As a seasoned crypto investor with scars from more than a few market rollercoasters, I find myself cautiously optimistic about RENDER‘s recent surge. The 10%+ price increase within 24 hours is certainly eye-catching, and its dominance over AI competitors is impressive. However, the mixed signals from on-chain data have me pausing before jumping in with both feet.

The price of RENDER has increased over 10% in the past 24 hours, making it the leading AI coin in terms of market capitalization, surpassing peers such as FET and TAO. However, on-chain analysis hints at conflicting signs regarding its future trend.

Whale behavior has reached its lowest point since December 2022, and the BBTrend signal is now negative, suggesting a decrease in momentum. The EMA lines show both optimistic and pessimistic scenarios, which means RENDER is at a crucial juncture that could result in new record highs or substantial price adjustments.

RENDER Whales Hit Its Lowest Level Since 2022

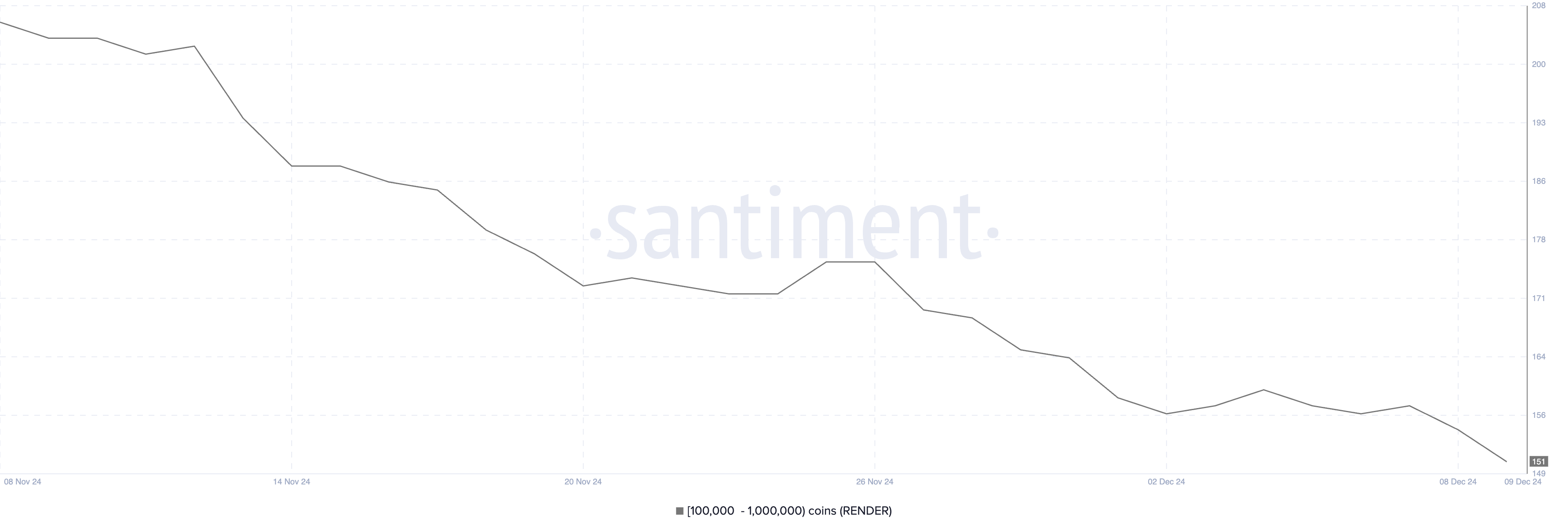

Despite RENDER’s price surge by 56% over the past month, pushing its market capitalization towards $5 billion and making it the largest among artificial intelligence coins, whale activity indicates a contrasting trend. Specifically, the number of wallets holding between 100,000 and 1,000,000 RENDER has dropped to 151 – its lowest point since December 2022.

This decrease suggests that significant investors, often referred to as “whales,” aren’t buying during the current price increase, which might hint at a lack of faith in continued positive growth. Without the backing of these whales, the rally could find it tough to sustain its power, potentially making RENDER susceptible to possible sell-offs.

Monitoring whales is essential as they frequently influence market tendencies. Their purchase behavior can indicate optimistic sentiments, whereas their sales or absence of stockpiling might predict price adjustments. The recent decline in RENDER whale accounts observed over the last couple of weeks suggests a worrying pattern.

It seems like this trend indicates that significant investors might be selling off their holdings, which could limit price growth for a while. If this trend persists, the value of RENDER may encounter more selling than buying, making it challenging for it to maintain its current pace.

RENDER BBTrend Is Now Negative

The RENDER’s BBTrend indicator stands at -4.13, which is its lowest point since November 29. Following a period of positivity between December 7 and December 10, during which it reached a high of 17.6 on December 8, the BBTrend has now shifted to a negative state.

This transition indicates that RENDER is now showing signs of shifting from a positive trend (bullish) to a negative trend (bearish). This change suggests a decrease in its overall strength and an increase in the possibility of its price falling.

BBTrend, or Bollinger Bands Trend, measures the strength and direction of a price trend using Bollinger Bands. A positive BBTrend indicates a strong bullish trend, while a negative value signals bearish momentum.

As BBTrend’s render becomes negative, there might be obstacles for the price to continue its uptrend. If pessimism continues in the near future, it could result in a pause or even a decline.

RENDER Price Prediction: $10 or $8 Next?

The EMA lines provided by RENDER show a conflicting picture. Lately, the shorter EMA line dropped beneath a longer one, suggesting a bearish trend. Yet, this line is on an upward trajectory now and might soon cross back above the other, hinting at a possible bullish turnaround.

If a bullish crossover takes place, it may ignite renewed buying enthusiasm, potentially causing RENDER’s price to challenge resistance at around $10.8. Overcoming this barrier might drive the price up to approximately $11.9, which could significantly boost its market capitalization to around $6.2 billion.

Regardless of conflicting factors, information from whales and BBTrend indicates a growing bearish trend. This downward movement may push RENDER’s price towards the support at $9.2. If this level does not prevent a drop, the price could continue to fall, potentially reaching $8.2 or even dipping as low as $7.1.

Read More

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- ANDOR Recasts a Major STAR WARS Character for Season 2

- 30 Best Couple/Wife Swap Movies You Need to See

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Is a Season 2 of ‘Agatha All Along’ on the Horizon? Everything We Know So Far

- Apocalypse Hotel Original Anime Confirmed for 2025 with Teaser and Visual

2024-12-12 00:19