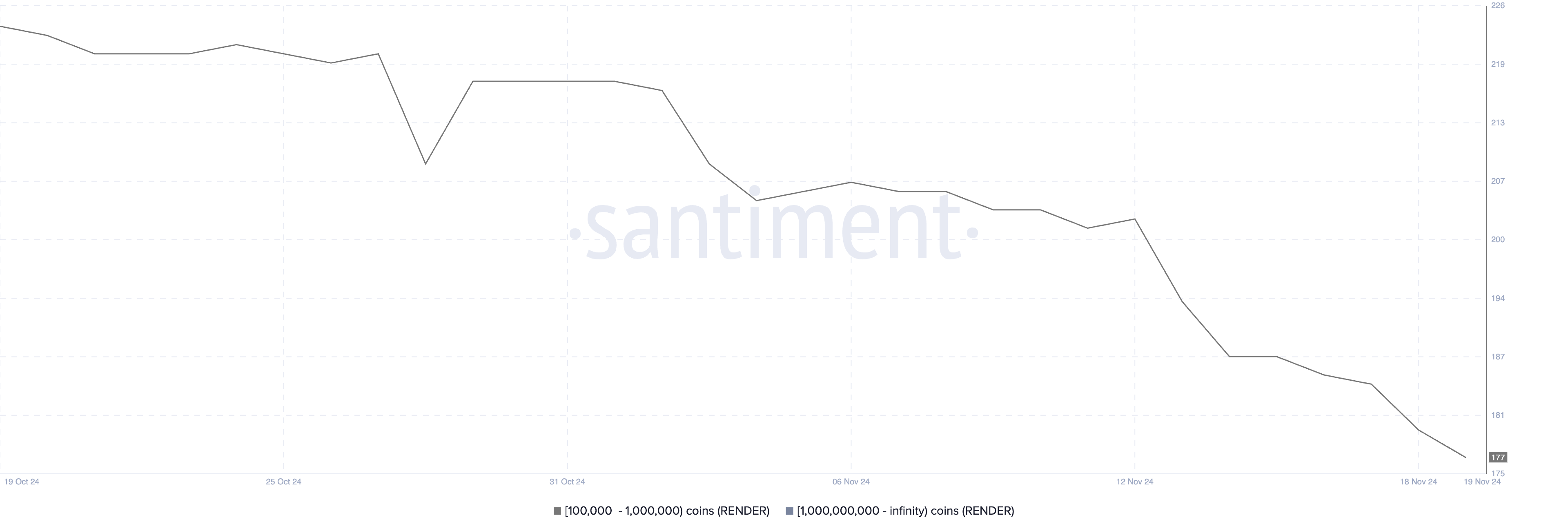

Whales Are Not Accumulating RENDER

The cryptocurrency RENDER is finding it hard to capture the attention of major investors, as there’s been a significant decrease in the number of people holding between 100,000 and 1,000,000 coins since early November.

Initially standing at 218 on November 1st, this figure has since dropped to 177, indicating a substantial decrease among major stakeholders, even amid the latest financial transactions.

This trend is notable because whales often play a crucial role in driving and sustaining price momentum. Even with RENDER price surging 48% in the past month, the continued decline in whale numbers suggests a lack of confidence among major investors.

It seems possible that the current surge might struggle to keep ascending if significant investors don’t offer robust backing.

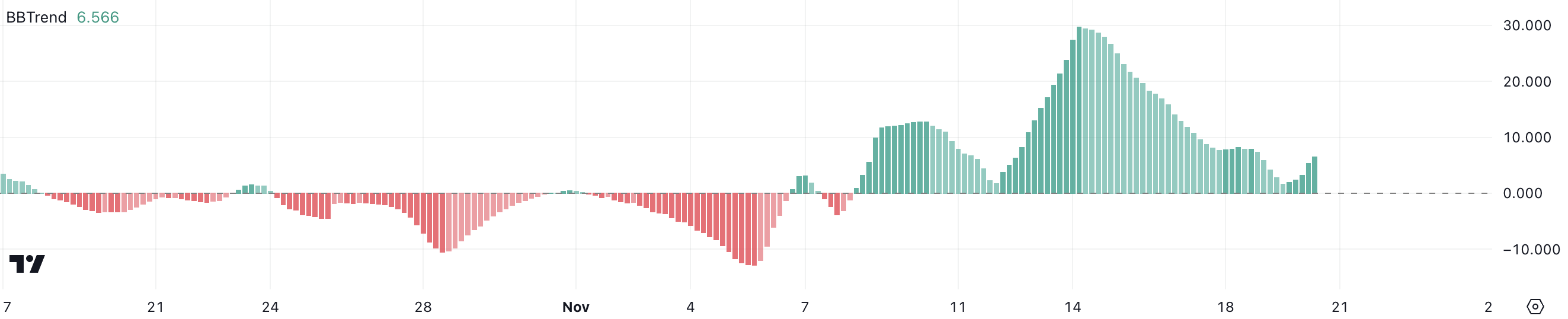

RENDER BBTrend Is Still Positive

BBTrend for RENDER is currently around 6.4, recovering from a recent low of 1.7 on November 19.

On November 14, the indicator hit a three-month peak of 29.7, but since then, it has experienced a substantial decline, indicating a slowdown in its momentum following the high point.

BBTrend determines the intensity and movement of trends based on its analysis of Bollinger Bands. A positive value suggests an upward trend, while a negative value implies a downward trend.

Since November 8, BBTrend for RENDER has been moving up and is now showing indications of a rebound; however, it’s still significantly below the peak levels reached in mid-November. This implies that while the upward trend continues, its present momentum is not as robust, suggesting some uncertainty about maintaining future price growth.

RENDER Price Prediction: Back To The $5 Soon?

At present, the Exponential Moving Averages (EMA) lines drawn by RENDER are suggesting a positive trend. This is because the brief-term EMAs sit above their longer-term counterparts, and the market value itself hovers above all these EMA lines.

Should the upward trend regain strength, it’s plausible that the RENDER token could challenge its resistance at around $8.29. If this holds, it may potentially reach a peak of $9.47, making it the highest price for RENDER since May and solidifying its position as the leading artificial intelligence coin in the market.

On the negative side, indicators such as BBTrend and whale behavior suggest a decrease in investor confidence. Should this trend change, RENDER might encounter support at $6.3 and $5.8. If these supports are unable to withstand the pressure, the price could potentially fall to around $5.0.

Read More

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- ANDOR Recasts a Major STAR WARS Character for Season 2

- In Conversation With The Weeknd and Jenna Ortega

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

2024-11-20 22:37