In the grand theater of finance, where every act is a balancing act between greed and gullibility, a new subplot has emerged: stablecoins, those digital paperweights of modernity, now threaten to upend the cross-border payment duopoly. Circle Internet Group’s IPO, a spectacle as flashy as a magician’s hat full of doves, has sent Remitly Global’s shares spiraling 30% from their zenith. Yet, as the stock market’s Cassandras whisper doom, Remitly’s latest maneuver might just be the equivalent of slipping a dagger into the ribs of its critics.

Here’s the rub: Remitly, a business that thrives on the alchemy of currency conversion, now finds itself in a game of chess with stablecoins. But does it truly face checkmate? A recent announcement-akin to a conjurer producing a rabbit from a hat-suggests otherwise. By embracing the very tokens it once feared, Remitly may yet turn the tables, transforming disruption into a lucrative proposition. Let us dissect this financial riddle and determine if today’s bargain-bin price tag is a golden opportunity or a Trojan horse.

Disrupting the Stablecoin Narrative

Remitly’s Q2 earnings report arrived like a magician’s final flourish: 8.5 million active customers now wield a digital wallet capable of holding not just fiat but stablecoins. This is no mere product update-it’s a sleight of hand. By integrating stablecoins into its ecosystem, Remitly has done the unthinkable: it has co-opted the disruptor. Meanwhile, partnerships with Stripe, the digital payments equivalent of a trusty steed, allow transactions to be funded via stablecoins, a move as smooth as a con artist’s smile.

But the pièce de résistance? Remitly’s balance sheet now leverages stablecoins to facilitate real-time cross-border transfers, reducing operational costs while polishing its customer proposition. One might call it financial alchemy-or simply the art of turning lemons into lemonade, with a side of liquidity. More growth, lower expenses, and a platform that smells of success: Remitly’s ledger now resembles a treasure map.

Market Share Gains and a Profitable Mirage

The second quarter was a carnival of numbers. Revenue surged 34% to $412 million, send volume leapt 40%, and net income nudged into the black at $6.5 million. Yet, for all the hullabaloo about stablecoins bypassing Remitly, the figures tell a different tale. The company’s profit margin is slimmer than a bureaucrat’s conscience, but this is no accident-it’s a calculated gamble. Every dollar spent on innovation and marketing is an investment in future dividends, much like planting a seed in a goldmine.

Remitly’s ascent against Western Union, the old guard of remittances, is a modern-day David-and-Goliath saga. With a global market share still below 5%, the company is but a fledgling phoenix, yet its revenue outside North America has skyrocketed to $350 million in a year. One might say the world is falling in love with mobile-first solutions, while legacy players fumble like drunkards at a chessboard.

Why Remitly Stock is a Buy (and a Bargain)

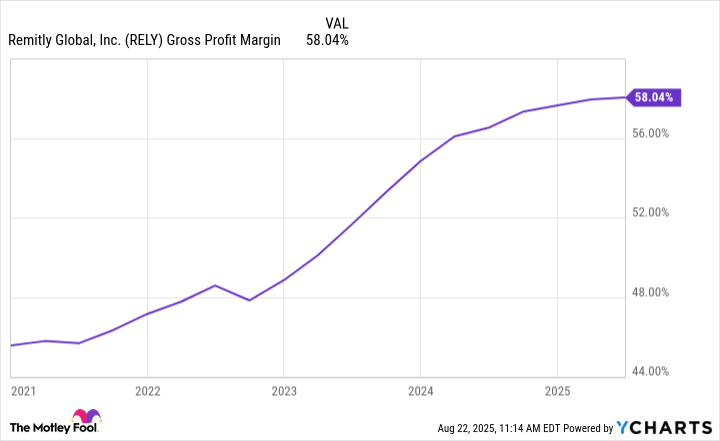

Despite this crescendo of growth, investors treat Remitly’s stock like a haunted house. Immigration policies and stablecoin fears loom large, yet the company’s growth remains unscathed. At $19 a share, the market cap stands at $3.9 billion-a figure that seems almost comically detached from reality when juxtaposed with Remitly’s $1.46 billion in revenue and 58% gross margins. With a forward P/E of 6.5, this is the financial equivalent of finding a $100 bill in an old coat pocket.

Consider the math: doubling revenue to $3 billion with a 20% net margin yields $600 million in profits. At today’s valuation, that’s a forward P/E of 6.5-practically a steal in a world where even the most optimistic investor might charge you interest for optimism. Remitly’s stock is not just a buy; it’s a masterstroke of financial sleight of hand. 🧠

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- Banks & Shadows: A 2026 Outlook

- The Best Actors Who Have Played Hamlet, Ranked

- Games That Faced Bans in Countries Over Political Themes

2025-08-24 00:12