People talk about biotech as if it’s all whiz-bang innovation, chasing the next miracle. Honestly, it reminds me of my Aunt Mildred and her collection of ceramic cats. Each one promised to be the most precious, the most unique, and yet, they all ended up gathering dust on a shelf. I prefer the companies that actually, you know, make something. The ones that aren’t just hoping for a breakthrough, but quietly, consistently, generating revenue. It’s less glamorous, certainly, but also, less likely to leave you explaining to your financial advisor why you invested in a company that’s perfecting glow-in-the-dark algae.

That’s how I ended up looking at Regeneron. Not because I’m particularly interested in macular degeneration – though, frankly, at my age, I should be – but because they’ve built a business. A real one. They’re not waiting for a miracle; they’re making things happen, and that, in this market, feels almost…radical.

A Company That’s Been Around the Block

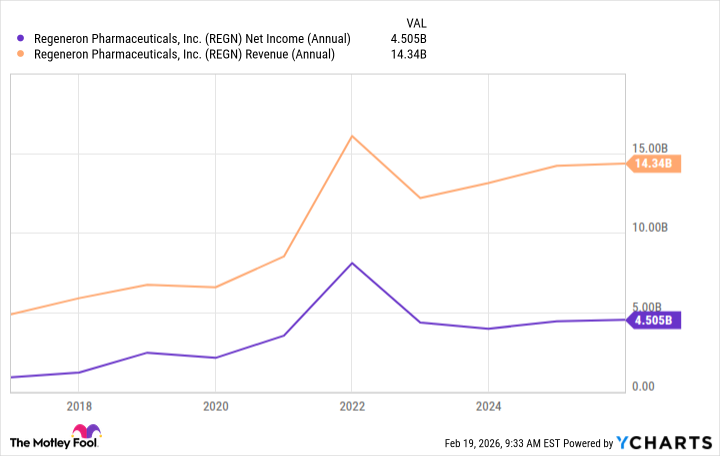

Thirty-five years. That’s how long Regeneron has been at it. Which, in biotech years, is practically prehistoric. They’re not a flash in the pan, a trendy startup fueled by venture capital and wishful thinking. They sell treatments for inflammation, cholesterol, eye disease… the sort of things people actually need. It’s a surprisingly solid foundation, isn’t it? My brother-in-law, a venture capitalist, keeps telling me about the “disruptive potential” of personalized algae smoothies. I’m sticking with Regeneron.

Their biggest hit, Dupixent, is a collaboration with Sanofi. Sounds complicated, doesn’t it? All these partnerships, these mergers… it reminds me of trying to assemble IKEA furniture with instructions written in hieroglyphics. But the drug works. Millions of people use it for everything from asthma to eczema. That’s a lot of relieved patients, and a lot of revenue. Which, let’s be honest, is what really matters.

They also have Eylea, a treatment for age-related macular degeneration. Apparently, competition is heating up, even from their own higher-dose version. It’s like they’re competing with themselves. It’s wonderfully inefficient, isn’t it? But the higher-dose version is doing well – revenue soared 66% recently. So, they’re adapting. They’re figuring it out. And that, in a world obsessed with instant gratification, is a rare and valuable trait.

The Pipeline: A Hedge Against the Inevitable

Here’s where it gets interesting. Regeneron isn’t just resting on its laurels. They have a massive pipeline of potential new drugs. Dozens of candidates in late-stage trials, targeting everything from immunology to oncology. It’s a bit overwhelming, honestly. It reminds me of my mother’s pantry – so many options, so much potential for expired ingredients. But it’s a good problem to have. It means they’re investing in the future, diversifying their risk. They’re not putting all their eggs in one basket, or, in this case, one potentially flawed gene therapy.

The beauty of a robust pipeline is that even if some candidates fail – and many will – they still have plenty of others in the works. It’s a hedge against the inevitable disappointments of drug development. It’s a long-term strategy, which, in a world obsessed with quarterly earnings, feels almost…responsible.

Right now, the stock is trading at a reasonable multiple of forward earnings. It’s not cheap, but it’s not ridiculously overpriced either. Considering their track record and their pipeline, it feels like a solid investment. A boring investment, perhaps, but a solid one. And in this market, I’ll take boring over brilliant any day. I’m not looking for fireworks; I’m looking for something that will quietly, consistently, grow over time. Something I can hold onto for the long haul. Something, frankly, I won’t have to explain to my financial advisor.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- QuantumScape: A Speculative Venture

- 9 Video Games That Reshaped Our Moral Lens

- Is Taylor Swift Getting Married to Travis Kelce in Rhode Island on June 13, 2026? Here’s What We Know

2026-02-21 23:52