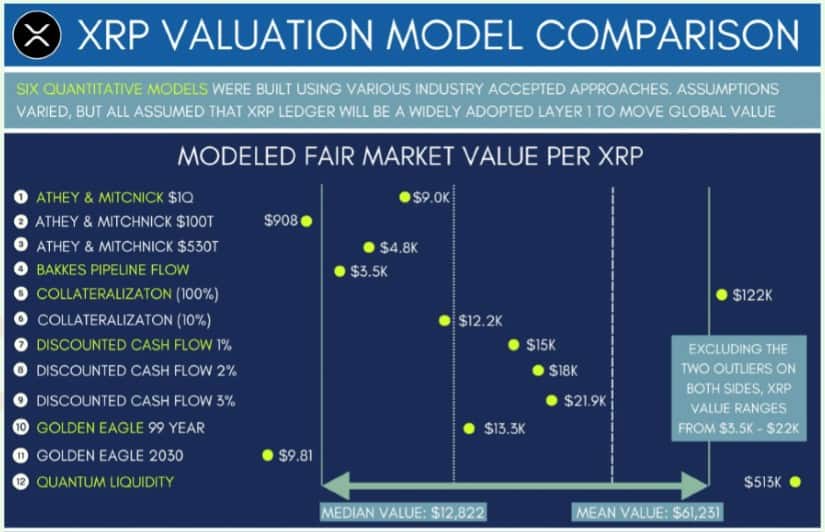

As a seasoned researcher who has navigated through the tumultuous crypto landscape for years, I find myself captivated by the recent study conducted by Valhil Capital’s Jimmy Vallee and Molly Elmore on Ripple’s native cryptocurrency, XRP. The use of six distinct valuation models provides a comprehensive understanding of XRP’s potential as a layer-1 asset in global value transfer, with projections that are nothing short of staggering. While the $22,000 under optimistic scenarios seems achievable, I must admit the $513,000 projection from the Quantum Liquidity Model makes me wonder if we’re talking about XRP or a newfound island in the Pacific!

According to the extensive assessment carried out by Jimmy Vallee and Molly Elmore from Valhil Capital, it is suggested that Ripple‘s indigenous digital currency could become a significant force in international money transfers worldwide.

