So, you’re contemplating a life funded by dividends, are you? A perfectly reasonable ambition, really. Everyone wants to reach a point where money gently drifts into their account while they pursue more…refined activities. The trouble is, the world of finance seems determined to make it as complicated as possible. We’re presented with options like REITs – Real Estate Investment Trusts – which sound reassuringly solid, like something your grandfather might have invested in. And then there’s AGNC Investment, offering a dividend yield that, frankly, raises a cynical eyebrow or two. It’s enough to make you long for a simpler time, like when people just buried gold in the backyard.

Federal Realty: The Steady Hand

Federal Realty, for the uninitiated, is a REIT that specializes in strip malls and mixed-use developments. Not exactly glamorous, perhaps, but remarkably stable. They’ve been increasing their dividend for 58 consecutive years, which is…well, it’s a streak. It’s the kind of consistency that makes accountants weep with joy. Their yield is a respectable 4.3%, which isn’t going to make you instantly wealthy, but it’s enough to suggest they’re not building castles on quicksand. It’s roughly four times the yield of the S&P 500, which, let’s be honest, feels a bit like bragging about having a slightly larger collection of bottle caps than your neighbor. Still, it’s a point in their favor.

The appeal of Federal Realty lies in its predictability. They’re not promising miracles; they’re offering a reasonably reliable income stream. It’s the financial equivalent of a sensible pair of shoes. Not exciting, but unlikely to let you down when you’re halfway through a crucial negotiation…or, you know, trying to reach the mailbox.

AGNC Investment: The Siren Song of High Yields

And then there’s AGNC. A 12% yield. It’s… arresting. It’s the kind of number that makes you suspect a hidden catch. Like a free puppy that turns out to be a fully grown Saint Bernard. AGNC is a mortgage REIT, which means they buy mortgages, bundle them into securities, and then…well, it’s complicated. Essentially, they’re betting on the housing market. Which, as recent history has demonstrated, is a bit like betting on the weather. It can change dramatically and unexpectedly, leaving you soaked and regretting your life choices.

They operate a bit like a mutual fund, managing a portfolio of mortgage-backed securities. They even publish a “net asset value” figure, which is a fancy way of saying “this is roughly how much stuff we own.” The problem is, like most funds, their primary goal is “total return,” which means they assume you’re reinvesting those dividends. If you actually spend the money – the whole point, really – the results get…interesting.

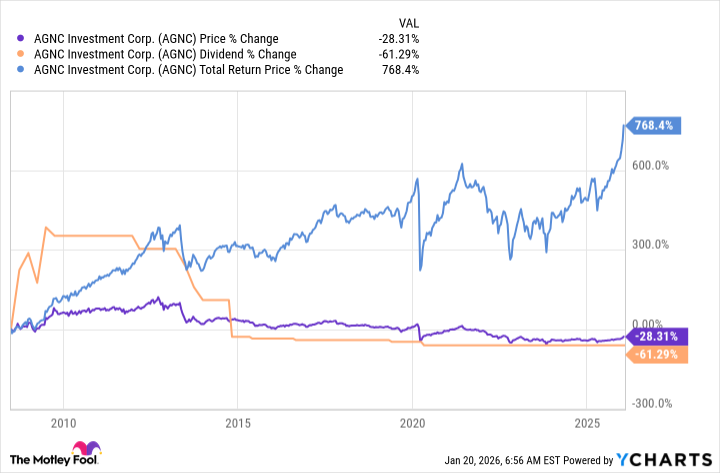

The chart tells a story, doesn’t it? The blue line – total return – looks impressive. But look closer. The orange line – the dividend itself – is a rollercoaster. And the purple line – the stock price – is doing its best to keep up. Over the past decade, if you’d spent those dividends, you’d be generating less income and have less capital. Which, to put it mildly, is not ideal. It’s a bit like trying to fill a leaky bucket. You can pour water in all day, but you’ll never actually have any left.

Capital Appreciation vs. Income: Choose Wisely

So, here’s the rub. AGNC isn’t designed to provide a steady income stream. It’s geared towards capital appreciation – hoping the stock price goes up. Which is fine, if that’s what you’re after. But if you’re looking for a reliable source of income to fund your retirement, you’re better off with something like Federal Realty. Something…predictable. Something that won’t keep you awake at night wondering if your financial future is about to vanish in a puff of smoke.

AGNC might work as part of a diversified portfolio, if you understand the risks. But it’s not a magic bullet. It’s not going to set you up for life, unless you define “life” as “a thrilling gamble with potentially devastating consequences.” And frankly, most of us prefer a bit less thrill and a bit more stability. Especially when it comes to our money. It’s a surprisingly comforting thought.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-01-21 22:13