Right. Dividend stocks. The siren song of passive income. Everyone’s chasing the ten-percent yield, convinced they’ve found the holy grail of investment… a perpetual money fountain. It’s a beautiful delusion. I’ve been wading through these swampy waters for years, and let me tell you, the alligators are hungry. You think a five-hundred-dollar stake is going to buy you freedom? It’s a start. But you need to be ruthless. Forget the fluff. Focus on what actually pays, consistently. Reliability, people. It’s not about getting rich quick; it’s about avoiding a financial implosion.

REITs: The Real Estate Racket (and Why It Might Work)

Real Estate Investment Trusts. They’re designed to funnel income to investors, a tax-efficient scheme if there ever was one. They hand over ninety percent of their taxable income as dividends – a legal loophole, essentially. The catch? You pay taxes on that income like it’s your own earnings. A Roth IRA is your friend here, shielding you from the IRS vultures. Generally speaking, REITs offer attractive yields, but don’t mistake a high number for a safe bet. It’s a jungle out there.

If you’re delusional enough to think you can live off portfolio income, REITs should be in the mix. But for God’s sake, do your homework. Some are built on solid foundations, others are teetering on the brink. Dividend histories are crucial, but don’t fall for a flashy past. Some models intentionally pay variable dividends – a gamble disguised as income. I prefer certainty, even if it’s a smaller payout. It’s about survival, not speculation.

Federal Realty: The King of the Hill (For Now)

Consistency. That’s the holy grail. And in the REIT world, Federal Realty (FRT +1.84%) is the closest thing to it. Fifty-eight consecutive years of dividend increases. Fifty-eight. That’s not luck; that’s discipline. They’re a Dividend King, the only one in the REIT sector. A freak of nature, almost. They don’t chase volume; they chase quality. Roughly a hundred strip malls and mixed-use assets, strategically located near wealthy population centers. Smart. They actively manage their portfolio, constantly reinvesting and upgrading. And they’re not afraid to prune the deadwood, selling off assets that have reached their peak and reinvesting in opportunities with potential. It’s ruthless, efficient, and frankly, admirable.

Currently, Federal Realty’s dividend yield is around 4.4%. Not spectacular, but stable. Roughly four times higher than the S&P 500’s ( ^GSPC 0.06%) pathetic 1.1% and above the REIT average. Five hundred bucks will get you about four shares. It’s a start. A small foothold in a potentially lucrative landscape. But don’t get complacent.

Beware the Siren Song of High Yields

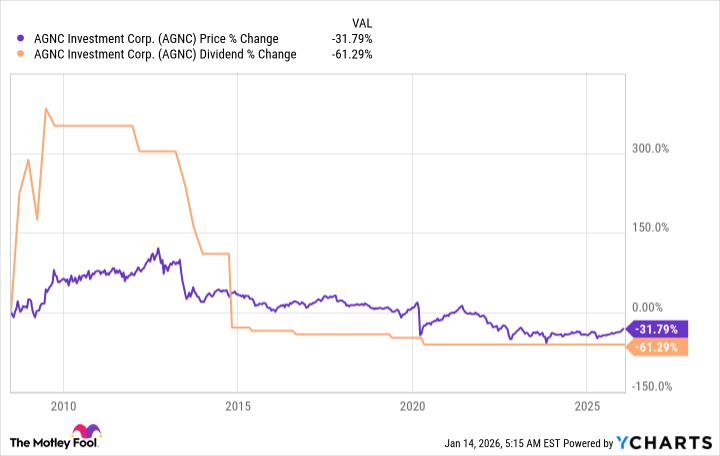

Some investors see 4.4% and scoff. They want twelve percent. They chase the flash, the immediate gratification. They look at REITs like AGNC Investment (AGNC +2.14%) with its monstrous 12.5% yield and think they’ve struck gold. A fool’s gold, I tell you. A trap. AGNC is well-respected, sure, but it’s not reliable. Look at the graph. It’s a disaster.

If you’re counting on those dividends to supplement your Social Security, you’re in for a rude awakening. Volatile payouts, a steadily declining trend… and a stock price following suit. Less income, less capital… that’s not what any serious dividend investor wants. I know that’s not what I want. It’s a slow bleed.

Dig Deeper, or Face the Consequences

Federal Realty is the cream of the crop, no doubt. But it’s not the only reliable dividend payer in the REIT sector. Realty Income (O +1.15%) has increased its dividend annually for thirty years, with a 5.4% yield. They own single-tenant properties with net leases – the tenant handles most of the property costs. It’s a simple, efficient model. They’re the industry giant, with over fifteen thousand properties across the US and Europe. They’re expanding into lending and asset management, too. Smart. Five hundred bucks buys you eight shares. A slightly bigger foothold.

Federal Realty and Realty Income are foundational investments for anyone serious about dividend income. But they’re just two examples. AGNC Investment, on the other hand, is a cautionary tale. They can deliver attractive total returns, but that relies on dividend reinvestment. Meaning you can’t actually use the income. It’s a mirage.

Put all the pieces together. Don’t fixate on yield alone. Do your homework. Or prepare to be devoured.

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- DOT PREDICTION. DOT cryptocurrency

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-01-18 01:13