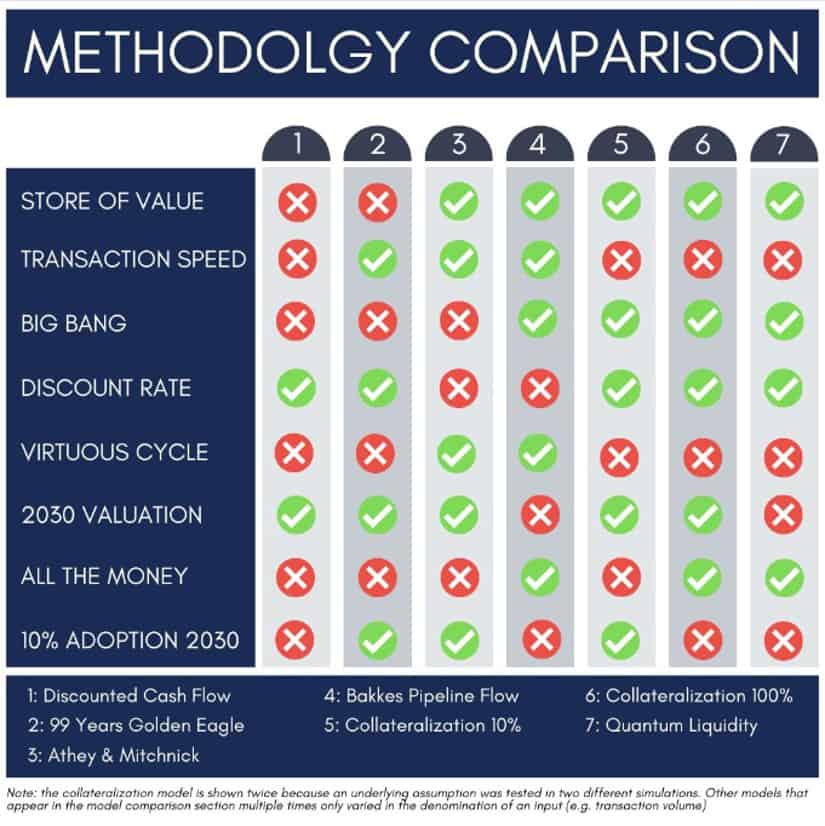

This research employs six separate valuation methods to evaluate XRP’s potential value, with each method providing a unique insight into its role as a foundational asset. The study suggests that under favorable conditions, XRP might rise to an impressive $22,000. Some models even predict higher values, such as $122,000 and $513,000. These forecasts are heavily contingent on the assumption that the XRP Ledger becomes a widely-adopted standard for global transactions.

XRP’s Valuation Amid Pro-Crypto Policy Shifts

Vallee and Elmore’s study explores multiple strategies to determine the potential market worth of XRP. For instance, the Athey & Mitchnick Methods assess XRP using diverse liquidity conditions worldwide. Under a $1 quadrillion scenario, the estimated value could reach $9,000, while a $530 trillion scenario predicts a price of around $4,800. The Bakkes Pipeline Flow model, on the other hand, concentrates on XRP’s function in streamlining global transactions, suggesting it might be worth approximately $3,500.

Beyond the topics already discussed, this research delves into collateralization methods for XRP. If fully collateralized, XRP’s worth might reach $12,200; with just 10% collateralization, it could be $1,220. Discounted Cash Flow (DCF) models offer more precise predictions, suggesting that with a 3% discount rate, XRP’s value could potentially rise to $21,900. These diverse methods highlight the versatile possibilities of XRP in various financial scenarios.

This study occurs at a time when there are substantial changes in the political landscape of the United States. After Donald Trump’s win in the presidential election, crypto companies such as Ripple and Coinbase expect a more lenient regulatory atmosphere due to Trump’s pro-crypto views. Trump has hinted at a positive stance towards cryptocurrencies and plans to replace SEC Chair Gary Gensler, which might result in reconsidering ongoing legal cases against these firms.

Paul Grewal, the top legal executive at Coinbase, showed a positive outlook regarding possible adjustments in regulations. During a recent conversation, he shared this sentiment.

It’s expected that the new administration will reevaluate all the cryptocurrency-related cases overseen by Gary Gensler, focusing on separating those that appear to be clear instances of scams or fraud from those that do not.

According to the research, the middle point for XRP’s worth is around $12,822, with an average of $61,231. This indicates a positive view among analysts about XRP. The most optimistic Quantum Liquidity Model in the study predicts that XRP could potentially rise to $513,000 if its role as a store of value is fully realized. Although these numbers seem high, they underscore the significant potential gains for XRP should it achieve widespread usage.

Pro-Crypto Stance Fuels XRP’s Fate

Brian Armstrong, CEO of Coinbase, viewed the election as a significant triumph for cryptocurrency. He pointed out that crypto support played a key role in Bernie Moreno’s victory over Senator Sherrod Brown in Ohio, suggesting a broader trend among congressional representatives leaning pro-crypto. This political endorsement could play a pivotal role in boosting XRP’s popularity and, ultimately, its worth in the market.

The constantly changing legal environment significantly impacts the potential trajectory of XRP. There’s optimism within the sector that a more accommodating Securities and Exchange Commission (SEC) leadership could lead to more transparent regulations and fewer instances of enforcement. Grewal underscored the importance of open dialogue between the SEC and the cryptocurrency community, asserting:

“Stop suing crypto. Start talking to crypto. Initiate rulemaking now. There’s no reason to wait.”

Ripple’s leadership has presented a 100-day action plan to the new administration, emphasizing the need for quick steps to enhance the Securities and Exchange Commission’s (SEC) methods regarding cryptocurrency regulation. They are suggesting influential individuals such as Chris Giancarlo, Brian Brooks, or Dan Gallagher to fill key positions, with the hope of creating a more favorable atmosphere for XRP and the overall crypto market.

In this post, we’re sharing content provided by our sponsor. Keep in mind that the views expressed here belong to the sponsor alone, and it’s always recommended for readers to independently verify facts and make their own decisions based on the information they find.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

2024-11-12 13:07